CME: New Slaughter Plants Welcome for US Pork Industry

US - Seaboard Foods and Triumph Foods announced last week that they would build a new, state-of-the-art pork slaughter plant in Sioux City, Iowa, write Steve Meyer and Len Steiner.The announcement comes on the heels of last winter’s announcement that Clemens Food Group (owner of the Hatfield Quality Meats pork plant in Hatfield, PA) would partner with several large, Midwestern producers to build a plant in Coldwater, MI.

The two announcements are critical for the future growth of the US pork industry but, needed as they are, neither will provide any capacity help until 2017 at the earliest.

First, let’s consider the current situation for the pork slaughter sector.

“Capacity” in these slaughter plants is a fuzzy concept. The limiting factors differ from plant to plant.

In one it may be the maximum speed at which carcasses can move through the harvest floor (ie. chain speed). In another it may be the rate at which carcasses can be disassembled into wholesale cuts. In yet another, the limitation may be the amount of cooler or freezer space that is available.

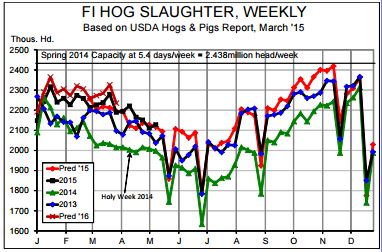

The capacities shown represented in the chart were given in response to the question “How many hogs can you process if supplies are plentiful and margins are good?”

Most plants can push a few more through in those situations by speeding up the chain slightly, adding an hour or two per shift or adding/extending Saturday operations.

Some plants work Saturdays as a normal part of their operations. Others never work Saturdays regardless of the margin conditions.

Our experience has shown us that the US industry can operate up to 5.4 days per week without much trouble and without having much negative impact on hog prices.

Thus, we convert the daily capacity estimates to a weekly capacity estimate in the chart using that 5.4 day workweek. Obviously, the line in the chart is not hard and fast but it serves as a “warning line”.

The Clemens Food Group plant will operate one shift of 8,000 head per day when it opens in, we understand, mid-to late 2017. Throughput will not be nearly that large in the early weeks.

The plant fills a long-term void created in 1998 when Thorn Apple Valley closed the only sizable plant in Michigan - a closure which was the final gale in the “perfect storm” of events that led to the hog price debacle that fall.

It will draw hogs primarily from Michigan, Ohio and Indiana but will also process Canadian pigs primarily from Ontario.

The latter source could become much more important if mandatory country-of-origin labelling gets repealed or otherwise resolved and if the US dollar remains strong.

Ontario producers are shipping a significant number of pigs to Quebec for processing after the closure last year of the Quality Meats plant in Toronto. Many of those pigs could come south when the Clemens-led plant fires up.

The Seaboard-Triumph plant will seek to duplicate the success of the two companies’ earlier arrangement in St Joseph, MO. Several large producers and one group of smaller producers own the St Joe plant and Seaboard markets the product from it.

By all reports, the effort has been a resounding success and the group began looking to duplicate it several years ago on a site in East Moline, IL. That plan hit a number of roadblocks, not the least of which was $7 corn and the Great Recession.

In the meantime, Smithfield Foods decided to close its John Morrell plant in Sioux City, IA leav- ing one of the nation’s iconic “meat” cities without a major pork packer in spite of being surrounded by a significant and still growing concentration of market hogs.

Sioux City was a logical location for a new plant and Seaboard-Triumph will locate this one well south of the downtown area that had grown weary of the congestion and odours that once were considered normal and welcome in the area of the now-closed Sioux City Stockyards.

The companies’ announcement said the plant would process 3 million hogs per year on one shift. We find that math a bit troubling since it implies 12,500 head per day (and thus per shift) and we know of no plant that runs a harvest line that fast.

The Smithfield plant in Tarheel, NC can exceed that number per shift but the plant, unlike any other one in the US (and perhaps the world) has two lines under one roof. Neither company promised a second shift at these plants but we suspect they will add one when sufficient sales opportunities and hog sup- plies are developed.

Spreading plant and management costs over more pounds is just too attractive to not pursue if the opportunity arises. That conclusion might apply more to the Seaboard-Triumph plant simply because there are more hogs in the region.

Why is this important?

It is clear from the chart above that hog supplies THIS YEAR will put that US hog packing sector very near its capacity.

We do not think the situation this fall will be tight enough to cause much problem with pig flows or prices beyond the normal impact of high pork supplies.

But the breeding herd is growing and producers are returning to their pre-PEDv levels of both productivity and, we think, productivity growth that averaged 1.8% per year from ‘07 to ‘12.

If that happens, supplies in Q4 2016 will be large but NEITHER OF THESE PLANTS WILL BE ON LINE IN TIME TO HELP! They will, nonetheless, be sorely need in ‘17 and beyond!