Is It Too Late for a Seasonal Hog Market Rally?

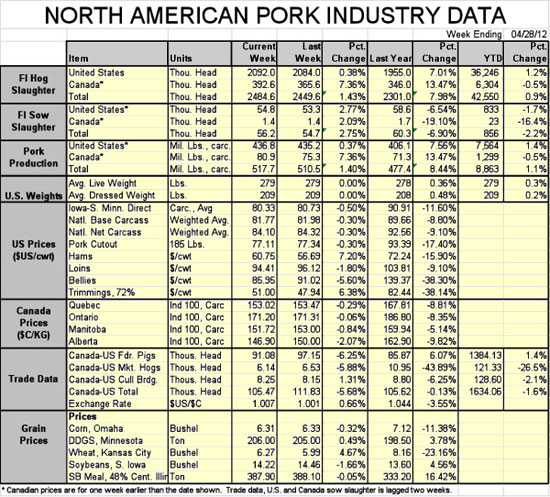

US - "It is no secret that we are running out of time for a seasonal rally in cash hogs and lean hogs futures prices. The price doldrums have continued long enough to steal the usual beginning of our annual summer rally. Is there enough time to even see one in 2012?" writes Steve Meyer in his "Market Preview" featured in National Hog Farmer magazine.Figure 1 shows the sideways pattern of national net negotiated hog prices. The only break in that pattern was a very unwelcome decline at the beginning of April. During a period in which this price has rallied an average of $11/cwt. over the past five years, it has done nothing this year, languishing near $83/cwt., carcass, for five weeks now.

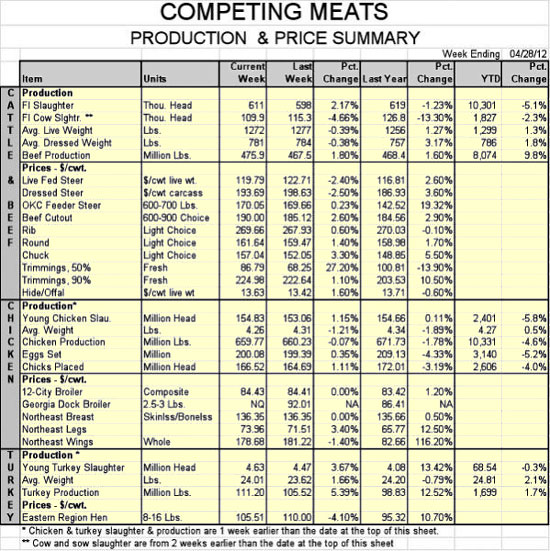

The situation is not much better for the national net price across all pricing methods (Figure 2). The inclusion of futures- and cost-based prices in this average tends to smooth it relative to the negotiated markets, but smoothing usually doesn’t help much over longer periods of time. This price has bounced around $83.50/cwt. the past few weeks with no discernible recovery or rally – just like its more volatile brethren. The “normal“ April rally for this price series is about $9/cwt.

Is It Supply or Demand?

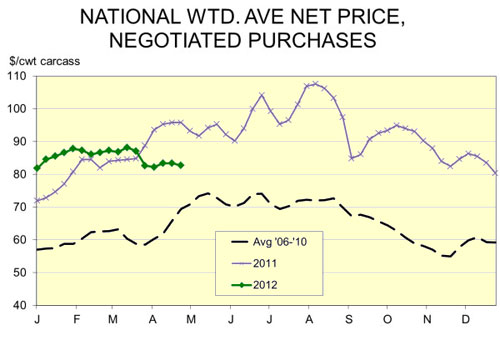

Both are culpable to some degree, so the answer is, quite correctly, yes. Supply issues are tending to mount up a bit, driven significantly higher, relative to last year, by last week’s 2.092 million head. That is a 7 per cent increase, but readers should note that it is relative to Easter week 2011. That the number was higher was no surprise. That it was 7 per cent higher was a bit of a shock! Wasn’t the last week of April supposed to be the first week of the “marketing hole“ driven by last July’s heat? Even I thought there may be merit to that shortage argument.

Higher weights, at least relative to last year, have added to the supply situation virtually all year. The average carcass weights of barrows and gilts reported under mandatory price reporting (i.e. virtually all of the top butcher hogs) set a record of 210 lb. the first week of 2012. After declining by about 2 lb. in January, they began slowly climbing again before jumping to 209.6 lb. the first week of April. Slaughter was running about as expected.

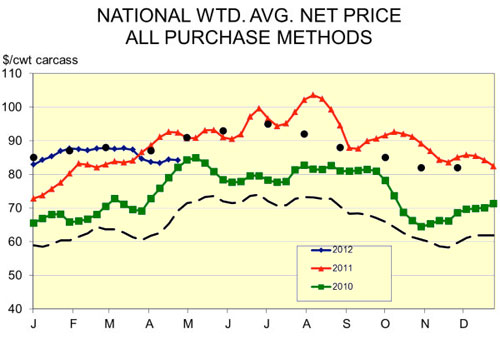

But over the past four weeks, federally inspected (FI) hog slaughter has exceeded year-ago levels by 3 per cent. FI pork production has been 3.7 per cent larger than last year. Those kinds of increases would suggest price declines of 10 per cent or so with demand stable. As can be seen in this week’s Production and Price Summary table, hog prices were 8-11 per cent lower, but the pork cutout was down 17 per cent, year-on-year, driven by a large decline in ham and belly prices. The latter of those were artificially higher last year due to large shipments to South Korea in the midst of its foot-and-mouth disease crisis.

The lean, finely-textured beef event has been a negative for demand – both in general and for pork in particular. The impact was, I believe, on consumer comfort levels with meat products in general and processed meats in particular. The cross-species effect was due to a $20 decline in beef cutout values. Those have now rebounded by $15. They should provide some positive demand impacts soon.

And let’s not forget exports. They have been strong for the months that we have data – January and February. But anecdotal evidence is that exports have softened considerably. We’ll know more for certain as those data become available.

So, will we see mid-$90s hogs this summer? The good thing is that summer lasts quite a while. It looks doubtful that we can rally hogs to hit those highs in June. The market frequently matches June highs again in August and that is still possible – provided supplies get back close to expected levels and no further demand crises are encountered. Those are two pretty big provisos. But there is still time for a good summer market if conditions get back closer to what we expected at the beginning of 2012.