GDP Slips, but Meat and Poultry Poised for Slight Growth

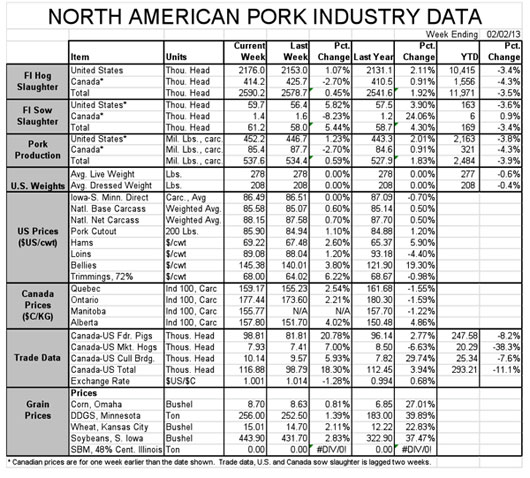

US - The news on the demand front was not good last week, but the gross domestic product (GDP) data released by the Commerce Department likely appeared more negative than it actually was. I realize that sounds like "spin" – and I loathe spin – so I think there is actually something to this "yeah, but. . ." analysis, writes Steve Meyer in his "Market Preview" as published in National Hog Farmer magazine.First, though, the National Restaurant Association’s (NRA) Restaurant Performance Index continues to indicate that the foodservice sector is struggling (Figure 1). The index dropped again in December, falling 0.2 points to 99.7. That is the second-lowest level for this measure of restaurant activity and performance since July 2011, and it pours some cold water on what many had hoped was a major reversal of the downtrend that has been in place since March.

What is more troubling to me is that the Current Situation Component of the index was the weak sister, falling to 99.1, its lowest level since January. I may be wrong, but I place more stock in the Current Situation Component than I do its companion Expectations Component simply because the latter is so dependent on the judgments of operators. Those judgments appear to have been pretty realistic since mid-2011, but it is easy to see that they sometimes run off to the positive and to levels that may not be justified by later indexes. The Expectations Component gained 0.3 points in December to reach 100.3.

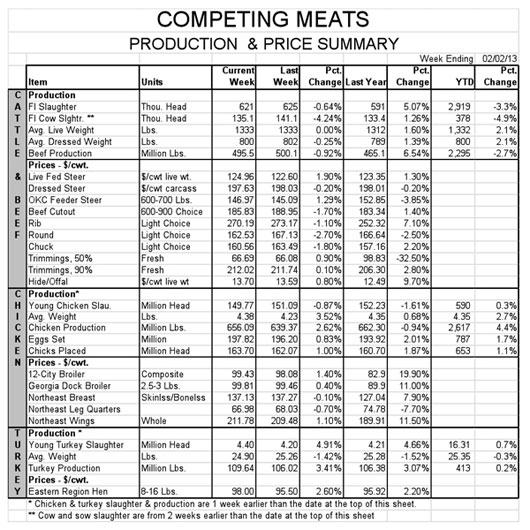

Perhaps the most concerning features of the NRA’s report is the continuing downtrend of operators’ estimates of customer traffic (Figure 2). December’s traffic index of 98.1 is the lowest since February 2010, when the entire economy was just beginning to climb out of the Great Recession. It is also down 2.1 per cent from November, a month that had promised some hope with a relatively healthy gain in traffic. The traffic slowdown was accompanied by a 2.5 point drop in the same-store sales index which at 100.4 hit its lowest level since January 2011. People aren’t coming in and they aren’t spending as much money. That’s not good.

Note that all of these indexes are constructed such that values of 100 or more indicate expansion while those less than 100 indicate contraction. A contracting foodservice sector is not a good sign for the pork industry. It is most likely a much more serious challenge for both beef and chicken.

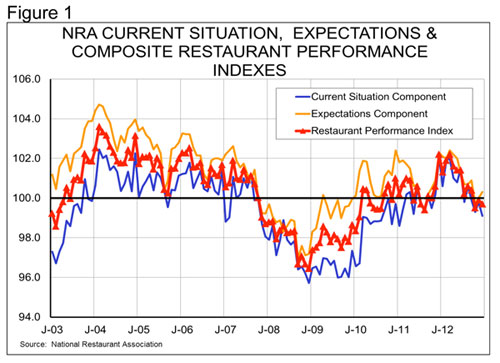

Government Cuts, Exports Soften

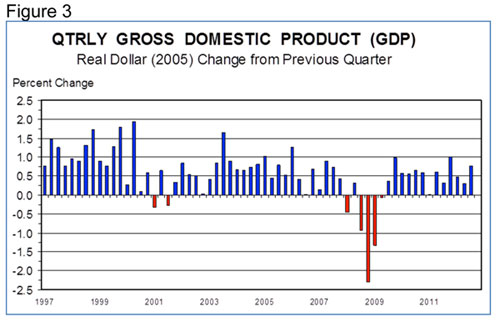

Last week’s GDP report indicated that fourth quarter (Q4) real gross domestic product was down fractionally from one year ago (Figure 3). That is obviously not good news. But the big negative drag on Q4 GDP was a large reduction in government spending. The cuts came primarily in military outlays and are not at all indicative of any reversal of recent patterns of government largesse. But they do mask positive contributions to GDP from increased personal consumption expenditures (which added 1.5 per cent to Q4 GDP after adding 1.1 per cent in Q3) and business fixed investment (+1.2 per cent in Q4 after +0.1 per cent in Q3). Those are big components of GDP that are headed in the right direction.

The larger, long-term problem for the economy is slowing exports whose contribution to GDP fell by 0.8 per cent in the fourth quarter. That is the first actual decline for export contribution but it has been soft for some time, a reflection of the continuation of a soft world economy.

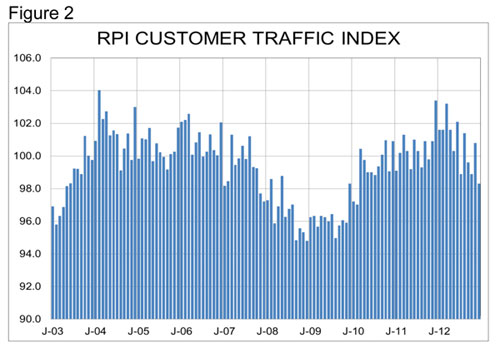

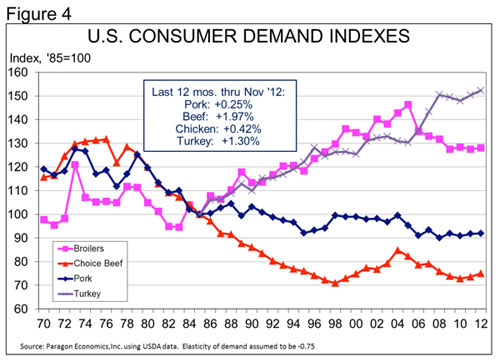

In spite of this, meat and poultry demands appear poised to do something they have never done before – all showing growth in the same year. As Figure 4 shows, all four major species demand indexes were higher for the 12 months that ended in November. The final piece of data needed to compute calendar-year indexes (December exports) will be released on 11 February. They could denote a unique year for meat and poultry demand though I would not characterize it as a banner year simply because all of the changes are likely to be small. The two smallest in Figure 4 (pork and chicken) have been getting progressively stronger while the two strongest have been softening as more 2012 data have become available.

I will never turn down a positive year for anyone, much less for everyone, but the changes will not be dramatic enough to cause any large celebrations.