More Hogs Than Expected, Summer Rally Possible

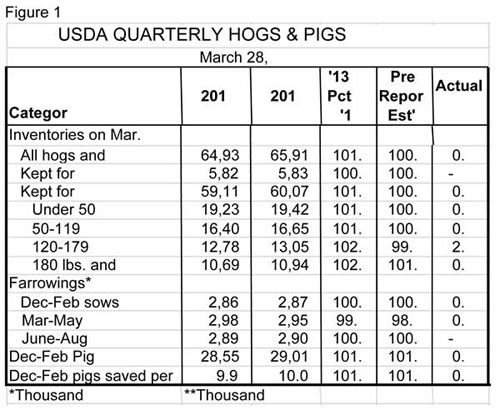

US - Reports issued by USDA last Thursday were a mixed bag for pork producers – providing some help on feed costs, but they also poured more cold water on an already-disappointing hog market, writes Steve Meyer in his latest "Market Preview" published in 'National Hog Farmer' magazine.USDA’s quarterly estimate of hog inventories came in reasonably close to the pre-report estimates but, just as they were in December, virtually every number in the report was slightly larger than expected (Figure 1).

The "momentum" of the numbers is expected to push hogs lower in Monday trading, especially for the May and June contracts, which will be impacted by the 50- to 119-lb. and the 120- to 179-lb. inventories, the latter being a big surprise at 13.059 million head (2.2 per cent larger than last year). The average of analysts’ estimates for the 120-179-lb. category was 99.9 per cent of last year. In retrospect, that figure looks pretty screwy relative to +0.7 per cent and +1.6 per cent expectations for the weight categories on either side of it, but the big positive deviation of actual from expected will still likely have a very negative impact on Monday’s Lean Hogs trading.

The report does appear to be internally consistent with Dec.-Feb. farrowings in line with the breeding herd and the Dec.-Feb. pig crop and the under-50-lb. inventories in line with farrowings and the average litter size. In addition, March slaughter has exceeded year-ago levels by 2.2 per cent, almost perfectly in line with the 180-lb.-plus head count.

March-May farrowing intentions still appear small relative to the breeding herd, leaving me still concerned that fall pig supplies could be a bit larger than what those intentions suggest.

The average number of pigs saved per litter for Dec.-Feb. set another record at 10.1. That figure is 1.1 per cent higher than last year, confirming that the rate of litter size growth has slowed a bit from its torrid 2 per cent pace of 2007 through 2011. The quarter though is the 39th consecutive during which the number of pigs saved per litter has exceeded one year earlier. That string dates back to the summer of 2003!

So what does this mean for hog prices? The market’s initial reaction was bearish and futures opened Monday morning in line with those sentiments. But traders have quickly stepped in to buy Lean Hog futures. Every contract was higher at the time of this writing. I think it is a general reaction to the negativity that has been in the market for the past couple of months and traders have said, “Enough!” This market has been beat up to the point that it is a value. All of the summer contracts are now trading over $3 higher than their recent lows.

There are still going to be plenty of hogs. I have reduced my summer price forecasts, too, but I still believe that this spring’s price decline has been overdone and that higher beef prices, warmer weather and slow but steady growth of the US economy will fuel a rally into the $90s this summer.

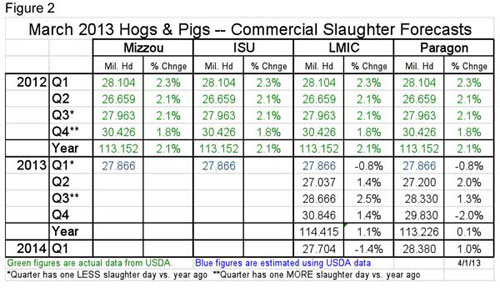

Figures 2 and 3 contain the quarterly slaughter and price estimates that I could gather by press time. Others will be included next week.

Grain Stocks, Planting Reports Helpful

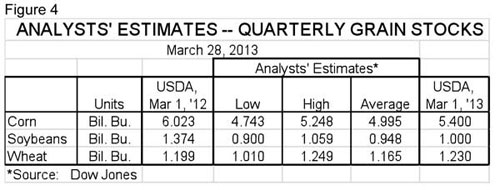

Thursday’s Grain Stocks report has stirred far more interest and caused far more market movement than any of the other reports released last week. The reason, of course, is that it contains an unexpectedly large number for March 1 corn stocks. The 5.4 billion bushels on hand was 20 per cent larger than the average of analysts’ pre-report expectations. That difference drove a lock-limit down day on Friday and old crop futures have been over 40 cents/bu. lower most of Monday. Data for corn, soybeans and wheat appear in Figure 4.

1 March stocks of soybeans and wheat both exceeded the average estimate of analysts, but futures for both fell sharply on Thursday and have fallen farther today. Corn is indeed king and the downward pressure there has definite impacts on substitutes in both usage (wheat) and production (soybeans).

The reductions in corn and soybean meal futures prices have dramatically improved the profit outlook this year for pork producers. My model (based on ISU’s Estimated Costs and Returns parameters) showed average 2013 losses of almost $20/head last Tuesday, March 26. As I write this, that figure is now at -$12/head. Still nothing to write home about but we’ll take improvement wherever we can get it at this point.

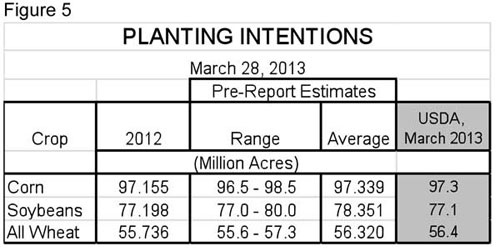

Planting Intentions Near Expected Levels

Figure 5 shows planting intentions for corn, soybeans and all wheat from Thursday’s USDA Prospective Plantings report. The corn and wheat figures are very close to analysts’ pre-report estimates, while the soybean figure is 77.1 million acres. The intended 97.3 million acres of corn would be the largest corn acreage since 1936, when 101.959 million acres were planted. US farmers harvested a whopping 1.259 billion bushels that year as dry conditions pushed yields down to 18.6 bu./acre. In spite of all the challenges, how blessed we truly are.