What’s Caused Prices to Falter: Demand or Supply?

US - Is it demand or is it supply? That question has been kicked around ad-nauseum this year as meat and livestock prices have consistently fallen short of expectations. In typical economist fashion, the correct answer is “both.“ But that brings very little satisfaction, so let’s look at the information we have, writes Steve Meyer, in the National Hog Farmer.Meat Demand

First, meat and poultry demand at the consumer level has not been bad at all. In fact, January was a great month for everyone as real per capita expenditures (RCPE) for beef, pork, chicken and turkey were 3.2 per cent , 3.7 per cent , 3.4 per cent and 6.3 per cent higher, respectively, than one year ago. February was not nearly so good, but year-to-date 2013 RPCE was still higher for all four major species at the end of February.

Like what you're reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

We will not know the figures for March until import and export data are available in mid-May. Strong March retail prices for beef and chicken suggest that their demand is still good. March’s average pork retail price was 3.5 per cent lower than one year ago but even that doesn’t mean March RPCE will be poor. It is very likely that March per-capita disappearance/consumption will be significantly higher than one year ago due to the challenges we have had with exports to Russia and China. Fewer exports means more product that U.S. consumers must buy and lower domestic prices. The question is “Just how much lower?”

All of this is a bit of a surprise to most analysts. Higher social security taxes, languishing per capita disposable income, high gasoline prices, snowstorm after snowstorm, etc. all had most of us thinking demand was soft. Such thoughts were quite logical and, it appears, wrong. The data simply do not agree and actually say that demand has been reasonably good.

Meat Supply

So that turns our attention to supply.

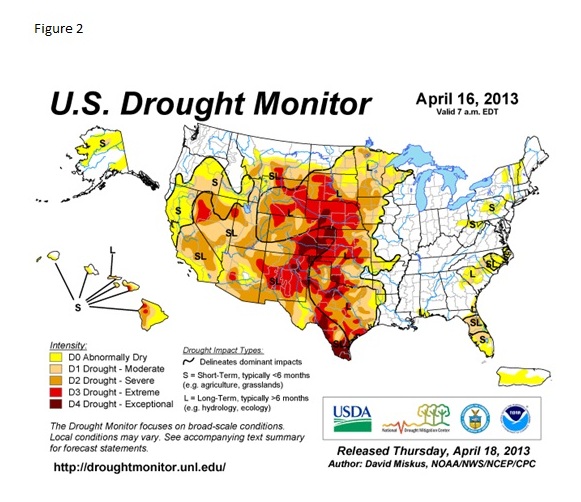

As is the case with demand, we must consider what was expected. The worst drought in 50 years, record heat in many parts of the country, mandated corn usage for ethanol, etc. all led to record-high corn and soybean meal prices – and wheat prices and sorghum prices, etc. Record-high costs were going to force hundreds or thousands of producers out of business, reducing meat and poultry supplies. At least that was the idea.

What Went Wrong

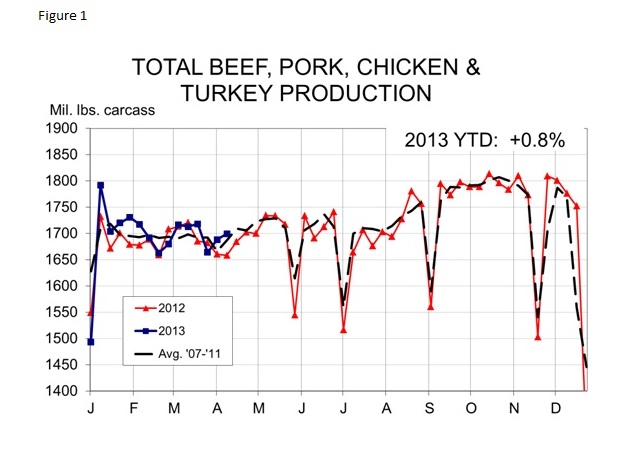

Things haven’t exactly worked out that way. Total meat and poultry production was down 3.6 per cent from one year ago during the first week of 2013. But that figure has to be dismissed in a year-on-year comparison, since the first week of 2013 had one less day in it than did 2012. Since that week, total beef, pork, chicken and turkey output has been larger than last year in 11 of 14 weeks. The largest year-on-year increase was the second week of the year at +3.5 per cent . The second largest was the week ending Feb. 2 at +3.1 per cent . But six other weeks have seen production at least 1 per cent higher than last year and last week’s figure was +2.5 per cent . The largest year-on-year decline was 1.6 per cent the week ending March 1.

And it gets worse. Total beef, pork, chicken and turkey exports were down 8.3 per cent through February (Figure 1), and our guess is that pork exports for March will be down sharply due to the ractopamine-related import prohibitions or limitations for pork, beef and turkey headed for China.

Supply Salvation?

When will the supply situation turn around? It may not. Chicken companies are already growing slightly. Hog numbers were larger on March 1. Feedlot inventories are lower than one year ago but feeders found significantly more cattle to place last month. Only turkey producers are making cutbacks of any significance – but it is only April in a business that is still driven largely by holiday demand. Chicken and pork producers could move quickly to expand if 2013 crops are near normal and new crop corn and soybean prices are more reasonable.

That of course brings us to weather which, itself, has improved. The Weather Service’s Drought Monitor map for April 15 appears in Figure 2. The improvement relative to late fall is dramatic and I expect to see even more improvement when this week’s map is released tomorrow. So there may be help on the way from the cost side – if we can just get it dry enough and warm enough to plant.

If it’s not one thing, it’s another!