USDA Holds to Corn, Soybean Yield Trend Lines

US - Last week’s World Agricultural Supply and Demand Estimates (WASDE) report from the US Department of Agriculture (USDA) carried no big surprises, writes Steve Meyer in this week's "Market Preview" as published on "National Hog Farmer" magazine.As expected, USDA used its own acreage figures for corn and soybeans from the June 28 acreage report. The harvested acres estimate for corn is 89.1 million, slightly lower than the 89.5 million used in June. For soybeans, USDA stuck with its forecast of 76.2 million acres harvested. The planted acreage is pretty well fixed at this point and it is too early to quibble about harvested acres.

USDA did not change its forecasts for either the corn or soybean yield, still basing those numbers on long-term trends until the first objective measurement data are available in August.

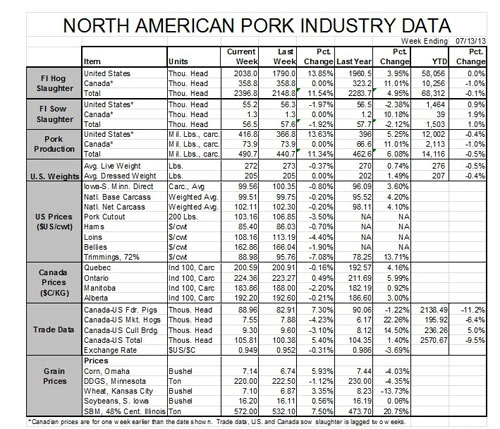

USDA did increase its estimate for corn imports for this year by 10 million bushels and increased feed/residual usage by 50 million bushels. Those two changes drove 2012-2013 carryout stocks to 729 million bushels from 769 million bushels or just 6.5 per cent of projected total use and making a tight stocks situation even tighter. The increase in feed/residual use was made to reflect the lateness of this year’s crop – a factor that has, in effect, made the 2012-13 marketing year about 14 months long. Recall that we dipped into 2012 corn supplies early last summer; this year they will have to last longer.

Add in some tweaks for various 2013-14 forecast uses, that amounts to a 100-million bushel reduction in total usage and USDA’s projected 2014 carryout stocks increased to 1.959 billion bushels or 15.4 per cent of total usage. That would be a much more comfortable stock level indeed!

It is important to note that futures markets for corn and soybeans are carrying weather premiums at this point, though, and we concur that there is still significant weather risk. June rainfall has been below normal in much of the Corn Belt from Indiana westward. Temperatures have not been damagingly high yet, but millions of acres of corn need a good drink of water just now as pollination begins. An equation relating December corn futures price to yield derived by Iowa State University’s Robert Wisner suggests that the corn futures market is reflecting a national yield of about 149 bu./acre at this time.

The premium in the soybean and soybean meal markets are even larger. New crop beans are $1.75/bu. or so higher than the mid-point of USDA’s forecast price range, while soybean meal is about $65/ton higher than USDA’s $320/ton midpoint. This late-planted soybean crop will likely require a late frost to reach USDA current yield forecast, and we won’t know if that happens until the day it actually happens!

Bottom line: It’s still the weather!