Karro, Cranswick Elected to Add Fuel in Pricing Debate

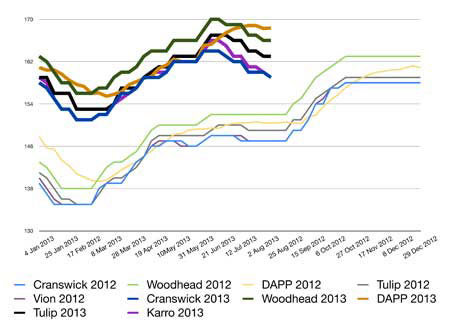

UK - As the debate heats up around the unilateral pricing mechanisms used by many of the key buyers – generally referred to as the shout price system, both Karro and Cranswick elected to add more fuel into the debate by not only removing a penny from their headline shout price, but more significantly, falling underneath the 160p mark, writes Peter Crichton.

After a nervous delay, Tulip took a more balanced view and stood-on at 163p. Woodhead took a similar line despite probably buying a large percentage of its supplies on a DAPP basis and also despite requiring fewer pigs as it nears completion of its Colne abattoir expansion plan and needed a temporary break in supply to finalise the works. Top dog of the day was Gills, which actually added a penny to its contract price and now shares top spot with Woodhead at 166p.

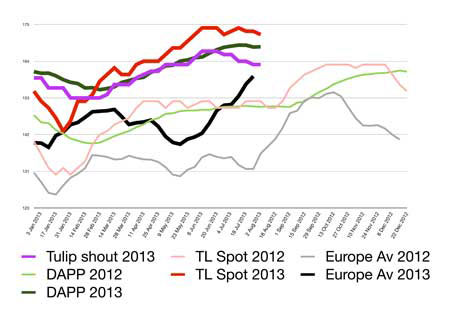

However, to put all of the shout prices in context, even the best is almost 3p under the DAPP land nearer 4p–8p below most spot bacon prices, which all stood–on, or added a copper.

With Tulip and Woodhead close to completing major investments in their facilities and news that Karro has just secured an additional £60m of funding for future investment, the key part of that strategy has to be to ensure they can source enough British pigs to keep their plants operating at optimum capacity.

Recent surveys of consumer habits and attitudes after Horsegate continue to highlight the increased importance they place on ‘British’ and even though price is still the key purchasing driver, over 50 percent said they now take time to check labels carefully before buying.

So to threaten that security of supply by unfair, unpopular and non-transparent pricing models, appears to be a short-sighted approach and not an approach finding much favour with those producers who continue to have this pricing option as their only option – for now. Given that the school holidays are already at the half-way point, it won't be long now before stronger demand adds pressure on pig buyers to find more numbers, coupled with outdoor producers commenting on 'how much lower their finishing numbers coming through are after high field losses of piglets during one of the coldest springs since records began more than100 years ago.

We have often been disappointed when September fails to deliver the promise of a better supply/demand balance for our pigs, but with real signs of the overall European-wide reduction in supply (predicted as a result of the revised sow housing rules) already pushing prices to be on a par with our own the outlook is positive and stronger cull sow prices – up again by 2-3p even though the euro weakened slightly, remain a good marker of a stronger pigmeat trade – even when some of our own prices don’t.