Brazil Hog Markets

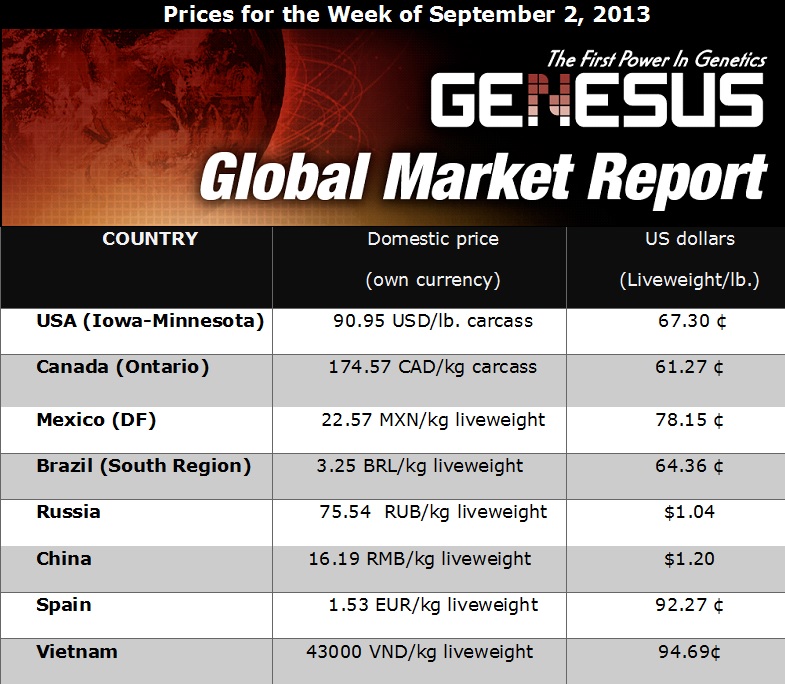

BRAZIL - The rollercoaster is rolling again! The last report from Brazil, in July, indicated that prices were retreating slowly. However, in the intervening six weeks or so, there has been a slow and firm recovery, writes Martin Riordan, Genesus Brazil.The price of market hogs in the southern state of Rio Grande do Sul has reached R$3.25 per kg live weight (64.36¢ USD/lb.) this week, and this increase is reflected fairly evenly throughout the country. In terms of local currency, this is a good price, as the cost of production is around R$2.80. In dollar terms, it is not so impressive, and is about US$0.65 per lb live weight.

However, producers buy most of their inputs in local currency and it is a relief for them to finally have a decent return on the activity. In fact, one of the reasons for the firmer prices is exactly the dollar exchange rate. A year ago, the dollar exchange rate hovered around R$1.80. In recent days, it reached a peak of R$2.44 and has now dropped to R$2.28. Even so, this means that packers who export (which includes all the biggest ones) are receiving 26% more per kg than a year ago, in local currency, and this seems to have made them more bullish.

They must be betting on the future, as exports in August, at 52,341 metric tons, were down 4.34% in volume and 1.17% in value. However, as related in the last report, exporters are optimistic about markets opening or reopening – maybe in September they are managing to sell more abroad and are thus buying up what they can.

The Christmas market will also be having an effect soon. Traditionally packers start forming inventories in the last 3-4 months of the year to supply supermarkets during the festive season. Perhaps, concerned that hogs will become more and more expensive over coming weeks, they are trying to form their stocks now.

The higher exchange rate, according to the pundits, is a result of two factors. First, a general appreciation of the dollar worldwide as the American economy shows signs of recovery. And secondly, the opposite effect in Brazil. The dubious macro-economic decisions being taken by the current Workers Party government are making international investors think twice about investments in Brazil and, perhaps attracted by safer returns elsewhere, speculative money is being taken abroad, increasing the demand for dollars locally.

One of the government’s latest master plans is to import “slave labor” in the form of Cuban doctors – up to 4,000 of them are expected to arrive in Brazil over coming months. Their salaries will be paid to the Castro brothers back home and they will be sent straight back should they think of asking for political asylum in Brazil. They are expected to be sent to rural areas where Brazilian doctors refuse to work in the public health service as there is a total lack of any facilities or drugs. So now these populations will be attended by doctors who don’t even speak their language! And who have been exempted from the legal requirement to sit a proficiency exam in Brazil to demonstrate that they are properly qualified.

Corn prices in the south of Brazil are holding firm at around US$191 per metric ton, while soy meal prices are rising to reflect the stronger dollar and have reached US$558 per metric ton, an increase of some 18% over the last month.

It seems like the idea of a sustained period of profitability in pig production is a thing of the distant past.

After the price recuperation that began in May, in June prices stabilized at around break-even, and now in July a slow decline has set in. This seems to be a result of low demand in both domestic and international markets.

June pork exports were yet another disappointment for the industry. At 40,626 metric tons, they were 7.5% below the same month in 2012. And in the first half of the year, sales were 240,515 metric tons, a full 10.5% below the equivalent figure for 2012.

But ABIPECS, the association of pig exporting plants, is spreading optimism. Its president, Rui Eduardo Saldanha Vargas, explains that the Ukraine market, which was closed to Brazil in March, reopened in mid-June. This is the major reason for the poor figures in the first half of the year, and is why the second half should be better, he says. Ukraine’s imports in the first six months of 2013 were 25,385 metric tons, representing a fall of 60.8% over the same period last year.

With the closing of the Ukraine market, Russia became the main destination of Brazilian pork this year, taking 28.7% of total exports, followed by Hong Kong with 25.3%. Rui Vargas also believes that the Japanese market could become important in the short, medium and long terms, now that it has partially opened to Brazilian exports.

Well, if optimism could pay the bills, pig producers would be smiling from ear to ear. As we know, it is what has kept (some of) them going for the last 5 years!

The survey of pig prices in the state of Rio Grande do Sul, conducted by this author since 2004, has now been taken over forcibly by the state pig association, by the simple expedient of telling its members not to give information on prices! The association does not divulge how the numbers are processed, so it is impossible to know how the weekly figures it divulges correspond to the figures produced by the previous report.

But, for what it is worth, the association’s survey for this week shows a price of R$ 2.66 (US$ 1.18) per kg live weight. Embrapa, a government agricultural research agency, published cost of production figures for June, showing a cost of R$ 2.69 per kg live weight to produce a 110 kg market hog.

Which demonstrates that, really, optimism is the only profit the producer has!

In January of this year, the cost of production figure was R$ 3.00, so over six months it has fallen by 34 cents of a real (the Brazilian currency). Most of this decrease (21 cents) has been generated by lower feed costs, due to the good harvests of corn and soy beans taken in during the first months of the year, bringing the prices of these basic ingredients down from the critical levels they had reached.

There is not a lot of optimism in the air for the general trend of the Brazilian economy, as shown by the massive popular protests that took place in June, when literally millions of people came out spontaneously onto the streets to express their dissatisfaction. There is a new generation of young people, with more access to education than many of their parents had, and much higher expectations of a decent life. And they are all interconnected via their cellular phones, with Facebook, Twitter and other social networks.

The protests were somewhat diffuse and permitted no participation by political parties, as these were certainly among the intended targets. But among the reasons for this popular uprising can be detected: concern about the blatant corruption of all political parties, rising inflation, first world taxes and third world services for health, education, public security and anything else the government has the duty to provide, and the fact that the government decided to spend billions of dollars to build fine football stadiums to host the World Soccer Cup next year when people die in hospital lines waiting to be attended. This seen by many as a questionable decision, especially as a good part of the billions will end up in the pockets of the politicians.

It is not a scenario that encourages high investments, particularly in an activity such as pig production that has not shown a return for many years. So it is hard to believe that Brazilian pig production, at least at the level of the independent producer, will be expanding in the near future.