CME: Economic Conditions to Affect Capacities of Packing Sectors

US - The capacities of US packing sectors will likely have very different impacts on — and be themselves impacted very differently by — economic conditions over the next few years, write Steve Meyer and Len Steiner.“Packing capacity” here refers to the capacity for firms to harvest or slaughter animals. This is the most measureable and, we think, most important capacity issue in the livestock and poultry industries since it is the one that is least flexible. A hog plant is a hog plant, a beef plant is a beef plant, etc., etc. but a meat processing facility has much more flexibility. Oh sure, there isn’t much need for belly shapers in a chicken plant but much of the equipment used for chopping, grinding, shaping, marinating, cooking, etc. can be used for different species.

Capacity is obviously important in that every animal must move through a plant. Ideally, the collective capacity of the processing sector will be well-matched to the number of animals that it is asked — or forced — to process. Such a match would optimize throughput and minimize costs thus providing the highest possible level of farm–level relative to consumer-level and lowest level of consumer cost (supply) relative to farm cost. But there is nothing to force a match between

capacity and numbers and there lies the rub.

The competitive forces of excess capacity eventually drive packer margins low enough that someone is forced to cut back or exit the business. That action, of course, puts capacity in balance once again, reducing the level of competition for livestock and allowing margins to grow to sustaining levels. The opposite is also true — tight capacity allows packers to realize better margins, thus providing incentives to expand, again balancing capacity with numbers. The process

is far from precise, however, since animal numbers can generally be changed much more quickly than can capacity.

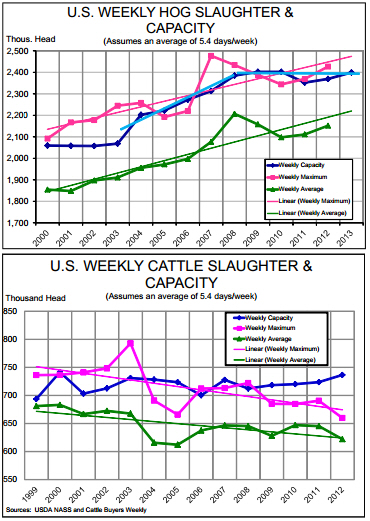

The beef and pork sectors present very different scenarios for packing capacity — both historically and for the future. As can be seen at right, the directions of these industries, in terms of numbers, are almost opposite. Hog numbers, though lower than their record levels of 2008, are growing again and are expected to challenge those annual records in 2015 depending on what feed costs do

between now and then. On the other hand, cattle numbers are hitting their lowest levels of the past 50 or so years. Ranchers are trying to expand the cow herd and increase numbers but that effort has been slowed by drought and resulting limited forage supplies and high feed costs. The result is tight capacity in the pork sector and continued and growing slack capacity in beef packing.

The linear trend for pork capacity (blue line in the top chart) is steadily upward but careful consideration of the data show that the linear trend is misleading. The actual trend since 2008 has been flat, a pattern without much consequence while hog numbers were flat in response to higher costs of production. But lower feed costs, profits and expansion will challenge that capacity quickly — perhaps by the fall of 2014 —and there is no additional capacity currently under construction. Triumph Foods announced several years ago that they would build a new state-of-the-art plant in East Moline, IL but have never broken ground on it. Several companies have expressed interest in double-shifting plants but even that would, in every case of which we are aware, take 12-18 months to accomplish.

The beef situation is just the opposite: Total packing capacity of the top 30 beef slaughter firms — which represent about 98% of total capacity — has stayed relatively steady as cattle numbers have fallen since 2008. These data come from Cattle Buyer’s Weekly and details are available to subscribers at www.cattlebuyersweekly.com.

The largest weekly total in 2012 left about 10% of unused capacity. The average week left over 15%. That has not been good for margins and the pressure is likely to grow as the diminished calf crops of 2012 and 2013 (and 2014? and 2015?) work their way through pastures, background lots, feedlots, etc.