CME: Restaurant Operators’ Outlooks Turning Negative

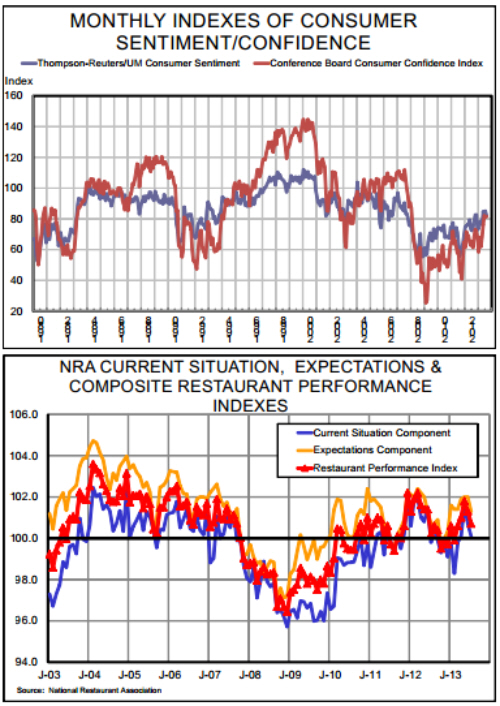

US - Three pieces of information released on Friday all point to consumer attitudes and behaviors that, though we wouldn’t call them weak, certainly do not add up to resounding strength, write Steve Meyer and Len Steiner.The items were the monthly Thompson-Reuters/University of Michigan Consumer Sentiment Index and The conference Board’s Consumer Confidence Index for August and the National Restaurant Association’s monthly Restaurant Performance Index for July. Historical data for all three appear in the charts at right. Some highlights of Friday’s releases are:

- The T-R/UM Consumer Sentiment Index fell 3 points to 82.1. That decline follows the two highest observations of the index in nearly 6 years but still compares quite favorably to last year’s 74.3. The index is up 10.5% for the year.

- Both components of the T-R/UM index contributed about equally to the decline with the Current Situation Index falling by 3.4 points to 95.2 during the month and the Consumer Expectations Index declining by 2.8 point to 73.7. Like the overall index, both of these still compare very favorably with year-ago level of 88.7 and 65.1, respectively.

- The T-R/UM press release pointed out that the “cross currents [for the index] are inevitable in a slow growth economy” and indicates that, though lower than in May and June, the index still points to increases in consumer spending during the year ahead. Notably, the release points out that survey respondents are more optimistic about income increases that at any time in nearly 5 years.

- The Conference Board’s Index of Consumer Confidence grew by 0.5 points in August to reach 81.5, a level which, like the T-R/UM index, is far higher than last year’s 61.3. The index remains lower than June’s 82.1 which was the highest monthly observation since January 2008.

- The higher Conference Board index was caused by a healthy increase in the Expectations Index from 86 in July to August’s 88.7. A nearly 3 point drop in the Present Situation Index (70.7 in August) partially offset that expectations gain.

- The NRA’s Restaurant Performance Index declined for the second straight month. July’s index of 100.7 is down 0.6 points from June but remains higher than the July ‘12 index of 100.2. This index is constructed such that 100 demarks expansion an contraction. The July value is the fifth straight expansion reading for the restaurant sector.

- Both major components of the RPI declined in July. The Current Situation (CS) Index was 100.1, 0.6 points lower than in June but still slightly higher than last July’s 99.8. The Expectations Index which measures restaurant operators outlooks for the next six months, was at 101.3 in July, 0.6 points lower than in June and, perhaps most notably, at its lowest level in seven months.

- Same-Store Sales (100.7) and Capital Expenditures (101.6) were positive for this Current Situation component while Customer Traffic (99.2) and Labor (98.9) were drags on the component value.

- All four components of the Expectations Index (Same-Store Sales, Staffing, Capital Expenditures, Business Conditions) remained above 100 in July though only the Staffing Index grew during the month.

- Restaurant operators’ outlooks for the next six months turned negative in July with the percentages expecting sales volume growth and better economic conditions falling to 37% and 23%, respectively from their June levels of 46% and 30%.