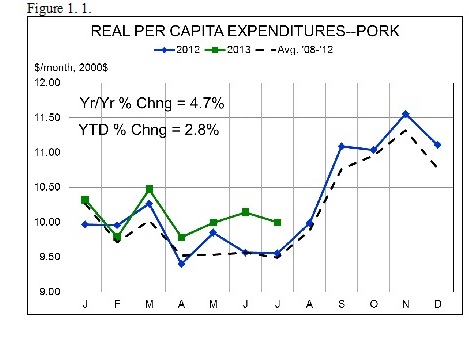

Pork Repeats Strong Demand Showing

US - Pork demand continued its strong 2013 showing in July. Real per capita expenditures (RPCE) for pork by US consumers came in at $9.49, 1.4 per cent lower than in June (a normal seasonal pattern), but 4.7 per cent higher than one year ago, writes Steve Meyer, for The National Hog Farmer.July’s growth follows a 6 per cent jump in RPCE in June, 4.9 per cent in May, 2.7 per cent in April and 4.4 per cent in March. January’s RPCE for pork was 3.6 per cent higher than last year, but February’s figure was 1.7 per cent lower than the year before. The year-to-date total for 2013 now stands at $68.12, 2.8 per cent higher than one year ago.

July’s excellent performance was driven by both quantity and price as per capita consumption exceeded the July 2012 level by 3.7 per cent and July’s real (ie. deflated) retail pork price exceeded the year-ago level by 3.5 per cent . That July price was the result of a NEW RECORD-HIGH retail pork price of $4.955 per retail pound! That price eclipsed June’s “old” record of $4.916, which itself surpassed the previous “old” record of $4.912 in January. Three new records so far in 2013! I would be surprised to see a fourth but it could happen given hog prices in August.

For comparison, beef’s RPCE was 2.3 per cent higher in July bringing the year-to-date total for beef to $141.72, an increase of 2.6 per cent vs. the same period in 2013. Chicken’s RPCE was equal to last year’s level in July but relatively good performance over the first six months leaves that sector up 2 per cent year-to-date.

Those three species are in good shape. But there is a train wreck occurring in the turkey sector. The average retail price of turkey fell to just $1.391 per pound in July, 10.9 per cent LOWER than one year ago and over 20 cents per pound lower than in June! I can hardly believe that number but if it is wrong, it is wrong at USDA because I checked the USDA online data set. Factor in inflation and the real, deflated price of turkey fell by 12.7 per cent from last year’s level. And all of this happened in a month that is usually the launching point for seasonal price increases!

What’s worse, those price declines occurred in a month in which per capita turkey consumption – and remember that “consumption” here really means “availability” -- was 4.3 per cent LOWER than last year. That drop follows 4.7 per cent and 4.9 per cent declines in May and June. Turkey’s RPCE in July was 16.5 per cent lower than one year ago and now stands 5 per cent lower than last year for 2013 to date.

This is not a case where the market is flooded as turkey slaughter and production are down 1.7 per cent and 1 per cent , respectively, from one year ago. Neither is it a case of export problems dumping product back on the domestic market as exports, which accounted for 13.4 per cent of production in 2012, are only 1.3 per cent lower than last year. Somehow, the industry has simply not been able to keep product moving at prices even close to last year in spite of every other species’ products being, on average, at or near their highest level ever.

Resiliency of Pork Demand

The exceptional performance for pork demand was not enough to keep the demand for hogs higher on a year-on-year basis early this year. My index of farm-level hog demand was below 2012 levels for January through March before just about breaking even in April. Since that time, though, the noted strong domestic demand and some recovery for exports have left hog demand 2-3 per cent higher than last year. Demand has no doubt been a primary driver of higher producer revenues this summer.

Can this last? Not only do I think it can, I think it is likely. This year’s demand has been helped along by higher prices for our two main competitors. Chicken prices will likely moderate, putting some negative pressure on pork demand as consumers opt for the lower-cost protein. But beef prices will, I believe, remain high through 2014 and may even climb as ranchers begin to retain heifers on their finally-green-again pastures in many parts of the country. I would say cheap turkey would be a drag on pork demand except for the fact that, as noted above, low turkey prices are not being driven by high supplies. They are being driven apparently by a souring of consumers’ preferences for turkey, and lower turkey demand will not hurt pork demand. In fact, consumers who are turning away from turkey will have to eat something so it may be helpful for pork demand.

And then there is positioning. In 1987, pork took a bold step to position itself as a close alternative to chicken, an “Other White Meat.” It was gutsy and brilliant and absolutely needed. This year’s “Cook It Like a Steak” campaign was pretty gutsy as well. It’s too early to call it brilliant but, when layered on top of new names for a slew of pork cuts, the 145 degrees F with a three-minute hold change in USDA’s cooking recommendation and the Pork. Be Inspired campaign launched in 2010, my early reaction is that it has been effective and positive. Only time and some far more sophisticated economic modeling will tell us the exact impact of all of those changes, but the results are encouraging indeed.

Now if we don’t screw it up by raising 4 or 5 or 6 per cent more hogs next year.