CME: Tight Hog Numbers Put More Focus on Performance

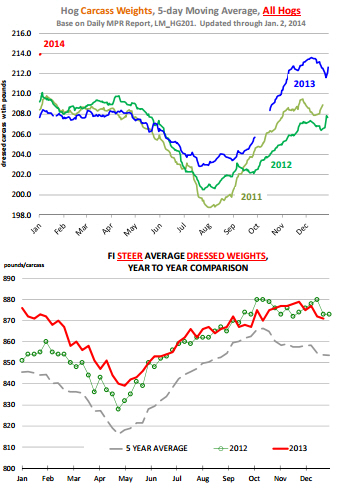

US - Tight cattle and hog numbers will put more of the focus on performance and, at this point, the hog and cattle markets are on different paths. In part, this is biology but changes in feeding regimens for cattle certainly have limited the carcass weight gains in recent months, write Steve Meyer and Len Steiner.In the case of hogs, producers and packers are trying to offset the death losses caused by Porcine Epidemic Diarrhoea virus (PEDv) by keeping hogs on feed a bit longer and adding more pounds to carcasses. The chart to the right shows the latest reading from the USDA Mandatory Price Reporting system. Keep in mind that the average weights shown in the chart reflect a five day rolling average and they include both producer and packer owned hogs.

In the past, the spread between producer and packer owned hog weights has been relatively small. Since September, however, the spread has increased sharply as packers have been much more aggressive in adding weight to hogs that will be processed internally. For the five days ending January 2 (Dec 27 -Jan ), the average carcass weight of all hogs was 213.9 pounds, 5.9 pounds or 2.7% higher than the same period a year ago. On a weekly slaughter of about 2.1 million head, this implies an additional 12.3 million pounds of pork or the equivalent of some 58,000 more hogs. Normally hog weights drift lower into January and early February as producers become more current. Still, with hog numbers expected to be steady or even slightly lower than a year ago, producers and packers will seek to maximize weight gains in order to bring more pounds to market.

Lower feed costs certainly are an inducement to add more pounds and those producers that have lost pigs certainly have the space to do so. The expectation is for hog weights to trend somewhere about 1.5-2% above year ago levels in Q1, which would imply a similar type of increase in pork production. The number to keep an eye on will be the hogs coming to market each week and how they match up with the latest USDA Hogs and Pigs survey. An increase in hog numbers coupled with very heavy carcass weights could put some pressure on pork and hog prices in the near term. Certainly that was the story in December and part of the reason why futures markets removed much of the premiums built into the nearby February contract.

The situation in the cattle complex is quite different than with hogs. The inclusion of more potent feed additives in 2012 certainly provided a boost for beef production and allowed producers to bring significantly heavier cattle to market. With an ever shrinking cattle herd, much of the increase in beef supplies has come through productivity increases. Following the removal of Zilmax from the market in the fall, however, cattle carcass weights have stalled and in the last few weeks have been below year ago levels. Some expected weights to decline more sharply but a combination of using other feed additives, cheaper grain and placing on feed heavier calves has allowed feedlots to at least match year ago levels. Increasing cattle weights in the current market environment will be difficult. This has been a very tough start to the winter and eventually the cold and wet weather will take its toll on cattle conditioning. Lower feed costs will encourage feedlots to hold cattle on feed longer but weight gains are not linear. The main benefit of modern feed additives is that they allow cattle add lean muscle at a time when normally they would either gain more fat or slow down the growth process. Cattle numbers will be tight in the coming months, this is something we have seen coming for a while. And with no growth in overall carcass weights, the decline in production may be more pronounced than in past years.