2013 a Difficult Year for Ireland's Pig Sector

IRELAND - Notwithstanding continued improvement in returns, 2013 was another difficult year for the pig sector. Continued high feed costs, albeit at a lower level than 2012, together with ongoing challenges in respect of non-feed costs combined to keep margins under pressure, according to the Annual Review & Outlook for Agriculture, Food and the Marine 2013/2014.A number of operators ceased production during the year with this was reflected in a 1.2 per cent decline in the pig herd in the June survey. However, there was an increase of 1.2 per cent in the breeding herd, a reversal of the trend seen in previous years. Output volume fell by approximately two per cent although this was offset to some extent by an average increase of six per cent in prices, with a resulting three per cent increase in the value of Irish pigmeat exports.

There was a continuation in the shift in exports from Continental Europe to international markets with 37 per cent of trade now going to the latter. China and Russia account for almost three-quarters of this growing trade.

Despite a reduction in feed costs, the impact of cereal price increases since 2009 on the pig sector remained significant. Margins continued to remain below long-term averages in both Ireland and the EU and were under pressure for most of the year.

Given that cereals account for up to 75 per cent of pig feed, the impact of this development on the pig sector has been considerable. Pig producers and the Department of Agriculture, Food and the Marine worked towards achieving compliance with the Loose Sow Housing regulations which came into force on 1 January 2013.

Output in Ireland

In 2013, the output value attributable to pig production is estimated to have increased by 7.2 per cent to almost €473 million.

| Output value1 and volume of pigs in Ireland in 2012/2013 | ||||

| 2012 | 20132 | |||

|---|---|---|---|---|

| Value (€m) | No. ('000) | Value (€m) | No. ('000) | |

| Live exports | 80.73 | 704 | 90.86 | 691 |

| Total slaughterings | 363.62 | 2,972 | 380.50 | 2,904 |

| Total disposals | 444.35 | 3,677 | 471.37 | 3,595 |

| Imports | 0.92 | 0 | 2.08 | 16 |

| Changes in stock | -1.71 | -60 | -1.64 | -24 |

| Total | 441.50 | 3,608 | 473.10 | 3,555 |

| 1Values are after deductions for transport costs 2 Early estimate Source CSO |

||||

Prices

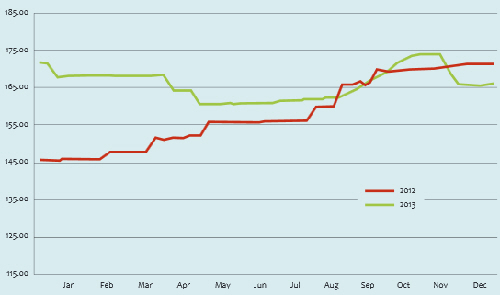

Producer prices for pigmeat increased during the first nine months of 2013 and were ahead week-on-week for the majority of the year, with this upward trend coming on the back of significant increases in 2012. Price declines in the latter part of the year resulted in the end of year price falling below the previous year for the first time since 2009.

The EU average price increased in the first nine months of the year with levels increasing by 10.5 per cent between January and September. The final quarter was considerably more challenging with a decline of almost 11 per cent experienced. These developments resulted in the December price being 1.6 per cent lower than 12 months earlier.

During the year, Irish prices remained below the EU average with a low point of 85.3 per cent being experienced in August. Although prices in both the EU and Ireland fell sharply in quarter 4, the rate of decline was greater in the EU. The result of this was that Irish prices ended 2013 at 97.5 per cent of the EU average.

(Source DAFM)

Slaughterings

During 2013, approximately 2.83 million pigs were slaughtered in Department of Agriculture, Food and the Marine export-approved plants. This equates to a decline of almost 2.5 per cent compared to 2012. Production declined by 1.3 per cent in the first half of the year, with the rate of decline accelerating to 3.6 per cent in the second six months.

Approximately 90,000 sows are included in this 2013 figure, a slight decline from 2012. Pork accounted for almost 97 per cent of the total.

The export of live pigs to Northern Ireland fell by approximately 55,000 head, a decline of 8.7 per cent and reached some 575,000 head in 2013.

Exports

Pigmeat export values increased during 2013 by three per cent and amounted to €525 million. This builds on significant increases seen since 2009. The UK continues to be the largest single market for Irish export product and witnessed a six per cent increase in values to almost €320 million. Volumes are estimated to have remained stable at approximately 77,000 tonnes.

The volume of trade to Continental European markets fell by almost 10 per cent to 35,000 tonnes as exporters continued to seek more favourable international markets. The value of exports to these markets still reached some €80 million, similar to 2012 reflecting higher prices.

Performance in International markets was far more positive. Export volumes grew by over seven per cent and reached some 65,000 tonnes. The value of this product is in the region of €125 million. Much of the increase was in the key destinations of China and Russia, two markets where Ireland continues to strengthen its foothold. The opening of the Australian market for uncooked pig meat provided further opportunities for exporters.

It is important to note that, while exports performed strongly during 2013, the domestic market remains the main volume outlet for Irish pigmeat. Consumption in this marketplace was largely unchanged and amounted to approximately 142,000 tonnes.

Outlook 2014

Following rebuilding and recovery efforts in recent years, the future for the Irish pig sector remains challenging. While feed prices have come back somewhat in recent months, they are forecast to remain above long-term averages for the foreseeable future. In addition, difficulties in the non-feed elements of production such as credit availability, energy costs and compliance with the EU Loose Sow Housing Directive, which came into force in January 2013 will present a significant challenge to producers. EU output is forecast to increase marginally during 2014 largely as a result of increased productivity levels.

All of these factors will strongly influence the production decisions of Irish producers and a marginal increase in export supplies is forecast. The anticipated opening of emerging markets in Asia is expected to complement lower levels of growth in already established markets such as China, Russia and Japan.

It is important to remember that pigmeat remains the most consumed meat worldwide and this will continue to present opportunities for Irish producers, given the level of self-sufficiency. In addition, the progress made in the last few years in establishing and consolidating a presence in important international markets will better position Irish producers to take advantage of growing demand.