Pork Industry Enjoys Positive Market Picture

US - I suppose the outlook for hog producers could get better, but I’m not sure exactly how. Yes, I know that pig losses from porcine epidemic diarrhea virus (PEDV) run against everything that we stand for and violate the fundamental reason we raise pigs: We like them, writes Steve Meyer for the National Hog Farmer.No one will be satisfied with death losses and disease prevalence at the rate we have witnessed since May 2013. But from a financial standpoint, it has been and will continue to be very good.

We have highlighted three important factors in this rosy outlook over the past three weeks:

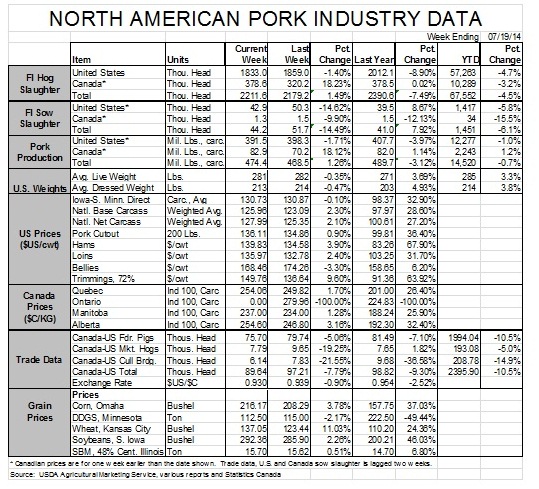

- Exports are higher than they were last year and have remained very strong given this year’s prices. There is no guarantee that will continue, of course, and I suspect that we may see some year-on-year shortfalls the rest of this year given the pork supply and price situation in China. But Russia is buying some product again, Mexican buyers have, according to anecdotal reports, bought hams this summer at prices once thought impossible, and the “Other” markets tracked by the United States Department of Agriculture continue to increase their purchases. Key among them are Australia, Colombia and Philippines.

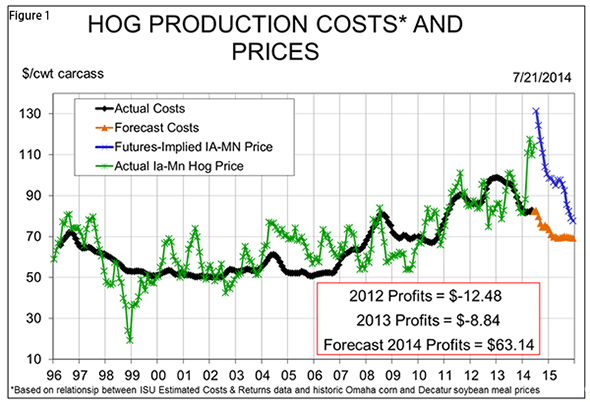

- Costs are as low as they’ve been since early 2010 and are, according to current corn and bean meal futures, heading to their lowest level since 2009. Next year’s forecast average costs (see Figure 1) are near $70/cwt. carcass, and I think that will be about as low as we will see in the next decade. Sub-$3 corn (a real possibility at harvest time!) and sub-$300 meal (possible, but less likely) would push costs into the $60s this year but I don’t think we will spend much time there – just as I don’t think we will spend much time above $80/cwt now that corn output has caught up with total corn usage/demand.

- Hog numbers are tight and getting tighter. The past three weeks have seen federal-inspection slaughter totals 8.4, 8.9 and 8.9 per cent lower than one year ago. Those numbers agree pretty closely with my computations, based on anecdotal evidence of sow infections, pig losses per infected sow and the time pattern of suckling pig case accessions to animal disease laboratories. In fact, my July number was -7.99 per cent so the recent numbers have actually been lower than my computations suggested. None of that means slaughter will necessarily stay near my forecast levels, but the similarity of these numbers and the fact that my May and June calculations ended up within 1 per cent of the actual data have me feeling much more confident, and a little upset that I didn’t have more confidence in making my third quarter and fourth quarter forecasts. My computations say August and September slaughter may be down more than 10 per cent from last year.

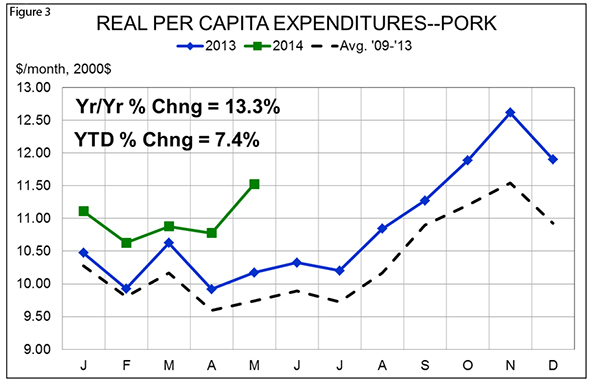

The remaining factor in this remarkable run is demand, and it has been nothing short of stupendous. I think the entire industry was happy with last year’s demand situation which saw my index of pork demand rise by 4.6 per cent from 2012. That was the largest annual increase since 1998. Real per capita expenditures (RPCE) for pork (a number closely related to the demand index) increased from $123.35 to $130.13 (in year 2000 dollars), a gain of 5.5 per cent .

But the demand news is even better this year. The demand index is up 5.8 per cent through May of this year and RPCE is up 7.4 per cent year to date, including a remarkable +13.4 per cent in May. Consumers have been willing (and apparently able!) to pay record-high prices for pork. There appears to be a bit of push-back with cutout values moving above $130, but think about that – the market doesn’t seem too concerned about prices until we get past $130 per hundred pounds of wholesale pork! Did anyone really ever think we would see that short of an Argentine-style hyperinflation?

The final positive point is that this pork demand is being driven by a fundamental shift in consumer tastes and preferences. The popular press talks all the time about protein. Even Time magazine ran a cover story informing readers that animal fats (butter was the feature item) are back in favor and were the victim of some very bad “science” in the 1970s and 1980s. The anti-meat lobby won’t take these new developments lying down, but right now they are being steamrolled by a public primarily interested in “red” meats. Beef demand is also strong this year while chicken and turkey demand have struggled.

So can it get any better? Absolutely. We could see a solution to PEDV and solve one major problem. But the financial situation will get worse if that happens. Of course, it would be difficult to change the current economic situation in any way that would not make it worse. Enjoy the ride!