CME Report: Tyson Will Sell Its Heinold Hog Markets

US - It appears that Tyson Foods’ acquisition of Hillshire Brands has cleared a major hurdle with yesterday’s announcement that Tyson will sell its Heinold Hog Markets, write Steve Meyer and Len Steiner.That sale is the crux of an agreement with the Department of Justice to resolve concerns over the merger’s impact on the market for cull sows. Tyson agreed to sell the markets within 90 days and to several terms regarding operation of the markets in the meantime.

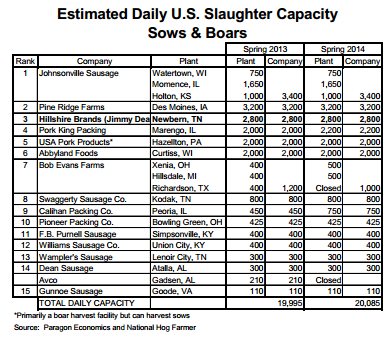

Hillshire has been a major player in the cull sow market for many years through its Jimmy Dean Sausage business that operates the country’s second largest single sow processing facility in Newbern, TN. As can be seen at right, Hillshire ranked third in terms of sow slaughter capacity this past spring behind only Johnsonville Sausage and Pine Ridge Farms.

These capacity figures, which are compiled annually by Paragon Economics for National Hog Farmer magazine, indicate that Hillshire has about 14 per cent of total slaughter capacity. Heinold is also a major player in the sow market. Formerly a farflung network of buying stations across the Midwest, Heinold (according to Meatingplace.com) now operates only eight stations in seven states from Nebraska to Michigan. Heinold was owned by IBP at the time of Tyson’s purchase in 2001. IBP had purchased 40 Heinold sta?ons in 1988 and from that time until the Tyson acquisition, the Heinold system was an important part of IBP’s hog procurement.

Its importance on the butcher hog side waned as suppliers became larger and more able to semi?loads of market hogs directly to plants. Many stations were eventually closed and the current one purchase sows, boars and “off” hogs (pigs that do not achieve top market weight and usually go into ethnic markets for smaller cuts)almost exclusively. Heinold handles few, if any, top butcher hogs. Heinold fills the role of an aggregator of sows, pu?ng together larger groups that it then re?sells to packers who specialise in these animals.

The Wall Street Journal quoted DOJ as saying that Heinold and Hillshire combined “account for more then one third of sow purchases from US farmers.” We aren’t privy to sow purchase data from the two companies but given Hillshire’s 14 per cent capacity share and the Heinold ’s owning only eight stations, that number seems very large to us. If the Feds believe it, though, we suppose it is the number that counts! Tyson Foods’ pork plants do not slaughter sows and thus do not compete with Hillshire in that market. There had been concerns, though, that the merged company could enact “tie in” requirements for sows and top barrows/gilts that might preclude small producers from sow markets.

There wasn’t much concern for larger producers since they often have enough cull sow volume to sell direct to sow processors. The reality and significance of this risk was up for debate. “Tie in” arrangements in the sale of products are illegal under the Federal Trade Commission Act. No one here at DLR is a lawyer (thankfully!), but we are not aware of any specific cases holding tie?ins in purchasing products as illegal. It is sensible, though, to infer such illegality, especially if the action were forced by the “price setter” in the transaction. And whether illegal or not, such actions could cause harm to other parties if they, in fact, occurred and were allowed to persist.

We really believe the probability of problems in this case was small given the visibility of Tyson Foods and the scrutiony that would have followed the merger if the Heinold stations were included.

This divestiture pretty well puts those concerns to rest, though. It appears that Tyson was not going to let eight Heinold stations stand in the way of an $8.7 billion deal that holds great strategic promise. But is concentration in sow markets an issue and does this forced divestiture help? As can be seen above, there is no single dominant buyer here.

The four firm concentration ratio based on capacity is 57.8 per cent — not a low number but certainly not high, especially in agricultural markets. Further, that 4 firm share is pretty equally spread with Johnsonville’s 17 per cent the largest share.

DOJ uses the Herfindahl?Hirschman Index (HHI, the sum of the squared market shares of all companies) to characterise competition and a merger’s likely effect on it. The HHI for sow slaughtering, again based on capacity and not actual purchases/slaughter, is 1025. A HHI of 1000 to 1800 is considered representative of a moderately concentrated market about which concerns are raised if a merger increases the HHI by 100 points or more.

The Tyson-Hillshire merger would not have changed the HHI at all since the two weren’t in the same market. But remember that the concern was not primarily over concentration. It was on tie?ins.