CME Report: Sudden Change of Heart in Lean Hog Futures

US - After a month long beating that saw the front month August contract fall by roughly $16, nearby fall contracts decline by about $20 and the deferred summer 2015 contracts lose $6 to $8, Lean Hogs futures have showed signs of life over the past week, writes 0Steve 0Meyer 0and 0Len 0Steiner.October closed yesterday back above $100 for the first time since 11 August and yesterday’s high represented a roughly 50 per cent retracement of the decline on the December contract. Why the sudden change of heart in lean hog futures — even as cash markets have declined to their lowest level since late February? First, Lean Hog futures have been very “emotional” all year prmarily because, we believe, this market has been starved for accurate information on the supply side.

Demand — including exports — has been strong across the board for proteins in 2014 but the supply situation, and especially the pig supply situation, has been a mystery. The biggest supply wild card, of course, has been the number of pigs that have been lost to PEDv. USDA’s Hogs and Pigs reports have estimated the number to be relatively low.

Our calculations would put the total between 8 and 9 million. Even if those calculations are correct, MUCH higher slaughter weights had made up for much of the losses through July. Against that backdrop of uncertainty, we think the “sudden change” back in July that carried futures prices to record highs was at least as much of an anomaly as the month-long sell-off that has brought them back to earth.

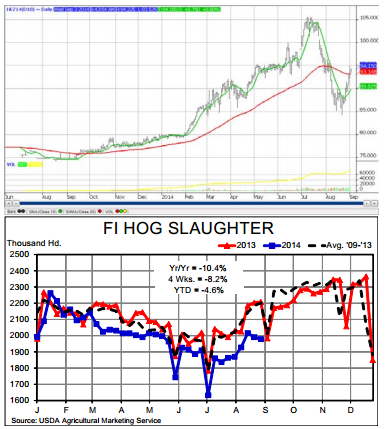

The two of those make this recent rebound pretty understandable as well. This market is groping for what the price “should” be —and as such is functioning precisely as a futures market should. It just happens that this particular futures market doesn’t have very good information with which to carry out that important function. We don’t mean that as an indictment on anyone. Just a statement of fact. The most recent rally has coincided with some pretty shocking year-on-year declines in hog slaughter.

As can be seen at right, slaughter has increased at a pretty normal pace since 1 July but the level is far below last year and the five year average with the past four weeks seeing hog numbers, on average, down 8.2 per cent and last week falling 10.4 per cent below last year. Where higher carcass weights had made up for almost all of the decline in numbers and left production very close to year-ago levels through June, pork production has been 3.6 per cent lower than in 2013 since 1 July and was down 5.4 and 5.9 per cent, year-on-year, the last two weeks of August.

So why have these low slaughter numbers not translated to higher cash hog prices? The trite but true answer is “Because they haven’ translated to higher cut prices — yet.” The cutout value lost about $6 last week to average just $101.67, its lowest level since the week of 21 February. Every pork cut has contributed to that decline but the largest hits have come from bellies (down nearly 40per cent since early July) and hams (down by one-third in just the month of August!).

We think those declines were a reaction by users to squeezed margins which, in turn, were likely driven by a greater-than-expected pullback in tonnage movement at the higher retail prices that were being asked of consumers. Instead of not having enough product, packers and processors suddenly had too much and prices crashed.

But the cure for low prices is low prices and US pork demand has historically — and contrary to much myth — been strongest in the fall, the result of seasonally higher tonnage and product movement at retail prices that are normally held close to summer levels. More pounds at constant price means higher demand. If that happens per usual this fall, then retailer margins will be strong, buyer interest in pork will improve and we will see some strengthening of wholesale pork markets.

Only then will hog markets improve. Wholesale pork cut prices are likely back to a level which will make pork attractive features against continued-expensive beef.

BOTTOM LINE: LH futures have been very emotional in 2014 and the early-July rally, late-July selloff and late-August rally were/are an effort to find the price in the absence of dependable information.

Lower cut values have driven the hog price decline but are probably at a level to renew interest in pork featuring. Will it be enough to push cut prices higher even as supplies grow seasonally? Time will tell but only higher cut prices and cutout value will push cash hogs toward these higher futures prices.