CME Report: Surge In Pork Prices

US - Lean hog futures rallied sharply yesterday and overnight the nearby October contract was up another 50 points or so, write Steve Meyer & Len Steiner.The surge in prices reflects strong gains in the cash market amid reports that hog supplies remain limited at a time when end users are looking for product. The holiday season is around the corner and for processors, there are only a few weeks left to put up stocks and start delivering against customer orders.

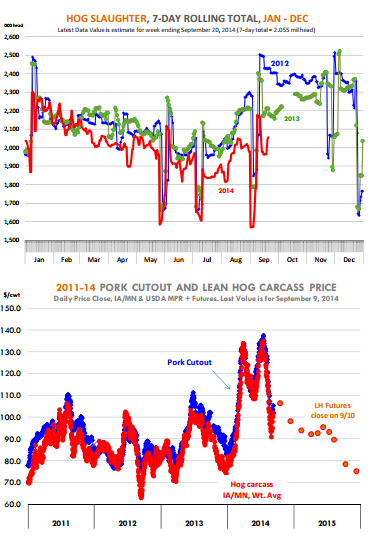

The IA/MN Lean Hog Carcass price last night was quoted at $102/cwt, up $1.5/cwt from the previous day. Cash hog prices have gained about $11/cwt in the last two weeks alone. The sudden shortage of hogs certainly reflects the impact of PEDv losses in late March and early April.Also, producers appear to have pulled back on their offerings given the premiums paid for October hogs.

Normally hog prices drop into the fall as supplies seasonally increase. There was some selling pressure that developed in August in part because of this expectation but also because of slowing export and domestic demand. Now, some of those same issues have come back to the forefront and this has buoyed futures. There are reports that export sales have once again started to pick up.

Buyers that opted to sit on the sidelines amidst record high pork prices in the summer, now are back in the market looking to fill orders. This is not all that unusual after all, almost every year we see pork prices trend higher in late September and October.

What is different this year, however, is that packers cannot rely on a big seasonal increase in slaughter to meet this demand. Hog slaughter the first two days of this week has been disappointing at 400k Monday and 405k on Tuesday.

We think slaughter will run about 407-410 today and tomorrow and then be notably lower on Friday and Saturday. For the week we could see hog slaughter down 8-9 per cent from year ago levels. And supplies will likely remain tight next week as well, with Monday slaughter likely well under 400k.

We expect hog slaughter next week down 6-7 per cent as well. Some, but not all, of the short fall in slaughter will be offset by heavier hog carcass weights. One indication that producers are holding hogs back once again is that weights have once again started to track higher.

Keep in mind that hog weights last year were particularly high and we are already gaining on those heavy weights. Our five day average of all hog weights as reported in the MPR report currently stands at 212.6 pounds, up about 4 per cent from a year ago.

Producer hog weights are averaging 212.8 pounds per carcass in the last five days, compared to 212.1 at the end of August. Packer hogs are currently averaging 212.7 pounds per carcass compared to 211.5 pounds in late August. Where do we go with hog prices from here.

The expectation is for hog supplies to increase as we go into Q4 of this year and early 2015. Keep in mind that PEDv cases declined dramatically in May, June and July and these are the hogs that we should expect to come to market in the last quarter of the year.

The 1 June hogs and pigs report indicated that the June - August pig crop was expected to be about unchanged from the previous year while the September -November pig crop was projected to be up 3.6 per cent. More hogs are coming and despite the short term rally in the market, pushing hog prices higher going into the winter period in the absence of any more supply shortage news will be challenging.

Futures already have a discount for those months but keep in mind that they are a discount off price points for October that are significantly inflated due to the PEDv impact. Hog weights remain very heavy and at some point, when producers are faced with a lower prices for future deliveries, we could see some selling pressure deveop. For now, however, strong short term demand and tight supplies are driving the boat in the hog market.