CME: Seasonal Expenditures on Pork

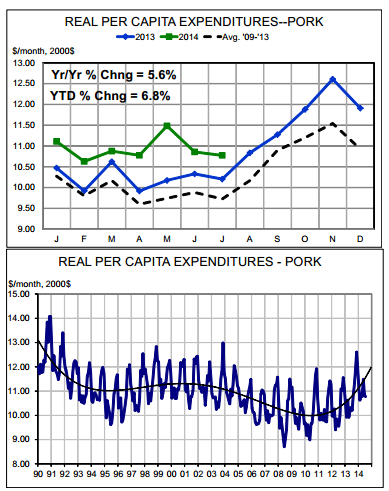

US - US consumers typically buy much larger quantities of pork in the autumn for retail prices that, though lower than in summer months, are not as much lower as would be expected given the higher supplies, writes Steve Meyer and Len Steiner on the 15 September 2014.The chart of real per capita expenditures for pork appeared in last week’s update on the status of various meat and poultry demands through July.

But today we direct you attention not to the green line representing 2014 data but to the seasonal patterns of 2013 and the five year average lines. “Demand will get stronger in the summer when people fire up the grills and start cooking those ribs and chops!”

That’s a statement we frequently hear and read in the spring of the year and it apparently could not be farther from the truth — at least as it relates to pork. US consumers clearly spend more money for pork products as temperatures and leaves begin to fall in late summer and autumn.

The peak comes, not suprisingly, in November when the ham trade for Thanksgiving and Christmas hits a peak. And the pattern is definitely not limited to the past five years. A quick perusal of the longer term chart clearly shows that this seasonal pattern is about as predictable as clockwork.

Very few years have not seen dramatic peaks for consumer level expenditures in the fourth quarter with 2009 being the most anemic seasonal rally since 1990. That, of course, was the “swine flu” year when pork products caught the undeserved brunt of concerns over H1N1 influenza.

But hog prices bottom out in Q4 so what gives? There are several factors to keep in mind. First, hog prices bottom out in Q4 because hog supplies almost always peak in Q4. This pattern was — and still is — a function of weather, the primary driving force of any seasonal pattern.

Warm spring temperatures once caused large numbers of sows to be farrowed outdoors in spring months, providing large numbers of market hogs from September onward. Such operations account for only a fraction of total output today but weather still impacts our modern, confinement, more climate controlled operations.

Summer heat still causes seasonal infertility that results in fewer and smaller lifters in winter months and fewer pigs the next summer. Cooler fall temperatures increase reproductive efficiency providing more pigs in spring and summer months and more market hogs the subsequent fall and winter.

Summer temperatures reduce feed consumption and growth rates while cooler fall temps and fresh corn enhance feed consumption and growth rates. The result is a bunching of pigs in Q4. Second, higher supplies impact prices at various levels of the system by different degrees. Hog prices have historically responded quickly to the added numbers of hogs but the RPCE data indicate that retail prices have not.

US consumers typically buy much larger quantities of pork in the fall for retail prices that, though lower than in summer months, are not as much lower as would be expected given the higher supplies.

The result is larger expenditures and the conclusion that pork demand is strongest in Q4.Finally, the difference in the price changes have historically meant that packers made most of their money in Q4. That stands to reason since the capacity to handle Q4 supplies must be maintained year round.

After fighting over limited hog supplies in summer months, packers have historically been in the driver’s seat when fall arrives. Significantly lower hog prices and wholesale cut prices supported by consumers’ willingness to buy more pork at not?severely?reduced retail prices are a good recipe for profits.

How will that play out this year? PEDv shortened hog supplies are already increasing and will continue grow this fall. But they will still be sharply lower than last year and may be enough smaller than normal to keep wholesale and farm level prices near current levels given August’s large downward “correction” in this market.

Much will depend on whether the normal Q4 strength of pork demand holds again in 2014