Pork Commentary: Russian Trip Over

RUSSIA - Last week we finished our trip to Russia through the Netherlands, and England. 23 days – 14 flights. The old adage “If you want to do business you better not sit in the office and wait for the phone to ring.“ comes to mind.It was probably a successful trip if all comes together, Genesus will have significant nucleus – multiplication in Russia with many more customers. Genesus Genetics are working well in Russia, customers are satisfied as they are getting value, and results that are leading to more business.

Below are seven links of articles written on a Genesus nucleus – multiplication sales with Ariant Company in Chelyabinsk, Russia.

http://www.cheltv.ru/rnews.html?id=1051043

http://www.kp.ru/daily/26273/3151574/

http://www.interfax-russia.ru/Ural/news.asp?id=532746&sec=1679

http://meatinfo.ru/news/agrofirma-ariant-sozdast-v-chelyabinskoy-oblasti-329303

http://lentachel.ru/articles/37436

http://itar-tass.com/ural-news/1391513

http://news.mail.ru/inregions/ural/74/economics/19283751/

The other nice part of the trip was I was able to spend 24 days with my seventeen year old son Spencer. Time is fleeting and soon enough he will have more obligations than carrying suitcases. I am fortunate as a father to be in a position to take him places that when I was his age were just pictures in the National Geographic. I am indeed fortunate.

What Happened to the Market When We Were Gone?

When we left for Russia at the first of August, lean hogs were $1.263 a pound. The day we returned, $0.976 or about 30? a pound lower. That’s over $65 per head drop! Not sure but we suspect the $65 drop is about a big a haircut this industry has ever seen in just over three weeks.

In July we heard one of the Ag – economists give two speeches talking $1.40 per pound in August. Didn’t sit right with us at the time. At one such meeting a person came up and put their hand on our forehead – they wanted to know if I’ve had a temperature?! Why? Our writings in their mind weren’t bullish.

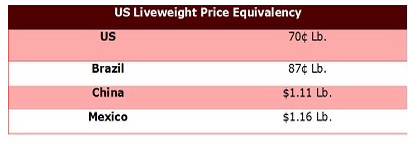

Our answer – prices $60 a head over a year ago. Yes less hogs but with weights higher, total pork production not much less than a year ago. We have a hard time believing such little pork decrease year over year translating to such a price increase year over year but they were $60 plus per head higher and that was reality. It was real money not a hypothetical difference. Since then there has been the price free fall. We suspect it’s a little overdone and prices will stabilise and maybe even increase as these lower prices will stimulate exports and domestic demand. US prices at current levels are the lowest of any country we monitor weekly

Lot easier to export when prices are cheaper relative to other markets. Six weeks ago the US at over $1.00 US liveweight was not a low price competitor.

China Grain Market

On the flight back from England we got a free Wall Street Journal. Front page article “China’s Abundant Grain Adds to Market Pressure.

Some Points

- China’s harvest looks as the 11th straight year bumper crop.

- China Government Grain Inventory (Corn, Rice, Wheat) is 150 million tonnes or about 5 billion bushels.

- Estimate that China’s held about 40 per cent of the world’s corn stocks. China plans to build storage to hold 50 million more metric tonnes in 2015 to cope with excess. (1.5 billion bushels).

- It is by estimated China’s media that China spent $36 billion US in the last two years to buy up low priced corn (low is subjective). China’s corn a bushel about $11 compared to US at $3.67.

- The price difference creates an incentive for Chinese Trading to import corn from overseas, exacerbating China’s already huge stockpile.

- China has tried to curb US corn imports this year, citing the presence of genetically modified strains, but traders are getting around it by importing feed substitutes such as barley and sorghum.

Implications

In our opinion:

- China due to its huge corn stockpile will have issues that keep US Grain, DDG’s, out of its market.

- US corn producers with their own record crop won’t be seeing much if any corn going to China to help prices. As a consequence Hog Farmers will benefit from cheaper US corn and DDG’s.

- China corn at $6.00 US a bushel more than US puts Chinese hog production costs over $60 per head higher than the US. The losses financially in the China hog market due to high feed prices relative to swine prices have triggered a Chinese sow herd liquidation of over 4 million sows in the last year. We expect lower hog supply to China by late 2014 early 2015 will lead to a jump of Chinese prices which in turn will lead to pork from USA (mostly Smithfield) to be imported at a significantly higher level. China exports will do much to support US hog prices in that timeframe.