British Pig Price Situation 'Serious'

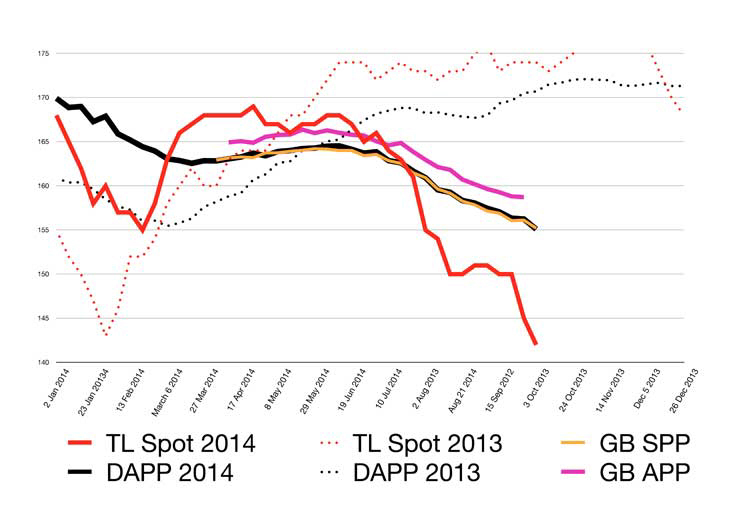

UK - It's serious now, with the spot price down to 135p and still prices continue to fall, says Peter Crichton in his latest 'Traffic Lights' price report.On 3 October, Peter Crichton wrote that it was a difficult day in the office as prices continue on a slippery downward slope, with spot bacon prices losing another 5p and the final DAPP published on its demise quoted at 155.10p compared to the fledgling Standard Pig Price (SPP) slightly higher than this at 155.21p.

Spot bacon buyers were few and far between and those who were prepared to bid were offering between 135p and 140p, although more money was available for regular spot sellers.

Contract sellers were, however, able to obtain premiums of between 15p and 20p above spot, with a whole variety of different price matrix combinations now available, including not only the SPP but the weekly Trib and what is now know as 'contribution prices', i.e. self-announced weekly prices.

Sharp falls in mainland European pig meat value seem to be the major culprit, with the ongoing Russian import embargo causing further stockpiles of meat at a time when it should be travelling freely to Russia.

An end to the Russian embargo or the introduction of Private Storage Aid would work wonders but, until that happens, prices are likely to fall further, with Germana producers nor receiving little more than 100p per kilo deadweight, which demonstrates why it is so difficult for UK pig meat to compete with much cheaper European imports.

Although the Euro has managed to hold at similar values on the week, trading on Friday worth 78.28p, sow prices are continuing to tumble, losing another 4p today, with quotes now between 78p and 81p per kilo and are at their lowest level for many years.

*

"Producers should be under no illusions about the serious situation facing the pig industry at present."

Weaner prices are continuing to suffer from finishers' concerns over the forecast values for slaughter pigs early in the new year. The latest AHDB 30-kg ex-farm weaner average has dropeed to £51.75 per head and 7kg at £37.94 per head. Once again, it is worth remembering most of the ADHB pigs quoted as for contract deals and spot prices can be lagging anywhere fromr £2 to £4 per head lower than this.

Cereal prices seem to have hit something of a plateau, with the latest ex-farm spot wheat price a little firmer at £100.80 per tonne and LIFFE quotes for feed wheat futures at £111.75 per tonne for November and £117.75 per tonne for May 2015.

And finally, despite the benefit of much lower feed prices compared with 12 months ago, producers should be under no illusions about the serious situation facing the pig industry at present. In some cases, sellers will be operating at a loss because the effects of much lower wheat and soya prices have yet to filter through the system as a who;e but cash flows will be instantly hit by much lower slaughter and weaner returns.

Perhaps BPEX should be concentrating more on point-of-sale pig meat promotion to see if demand can be stimulated at the retail end in the run-up to Christmas?

This could re-open the discussion over an additional promotion levy which a number of producers feel would be worthwhile on the basis that the industry should not hide its light under a bushel.

Our welfare standards are amongst the highest in the world and pork quality continues to improve so we need to make sure this hard-hitting message is spread far and wide.