CME: Decline in Hog Prices

US - Could cash hog prices really fall by as much as Lean Hogs futures now suggest? Anyone who might say “No way!“ to that question should ponder the question “Did you think hog prices could every rise by as much as they did this past year?“ Writes Steve Meyer and Len Steine.To say it has been a wild ride is an understatement. PEDv piglet losses, the best situation for consumer level demand since 2004, surprisingly strong pork exports, record beef prices and unexpectedly low broiler supplies have all worked the same direction. I can’t recall exactly the five items in the “Royal Flush” for hog prices that Professor Grimes talked about a few years ago but the five items listed here have certainly made up a strong hand for hog producers in 2014.

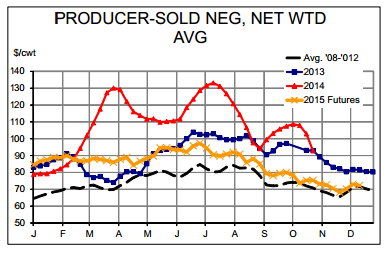

Some of those cards will go “in the muck” over the next 15 months but some of them will stay in producers hands. Just how much of a decline are futures traders anticipating? Substantial to say the least. The chart at right shows weekly average net prices for producer sold hogs and implied cash prices for 2015 given the values of 2015 contracts at Friday’s close and an average basis for the past five years.

The declines implied for 2015 are indeed large, reaching over 30 per cent, year on year in April, July and October. The average decline for January through October (since we don’t yet have November and December 2014 data to which to compare) is 17.8 per cent.

Many analysts are predicting an increase in US hog slaughter of about three per cent next year. Some less, some more but that seems to be a representative figure. Everyone’s inclination is to add something to that figure to account for hog weight increases since that has been the pattern for 50 years, especially when feed costs are declining.

We’re not sure that makes sense this year since one of the driving factors of this year’s record weights was available space in finishing buildings. The industry does not normally have slack space but PEDv pig losses created some this year. The lack of pressure from following groups of pigs allowed producers to feed hogs longer and take weights to heretofore unheard of levels.

As we highlighted last week, new PEDv case numbers are staying surprising low even as temperatures cool. With roughly 60 per cent of the breeding herd having been exposed to PEDv —and thus having some level of immunity — and vaccines available that boost that immunity to some degree in these previously exposed animals, pre-weaning death losses are expected to decline.

Perhaps dramatically from 2013-14 levels. Litters will be larger and the amount of slack space will be far less. Will average daily gains improve enough to offset that? It is doubtful. The industry might gain one per cent for weights but even that is a pretty shaky number. Unchanged to slightly lower probably makes more sense.

So would a three per cent increase in output warrant a nearly 18 per cent decline in price? The “normal” price flexibility is –two to –three, meaning hog prices would fall six to nine per cent lower, ceteris paribus (which is econo-speak for “be afraid of what’s coming next!”). In this case, the “all else held constant” conditions would include domestic demand, export demand, chicken prices and beef prices. We think beef prices are the surest bet to remain a positive factor among those with domestic demand running second.

Export demand is always somewhat of a crapshoot and the value of the US dollar is an emerging challenge. Chicken prices will almost certainly move against pork as the broiler companies finally get rolling on expansion. But even if futures markets are right, consider the context. Every price represented by that orange line is higher than its respective average for 2008 through 2012.

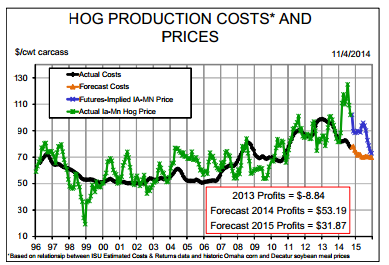

Though hog prices may be substantially lower than in the past year, they currently appear far, far from bad. And when lower costs (our model has them at just over $70/cwt. carcass, down from $80 in 2014 and $94 in 2013) are considered, 2015 forecasts would rank it as the fourth best year in history for US hog producers.