CME: Expected Hog Breeding Growth

US - A heads-up on the timing of the upcoming quarterly Hogs and Pigs report from USDA — It will be released on 23 December, write Steve Meyer and Len Steiner.We do not recall it ever being scheduled for release before Christmas before. It is quite understandable that NASS would want to get it done before the inter holiday week but it might take some getting used to on the part of market analysts and observers.

So if you haven’t done so already, mark your calendars for 23 December, 3:00 pm. ET/2:00 pm. CT for the December Hogs and Pigs Report.

How much breeding herd growth might the December report show us? Perhaps more important is how much growth future reports might indicate but let’s get past this one first.

Long time pork industry researcher and now consultant Mike Brumm addressed that topic just this morning in his "Brumm Speaks Out" feature at PorkNetwork.com.

Mike confirms what we have been hearing that gilt (young female) sales have been very strong. In fact, we hear that there are very few gilts now even available for the next few months as virtually all have been spoken for as either replacements or to stock new units.

We do believe the replacement rate may be high for a few months because retention of PED immune sows since mid?2013 has almost certainly aged the sow herd. But the tightness of gilt supply suggests aggressive expansion is underway.

Mike also cites the fact that producers are cash flush with this year’s excellent margins. Our experience is that hog producers with cash might do a lot of things but at the top of the list is "Raise more hogs."

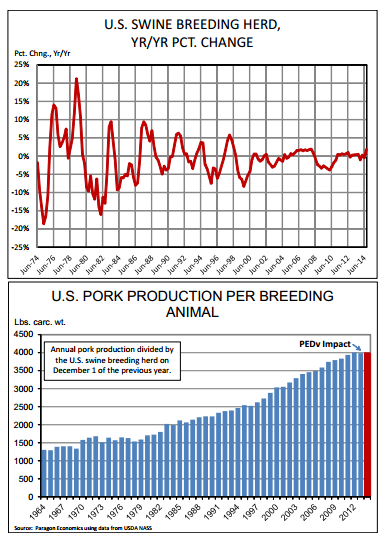

A little historical context might be useful. The top chart below shows the year on year percentage change in the US swine breeding herd sine 1974.

What was once the willd, wild west of shoot from the hip expansion and contraction steadied dramatically in the 1980s and 1990s and than disappeared almost entirely as of 2000.

The four year "hog cycle" that was so apparent is virtually gone — at least in terms of the breeding herd. Perhaps the most interesting — and shocking — feature of this chart is that September’s +1.8 per cent figure is ?ed for the second largest yr/yr growth rate since June 1998!

Only December 2007’s 1.9 per cent was larger during that time span. Most analysts expect year on year growth to increase into 2015. Why the reduction in growth?

The biggest reason is simply efficiency. More litters per sow per year, larger litters and heavier market weights all began to drive production per sow higher as early as 1980. Steady progress took production per breeding animal from just over 1500 pounds, carcass weight, in that year to roughly 2500 pounds, carcass weight, in 1995.

After a one year setback when feed prices spiked in 199596, productivity growth took off once again at an even more rapid pace as production units rapidly became larger and captured significant economies of size and specialisation.

Average production per breeding animal exceeded 4000 pounds in 2012 before dropping slightly in 2013 primarily due to pig losses from PEDv.

It appears that this year’s figure will be down slightly once again as PEDv losses more than offset much higher slaughter weights. With each animal producing more pork, fewer and fewer breeding animals were needed.

Therefore, few net gains were made in the number of breeding animals being held — even in expansion periods. We simply have not needed many more breeding animals even in good times since the ones we have are producing so much more.

PEDv has changed that — or has it? It certainly hurt output this year but the case accession data from USDA and sow herd incidence data from the University of Minnesota still suggest that immunities, management systems and biosecurity practices are mitigating it impacts so far this winter.

Is a rapid expansion of the breeding herd needed if a return to more normal productivity levels is happening? We doubt it. One or the other is likely desirable given this year’s pork prices and, now, lower costs. But both could make for a scary situation in 2016 and beyond.