CME: Pre-report Estimates of Hogs and Pigs Report

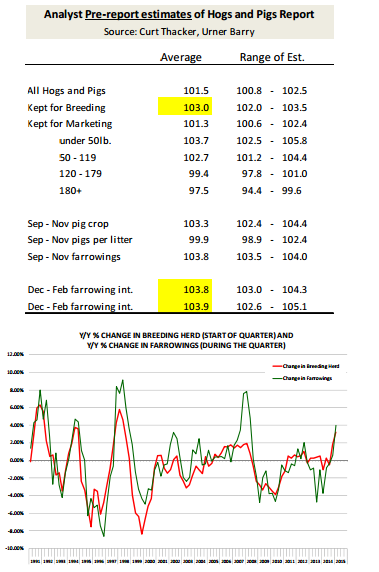

US - USDA will release its Quarterly Hogs and Pigs report on Tuesday 23 December, 3PM ET, write Steve Meyer and Len Steiner.On average, analysts expect the total inventory of hogs and pigs as of 1 December to be up 1.5 per cent compared to the previous year. This will be the first year over year increase in hog inventories since March 2013.

Keep in mind, however, that hog inventories dropped sharply last December as a result of higher feed costs in the fall of 2012 and first half of 2013.

If analysts are correct and inventories are up 1.5 per cent, this would imply a December inventory of 65.747 million head. In December 2012, hog inventories were 66.224 million head.

The inventory of hogs over 180 pounds is expected to show a 2.5 per cent decline compared to a year ago, which is in line with slaughter levels we have seen so far this month.

Analysts, however, expect inventories of market hogs to improve in the next few months, reflecting the higher pig crop during the September - November period.

On average, analysts think that the pig crop during the fall months was up 3.3 per cent compared to the previous year. A larger breeding herd as of 1 September and lower feed costs are expected to push farrowings for the September - November period to be up 3.8 per cent compared to a year ago.

Analysts expect pigs per litter to be at about the same level as a year ago although this is always a major uncertainy. It is difficult to ascertain how conditions over the fall compare to year ago levels.

One thing to watch in this upcoming report is how USDA revises previous quarters and how this impacts the net number of hogs going forward. The breeding herd as of 1 September was estimated at 5.920 million head, 1.8 per cent larger than a year ago.

If analysts are correct and farrowings will be up 3.8 per cent in the September - November quarter, this implies a ratio (farrowings/herd) of 48.7 per cent. Prior to last year, the ratio was closer to 50 per cent.

One thing to consider when analysing the possible inventory levels as of 1 December is the size of hog imports during the last three months. By our estimates, hog imports could be up as much as 20 per cent compared to a year ago.

On the other hand, hog slaughter for the September/November period is likely to show a four per cent decline (we had to estimate November slaughter based on weekly data).

Taking the starting inventory as of 1 September, add to it the pig crop as estimated by analysts (+3.3 per cent) and hog imports and then deduct from it slaughter and a normal death loss, you come up with an inventory number as of 1 December that is about 1.8 per cent higher than a year ago.

This is in line with what analysts are projecting. But could we see a pig crop suprise in the report.

It is entirely likely given how much last year’s numbers were skewed by the spread of PEDv in October and November. The size of the breeding herd as of 1 December remains, in our view, one of the more critical numbers in the report.

Analysts expect the breeding herd to be up three per cent compared to the previous year. This is the biggest year/year increase in the breeding herd since the late 1990s (see chart).

Gilt retention has been a subject of much conversation in the industry and anectodal evidence suggests that producers are indeed holding back more gilts.

The last survey implied a notable improvement in gilt retention (calculated as a residual) and it is likely we will see the trend continue in this report as well.

A lower sow slaughter during September - November and a modest four per cent increase in gilt retention could easily see breeding herd numbers climb three per cent compared to a year ago.

And with fewer baby pigs dying because of PEDv, we could see the pig crop jump sharply in the next two quarters.

Increasing breeding herd in 2015 and further improvements in PEDv losses could push hog numbers up significantly, possibly bumping against slaughter capacity constraints.