Mexico: Hog Market

MEXICO - 2014 was an excellent yet atypical year for the Mexican pork industry, write Carlos A. Peralta (President) and R. Carlos Rodredguez (Vice-president) of Genesus Mexico.During December 2014 the farm grain prices were for:

- Corn: US$244.00 (MX$3,590) per ton, 20 per cent above previous month.

- Sorghum: US$175.00 (MX$2,570) per ton

- Soybean meal US$576 (MX$7,474) per ton, 6.7 per cent below a month ago.

Feed costs were consistent and low for most of the year but during the last month, the prices for these products have increased sharply compared with the rest of the year.

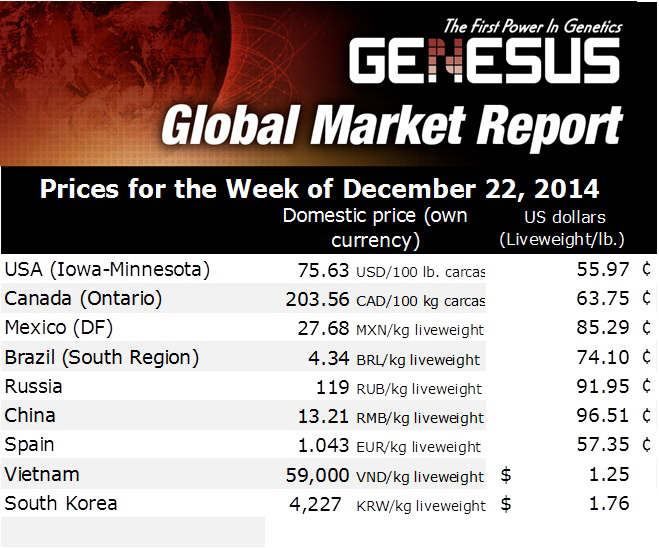

The live slaughter price for Mexico City metropolitan area is US$1.88 (MX$27.68) per kilo, 7.5 per cent above previous month in Mexican pesos but not in US$.

The peso (Mx$)-US$ exchange rate moved to MX$14.85:US$1.00, seven per cent worse than previous month. Average production cost still between MX$18.00 and MX$19.00 per kilo, obtaining MX$9.02 as profits per kilo or MX$1,037 per 115-kg slaughter pig (US$69.83 per kg), 40 per cent less profit than the previous quarter.

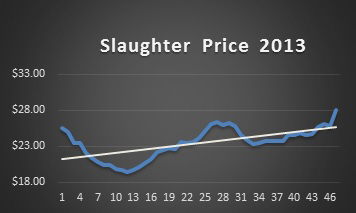

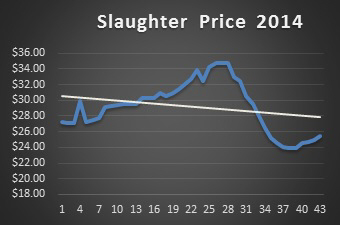

Average production cost during 2014 was at US$1.37 (MX$18.50) per kg and the average live weight slaughter price was at US$2.16 (MX$29.21) per kg with a profit of US$0.793 (MX$10.71) per kg or US$87.26 (MX$1,232) for a 115-kg live weight slaughter pig. These compare with results obtained previous year (2013), when the production cost was at US$1.48 (MX$20.00) per kg and liveweight slaughter price was at US$1.74 (MX$23.46) per kg, with an average net profit of US$0.26 (MX$3.46) per kg or US$39.90 (MX$380.00) slaughtering a 115-kg pig.

Continuing with an atypical slaughter price during the year, at the end of 2014 is when the slaughter price has decreased dramatically (relatively) the profits per kilo to US$0.45 (MX$6.08) per kg or US$51.75 (MX$700.00).

Over a period of almost five months (from the end of April until middle of September), pig producers obtained the highest profits in their business of US$1.02 (MX$13.75) per kg or US$117.30 (MX$1,581) per pig.

All the calculations between US$ and Mexican Peso were realised with a constant exchange rate of MX$13.50:US$1.00, in spite the Mexican currency depreciation (10 per cent) occurred during the last weeks, going from MX$13.50:US$1.00 to MX$14.85:US$1.00.

The oil prices dropped (50 per cent) and allowed the US$ to rise in value against all the other worldwide currencies, including the Mexican peso.

As a result, imported goods will have a higher cost to the producers, affecting their margins and their profits.

The Mexican Government, instead of helping local pig producers, has approved the import of pork meat with a non-compensatory tariff from Countries outside the NAFTA agreement region since 11 December, arguing through the Ministry of Economy the national pig production plus the imports from the NAFTA countries is not enough to supply the national demand of pork.

With this measure, Mexico will continue increasing imports and the local pig producers will suffer the consequences due the slaughter price reduction for the year 2015, causing many producers to only break even and some to go into bankruptcy.

Whom will the Mexican Government support? At one point, Mexican government authorities travelled to different countries to promote investment in Mexico and after they cached the foreign investments, they apply policies like this one.

It looks like all the pig producers who invested hundreds of million dollars to have an international and competitive Mexican industry, are those the government is willing to kill.

The slaughter price increase we had during 2014 is a logic consequence of the PED health problem Mexico suffered at the beginning of 2014, causing pork meat scarcity for some of the year.