CME: Flow of Hogs to Harvest Driven by Interplay of Incentives

US - The flow of hogs and cattle to harvest is driven by a constant interplay of incentives. Producers must have the incentive to sell whether that incentive is caused by available profits, lack of feeding space, fear of what tomorrow might bring or a host of other potential issues, write Steve Meyer and Len Steiner.Packers must have the incentive to buy whether that be caused by attractive margins or simply the need to have enough product available to remain a dependable supplier to their customers. Obviously, both parties would like to be driven by profits but that is not always possible.

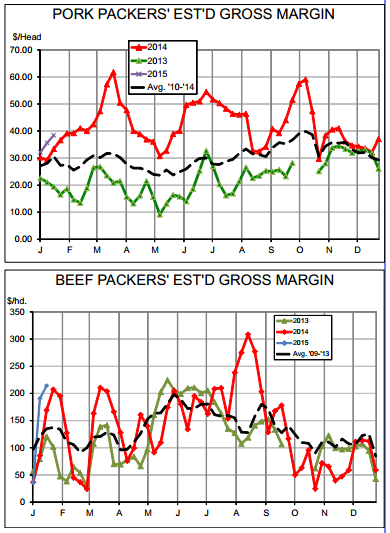

Pork and beef packer margins have improved some from their fourth quarter levels so far in 2015. Our computations of gross margins appear at right. These figures represent the spread between the value of the average carcass and its by products less the value of the animal purchased from producers. It is not a net profit as packers must still play all non livestock costs from this margin. Those costs can be influenced by a number of factors not the least of which is plant throughput. Packers of both species have dealt with that factor over the past year as PEDv reduced pig numbers and cattle marketings lagged year earlier levels by significant amounts. It now appears the pig throughput situation will be much better this coming year while steer and heifer throughput will remain an issue.

As can be seen, pork packers are coming off an excellent year in 2014 with near record gross margin levels in March and much higher than normal margins in the summer and early fall. Q4 pork margins were about normal and have improved slightly to about $38/head since then. The improvement has been primarily due to lower hog prices as market hog sup? plies have grown.

The dynamics of last year’s PEDv losses and the subsequent rise in market weights may be having an impact on the current marketing decisions of pork producers. Recall that as PEDv took a bigger and bigger bite out of pig numbers last year, average market weights moved to record high levels that exceeded year earlier levels by as much as 6 percent in late May and stayed very near 5 per cent higher than year ago levels through August.

Weights have remained higher through the winter. Feeding hogs to heavier weights takes more time and thus more finishing space and we suspect that this year’s surprisingly low incidences of PEDv is causing the number of newly weaned pigs to grow enough that providing space for them in grow finish barns is becoming an issue.

Producers may not have much choice but to move market hogs, pushing short term slaughter higher and allowing hog bids to fall. Until finishing space is once again balanced, hog prices will likely lag and packers will realize some nice margins.

A similar dynamic is likely at play in the feedlots. Average weekly cutout values have risen since the week ended January 3 by about $10 per cwt. Live and carcass steer prices have fallen by roughly $6 and $10 per cwt. over the same time period. The combination is obviously positive for beef packer margins. But like their pig feeding brethren, cattle feeders are in a bind as well — not because they don’t have space but because they have a large number of long fed, big cattle on hand.

According to the most recent Cattle on Feed report, the number of cattle in yards that had been on feed 120 days or more as of January 1 was 11.5 per cent higher than one year ago. Steer carcass weights the week of January 10 (the most recent data available) were 889 pounds, 18 pounds heavier than one year ago. Heifer carcasses weighed 815, up 9 pounds from last year, that same week.

The need to get current on marketings is, we think, clear but falling cash prices are a pretty poor incentive to do that. And it opens the sector up to the “feed them until prices improve” mentality that never works! Making heavier cattle hardly ever allows prices to rise as tonnage increases. The rate at which feeders of each species gets current will be very important for price movements over the next 30 to 60 days.