CME: Labour Crisis Close to Resolution

US - According to a Bloomberg report, the labor crisis currently gripping West Coast ports may be close to a resolution, with only one outstanding issue remaining before both sides reach a deal, write Steve Meyer and Len Steiner.Such a resolution would be welcome news for the US beef, pork and poultry industries that rely on exports for a significant part of their business. Many in the industry and government have noted that port congestion has contributed to the dramatic decline in beef, pork and chicken exports and directly affected livestock and poultry values.

So what happens if/when both sides agree on a new work contract and the slowdown strike comes to an end? Will we see exports rebound sharply and meat protein prices recover much of the ground lost in the last couple of months? We are not so sure that it is really that simple.

It is possible that once a full agreement is reached, futures may respond positively and register strong gains across the board. Afterall, markets have priced the bearish export impact and traders will want to reprice cattle and hog contracts accordingly. But a resolution of the port situation will not fix some of the other issues that have impacted US exports in the last six months. The most important, in our view, is the effect of a strong US$.

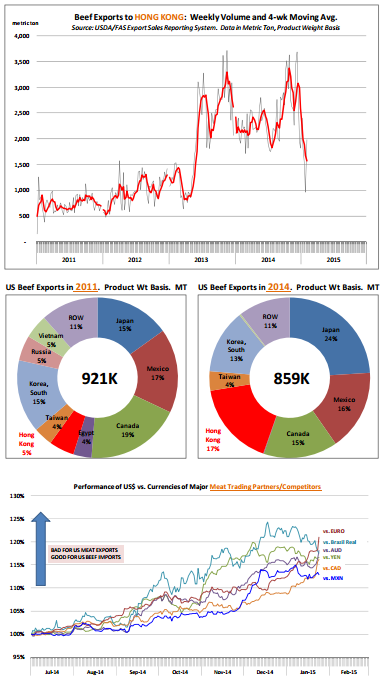

While a strong US dollar is good news for a US traveler that wants to visit another country (their prices are now cheaper) it also makes our goods more expensive relative to competitors. The US dollar index currently is 17.5 per cent higher than it was in July 2014 and it is up over 20 per cent against the Euro (see chart).

We think the dramatic increase in the value of the US$, as well as sharply higher prices in the US last year, are largely responsible for the slowdown in exports. And once world buyers start looking elsewhere to source product, it normally takes a while to get that business back. There currency is the most important but not the only factor nega- tively impacting our exports.

Beef exports to Hong Kong have declined sharply in the last few months and this has taken a toll on overall US beef export volume. Hong Kong emerged as a major market for US beef in the last couple of years, accounting for about 17 per cent of shipments (on a product wt. basis). In 2011, Hong Kong was just 5 per cent of US beef and veal exports. In the last four weeks, beef exports to Hong Kong are down 28 per cent , accounting for about 40 per cent of the overall reduction in export volume.

We do not think the situation in the West Coast ports is why exports to Hong Kong are down. After all, beef exports to Japan are at levels similar to a year ago. Rather, the decline in exports appears to reflect internal policy decisions and some seasonal influences (end of Chinese New Year).

It remains to be seen if exports to Hong Kong will recover or if this is a sign of a much more stringent import policy regime in Hong Kong and China. Then there is the effect of lower feed costs across the world. We have seen a recovery in red meat and poultry production in a number of countries, as producers respond to the decline in feed costs. But while production levels have increased across the world, demand in some key markets has been lagging. Lower crude oil prices have negatively affected the purchasing power of consumers in emerging markets that rely on crude exports. Gettng their business will likely require lower prices rather than just open shipping lanes.