CME: Revisions to Pork Forecasts

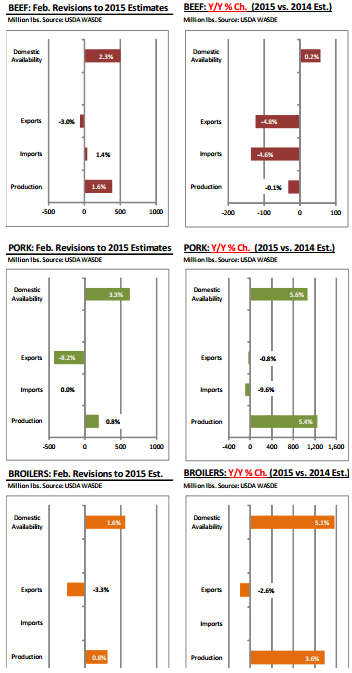

US - The USDA has made significant revisions to its earlier forecasts for beef supply and pork exports, write Steve Meyer and Len Steiner. Below are some of the highlights:Beef: USDA revised up its production estimate for 2015. Beef production this year is forecast at 24.291 million pounds, 1.6 per cent larger than what USDA forecasted in January.

At this point USDA expects US production in 2015 to be about the same as the previous year. The change in output numbers was to be expected following the results of the January 1 Cattle Inventory survey, which showed larger than expected inventory numbers.

The cattle inventory numbers showed both larger cow numbers and a larger supply of cattle outside of feedlots. As a result, slaughter forecasts have been revised higher. But, in its notes, USDA also indicated that “the increase in slaughter is partly offset by slower growth in carcass weights.”

Weather remains a key wild card for slaughter in 2015. Last year, producers took advantage of excellent pasture conditions and were able to hold back a larger percentage of the breeding stock. Beef and dairy cow slaughter numbers were down sharply (hence the larger Jan 1 inventory).

Another year of ample pastures could once again reduce the supply of cattle coming to market in the short term but it would also accelerate the pace of herd rebuilding that already is under way.

USDA lowered its beef export forecast 75 million pounds (-3 per cent ) and now it expects shipments in 2015 to decline by 4.8 per cent from a year ago. Imports were adjusted only modestly and USDA still expects imports to also decline, largely reflecting a slowdown in Australian slaughter.

Ireland is cleared to ship product to the US but volumes are expected to be relatively small. Despite current changes, per capita availability is expected to be just 0.2 per cent larger than a year ago, implying beef prices near 2014 levels.

Pork: There was a significant change in the USDA export outlook for pork in 2015, something that futures have been trading aggressively in recent weeks. USDA reduced 2015 pork exports by some 430 million pounds (- 8.2 per cent ) and for the year US pork exports are now expected to be down 1 per cent from a year ago.

This is a very significant change considering that pork production in the US in 2015 is currently forecast to jump 5.6 per cent compared to the previous year. The combination of slower exports and higher production implies that an additional 1 billion pounds of pork (+5.6 per cent more than a year ago) will need to be absorbed in the domestic market.

Per capita pork availability in 2015 now is pegged at 47.3 pounds, 2 pounds (4.2 per cent ) higher than a year ago and the largest per capita availability number since 2010. That year, the IA/MN lean hog carcass price averaged $59.43 and summer hogs were under $70/cwt.

One thing that has changed this year compared to 2010 is that meat protein demand is in much better shape. Back then the country was coming out of the recession and high protein diets were not all the rage.

Pork supplies in 2009 were even larger. Still the point is that now USDA is projecting a dramatic jump in per capita availability (~2), the biggest such increase since 1998—a year hog producers prefer not to remember.