CME: Latest USDA Report has Bearish Implications for Pork

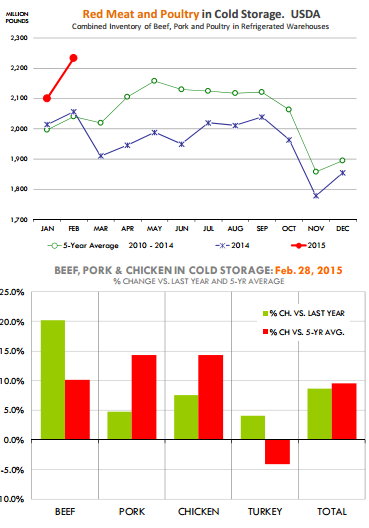

US - USDA released on Monday, March 23, the results of its monthly survey of refrigerated warehouses and we think the results have bearish implications for beef, pork and chicken, write Steve Meyer and Len Steiner.Below are some of this highlights from this report Total supplies of beef, pork, chicken and turkey in cold storage at the end of February were reported at 2.234 billion pounds, 8.6 per cent higher than a year ago and 9.5 per cent higher than the five year average. The normal increase from January to February is about 1-2 per cent but this year it was 6 per cent , which could imply that a slowdown in demand coupled with larger than expected production pushed more product into freezers. This supply will be carried forward to future consumption periods. Demand seasonally improves into the spring but the higher production levels and larger carryout stocks imply ongoing price pressures, especially for pork and chicken, the supply of which is growing at a faster pace than earlier projected.

Beef cold storage inventories at the end of February were 492.1 million pounds, 20.2 per cent higher than a year ago and 10.1 per cent higher than the five year average. Higher stocks of boneless beef contributed to the big jump in beef inventories. We don’t have detailed info as to what kind of beef this was and USDA does not even tell us whether this was imported or domestic beef. Our first inclination is to attribute the increase in boneless beef stocks to the sharp rise in imported beef volume and the port congestion issues in the West Coast, which caused significant disruptions to the flow of product into commerce. The USDA data does imply that this is the case.

Stocks of boneless beef in the Middle Atlantic region (port of Philadelphia is part of this) were reported at 100.7 million pounds, 29 million pounds (+41 per cent ) higher than a year ago.

However, the total increase in boneless beef stocks was 85 million pounds and we saw a big jump in stocks in regions where there is little imported beef (East and West North Central Regions). It appears that stocks of domestic beef trimmings in cold storage are also heavy and the depressed price of 50CL beef is evidence of that.

Inventories of pork in cold storage rose 15 per cent from the previous month when normally we see an increase of around 5-7 per cent . Current stocks are 5 per cent higher than a year ago and 14 per cent higher than the five year average. A larger than expected surge in pork production and slow exports have contributed to the increase in pork freezer stocks. All pork items were higher but some stand out. Pork trim inventories were 67.5 million pounds, 80 per cent higher than a year ago and 28.4 per cent higher than the five year average.

The price of pork trim is down sharply and this has depressed the entire value of the carcass since you get trim credit from almost all primals. It also has lowered the grinding value for other pork cuts. Belly inventories increased from the previous month and they are also 13.5 per cent higher than the five year average. Belly prices need to gain traction into the spring and early summer to give the normal seasonal boost to the pork cutout. So far, that has not been the case.

Chicken cold storage stocks are also heavy. Total inventories of all chicken products were 732 million pounds, 7.5 per cent higher than a year ago and 14.4 per cent higher than the five year average. The slowdown in exports appears to be taking its toll. Inventories of leg quarters were up 6.5 per cent higher than last year and 43.2 per cent higher than the five year average. Turkey stocks at 323.3 million pounds were 4.1 per cent higher than a year ago. Breast meat inventories remain limited, down 24.5 per cent from a year ago and 31.3 per cent lower than the five year average, which helps explain why prices for this item remain firm despite a significant increase in turkey production.