CME: Lean Hog Futures Posted Sharp Declines

US - Lean hog futures posted sharp declines yesterday on continued weakness in cash hog markets, large slaughter volume and a steady erosion in the pork cutout, write Steve Meyer and Len Steiner.Hopes of a market bottom, which permeated trading last week, appear to have been premature. For the moment, there appears to be a lot more pork in the market than previously expected and lower prices are required to absorb this additional supply (see our discussion on production numbers yesterday).

Inclement weather across heavily populated areas in the Northeast may be a short term factor. And then there is the residual impact of the sharply higher pork prices we saw last year, which still linger, be this as expensive processor inventories, high priced product contracted last fall and near record prices at the retail case.

The pork cutout last night was quoted at $69.01/cwt, 36 per cent lower than a year ago and 17 per cent lower than where it was at the start of this year.

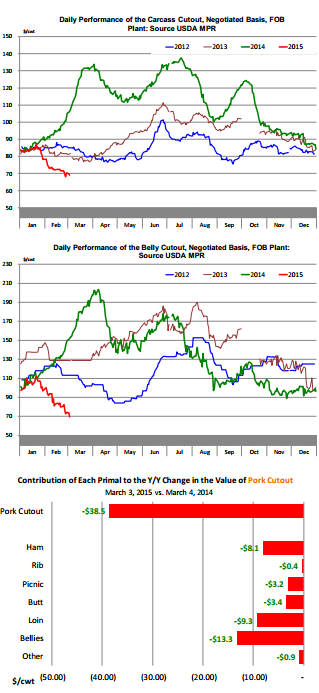

The declines appear quite dramatic but, if you look at the price chart to the right, they are not really that surprising from a historical perspective. In 2012, the pork cutout drifted lower all the way into mid April while in 2013 pork values did not bottom out until the end of March. This year, we have the complications of weaker than normal export sales due to a strong US$ and transportation issues at US West Coast ports and also the sticky retail prices that will take a while to adjust.

On this last point, consider that all fresh retail pork price in January was $3.99, 6 per cent higher than a year ago.

Wholesale prices may be down sharply but retailers are taking their time adjusting prices. This is in part because that’s what retailers normally do, they don’t like sharp price adjustments that could confuse shoppers.

It also reflects the fact that a sharp reduction in pork prices at retail could lower their overall dollar revenue even if they were to sell a bit more product.

Belly prices are a case in point. There appears to be a significant glut of pork bellies in the market. The belly cutout last night was quoted at $69.58/cwt, down 55 per cent from a year ago. Bellies account for just 16 per cent of the hog carcass but so far their lower prices are behind 1/3 of the drop in the value of the carcass.

Still, looking at the consumer price index data, bacon prices at retail in January 2015 were only slightly lower than the prior year and 8 per cent higher than where they were in January 2013. Now one can argue with the methodology used by BLS in collecting some of this retail data but the information provided seems to match what we are hearing from market participants.

Retail prices remain high for a number of pork items and this is making it more difficult to move product.

Foodservice sales appear to be ok but winter weather has certainly impacted some of the larger chains that normally sell a lot of bacon. They probably want to see their inventory positions get in line with their internal benchmarks before they start ordering more. And don’t forget that many of them likely reduced their bacon features last year and it takes several months for new promotions to kick in.

For now, the US domestic pork market is oversupplied and it will take some time for retail markets to adjust and the seasonal improvement in demand to kick in. Calling a market bottom is always fraught with risk and recent trading in hog futures seems to confirm that.