CME: Retail Pork Prices Declined Slightly in January

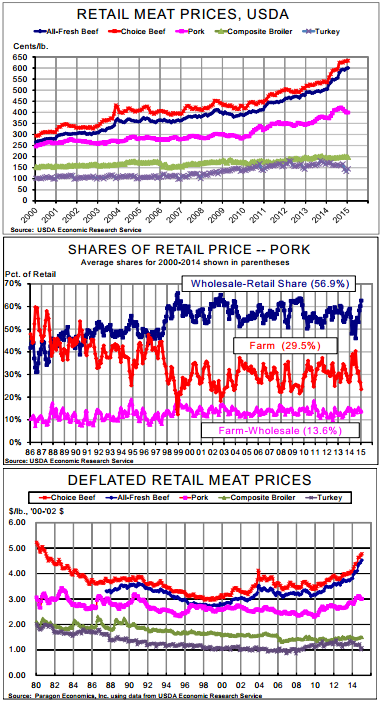

US - Retail pork prices declined slightly in January and retail beef prices set yet another record in January. That makes 11 record highs in the past 12 months for Choice beef and 20 record highs in the past 21 months for the All-Fresh beef price series that includes Select and store-grade beef items, write Steve Meyer and Len Steiner.Retail beef prices set yet another record in January. That makes 11 record highs in the past 12 months for Choice beef and 20 record highs in the past 21 months for the All-Fresh beef price series that includes Select and store-grade beef items.

The Choice price of $6.333 per retail pound was 0.4 per cent higher than in December and 18.5 per cent higher than one year ago. This makes ten straight months of double-digit year-on-year increases for Choice beef.

The last time that a monthly retail Choice beef price was lower than one year ago was February 2010 - nearly five years ago! The All-Fresh price was $6.000 per pound, 0.3 per cent higher than last month and 18.9 per cent higher than last year. It, too, has not been lower than one year earlier since February 2010.

Retail pork prices declined slightly in January. The average retail price of a pound of pork was $3.989, down 0.1 per cent from the previous month but still 6.1 per cent higher than one year ago. The retail pork price has been higher, year-on-year, in every month since March 2013. The small reduction in this price and persisting year-on-year increase is noteworthy in that, when combined with January exports that will likely be lower than last year and January production that was sharply higher that last year, it will imply continued strong consumer-level pork demand. And we would argue that that conclusion is more than some strange result of the data.

Consumers paid those prices (or something close to it given the foibles of the BLS/USDA retail price data) for that quantity of product. Thus, demand likely remained strong. The beneficiary was retailers and foodservice operators that saw the wholesale-retail margin widen from 53 per cent of the retail price in October to 62 per cent in January. But that 53 per cent figure followed some of the lowest wholesale? retail spreads last summer (45.9 per cent in July) that had been seen since 1997. The incentive to sell pork is back - and we think retailers and foodservice operations will take advantage of it over the next few months.

Meanwhile, retail chicken prices trod steadily along. January’s composite broiler prices was $1.978 per retail pound, 0.8 per cent lower than that of December but 2.1 per cent higher than one year ago. Last year’s much?noted productivity challenges allowed prices to remain strong and set the stage for wholesale prices that promise to be very profitable in 2015. Note the steadiness of the retail broiler price in the top chart. Having 8?week egg set to finished bird and 8 month breeder chick to finished bird cycles certainly provides some advantages!

Finally, we note again that the turkey price shown here is for whole birds and is not indicative of the robust markets we have witnessed in recent years for turkey parts and value-added turkey products. We show the price because it is all we have and, based on the miniscule amount of adaptation to the modern world we have seen in these BLS/ERS retail prices in the past, probably all we will have in the future.

So, beef’s a bad deal for consumers now? Depends on the perspective. Relative to other proteins, beef is no doubt pricey. But, while deflated beef prices have indeed risen from 2004-2012, they are still lower than back in the early 1980s! Deflated pork prices are at their highest levels since 1990 while chicken remains very near its all-time lows of 2011.