CME: USDA Hogs Report Supportive for Deferred Futures

US - The USDA has released the results of its quarterly Hogs and Pigs inventory survey of markets, which can be seen as neutral for spring and summer futures but supportive for deferred contracts, write Steve Meyer and Len Steiner.Inventory of hogs and pigs as of 1 March was 7.2 per cent higher than a year ago and 1.3 per cent higher than 2013 levels.

Pre-report estimates on average expected the inventory to be up 6.8 per cent from last year’s levels. The inventory of market hogs was close enough to pre-report estimates and, if anything, futures markets may be buoyed by the fact that USDA did not show an even bigger increase in the number of hogs coming to market this summer.

The pig crop for December until February was up 9.2 per cent from the previous year exactly the same as the average of analyst’s estimates.

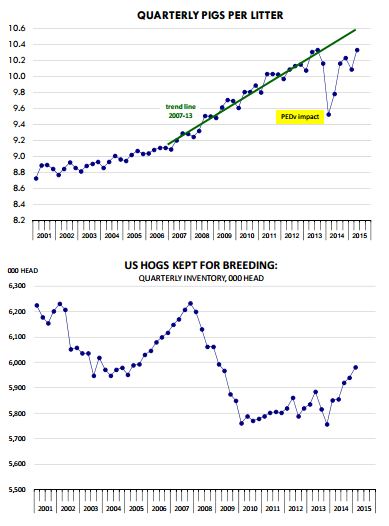

USDA published a smaller number of farrowings than analysts expected but the pigs saved per litter were 6.7 per cent higher than the previous year. The number of pigs saved per litter has increased faster than most expected, an indication that PEDv impact this winter has been quite limited.

Current pigs per litter remain below the trend levels during 2007-13 but they could approach that trend in the next four quarters.

We think the latest data is supportive of deferred lean hog futures, especially late 2015 and 2016, due to the smaller than expected breeding herd inventory numbers.

The breeding herd as of 1 March was 5.982 million head, 2.2 per cent higher than a year ago but much smaller than the 3.5 per cent growth analysts expected prior to the report.

The number of gilts retain appears to have declined compared to the same quarter the previous year. By our calculations (calculating retention as a residual of breeding herd numbers, slaughter and imports), gilt retention for the quarter was about seven per cent lower than the same quarter last year.

The smaller than expected breeding herd implies lower farrowings for Mar-May and Jun-Aug.

Prior to the report analysts expected Jun-Aug farrowings to increase 2.7 per cent while the USDA survey actually shows farrowings during this period down 2.1 per cent. Needless to say, this farrowing number may prove to be too low but, at least initially, it may have some market impact.

Futures for late 2015 and 2016 have been trading lower on expectations that an expanding breeding herd and more pigs saved per litter will continue to bring more hogs to market. The survey did show we will have more hogs coming to market in the next 12 months but the increases may be smaller than what futures have been pricing to this point.

Hog supplies have recovered from year ago levels but are only moderately higher than in 2013. The increase in the breeding herd is smaller than most have expected and producers will likely limit further expansion in light of recent price declines and troubles in export markets.