Mexico Hog Market

MEXICO - USD revaluation in front of worldwide currencies. What will be the effect on the Mexican market? write Carlos A. Peralta, President and R. Carlos Rodriedguez, Vice-president, Genesus.During March, the farm grain prices will be as followed: i) corn at $242 vs $225 USD previous month ($3,740 vs 3,410 Mx/Ton), 7.7 per cent above previous month in USD and 9.7 per cent in Mexican Peso), ii) Sorghum $224 vs $215 USD ($3,450 vs $3,260 Mx/Ton), 4.0 per cent above previous month in both currencies), and iii) soybean meal $487 vs $482 USD ($ 7,510 vs $7,300 Mx/Ton) even in USD terms and 2.9 per cent above in Mexican Peso). The feed costs had a constant value in USD terms but not in Mexican pesos terms.

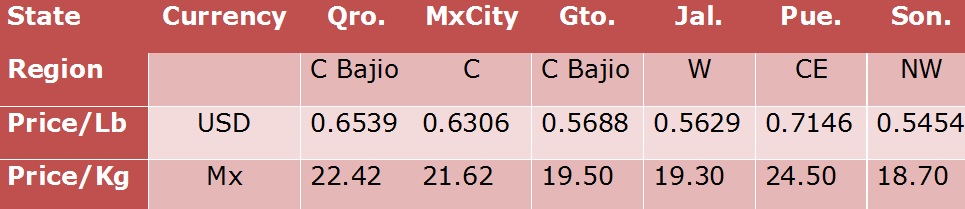

The life slaughter price in some Mexican Regions as follows: USD per pound and Mexican Pesos per Kg.

As you can see in the previous chart, we have a slaughter price difference of $0.1692 USD/Lb ($5.80 Mx/Kg).

We need to remember that the two weeks of the Easter holidays will start in just a few days and historically during these weeks the slaughter price drops significantly due to low pork meat consumption, which raises the recurring questions: “How far is the price going to drop this year?”

If there is no deviation from the historic trend, the slaughter price will inevitably drop, however as always it will recuperate and increase and stabilize at a profitable level during the second half of the year.

Let´s remind ourselves that we are located in the middle of a pork slaughter price supply and demand line and the price has been so low due to the difficult situation the US is going through. Internally as well as internationally, such as the increase in the inventories, higher slaughter weight and a reduction in their exports, attributed to the appreciation of the USD. compared with the rest of the world currencies. Likewise, the export restrictions from the chicken importers due to health problems suffered in the US and the extra availability of chicken meat that will compete in the same market as the pork meat.

The US corn price also went down, basically due to the following factors: i) Worldwide currencies devaluation compared with the USD, ii) Very good corn harvest in South America and iii) worldwide high inventories.

In the previous report we mentioned that the increase in the production cost were higher than in the past, due to the USD exchange rate vs. Mexican Peso ($15.43 Mx vs. $1.00 USD). Today production cost are between $1.39 to $1.43 USD/Kg or $0.6256 to $0.6436 USD/Lb ($21.50 to $22.00 Mx/Kg), with regions were some pig producers are at breakeven point, other with a very low margin per Lb ($0.0135 to $0.0675 USD/Lb) and other were the pig producers are losing $0.0671 USD/Lb.

Profits or loses per slaughter pig at 255 Lbs (115 Kg)

Production cost per pound has increased by $0.1167 USD/Lb in Mexican pesos from the end of November until now (22.22 per cent ) and in the meantime, the Mexican peso was devalued by close to 17 per cent .

This is the first time during the last 18 months some pig producers are losing money in their operational results.

We have had a lot of the Mexican Peso volatility against the USD. If we take as an example the day when we were writing this report, the USD value started at $15.73 Mx: $1.00 USD. During the whole day, it grew above $16.00 Mx and the final figure ended at $15.43 Mx: $1.00 USD.

The delay from the US Federal Reserve System (FED) to increase the interest rates was the main reason for the Mexican Peso volatility, but this will continue until the Federal Reserve decides to adjust the interest rate.

Worldwide currencies have had a devaluation against the USD and some of the leading Mexican economist have said that the Mexican

Peso exchange rate ought to be between $16.50 to $17.00 Mx/USD. At this value, the Peso would be adequately valued.

Since the approval on December 11th by the Mexican government (Ministry of Economy) of pork meat importation from outside NAFTA the Mexican Pig Producers Associations has been trying to repel the above-mentioned approval due to the fear of the prices racing towards the abyss of unprofitability. They believe they could have a high chance to win and that will help the industry to raise the slaughter prices. More than 90 per cent of the imports are coming from the USA and Canada and they are protected by the NAFTA Agreement signed in 1994 (in spite of the Mexican Peso exchange rate against the USD)

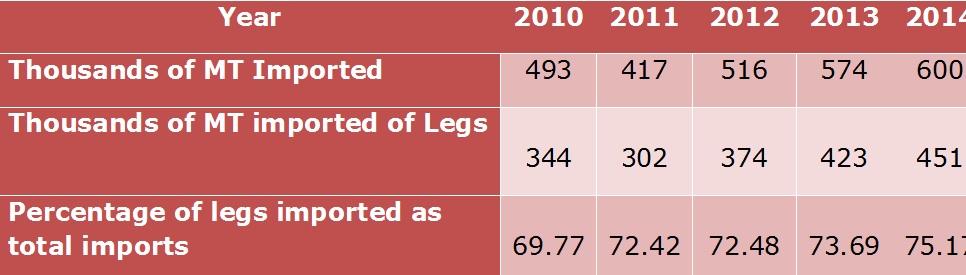

Talking about figures. . .

- Pork meat imports increased year by year

- Mexico is imported 33.33 per cent from the National Pork Consumption or saying in other words, Mexico´s imported 50 per cent of the total internal production.

Do we have in Mexico the real exchange rate? Are our federal authorities manipulating the Mexican peso exchange rate? Is the Bank of Mexico helping the Mexican Peso exchange rate with the daily USD injections of $200M USD to the Mexican economy to reduce the Capital Flight? Who could let us know the real situation of the Mexican Peso exchange rate?

We considered everybody will know the answers soon because in a Science Fiction Economy sooner than later we will see the real situation.

.jpg)