CME: Lots of Speculation About Pork Exports

US - Weekly beef and pork export data were released this morning and, given all the attention currently on red meat export demand, we thought it would be a good idea to at least review what the data says, write Steve Meyer and Len Steiner.In the past USDA has had some issues with the weekly export numbers not matching with the monthly official statistics and some of the issues will likely persist. Still, this is the best (only) data available we have and it is worth monitoring, especially with regard to recognizing shifts in short term trends.

Pork: There is a lot of speculation about pork exports given the very slow start to the year at a time when pork supplies are increasing rapidly compared to both 2014 and 2013 levels. In its latest update, USDA projected pork exports in 2015 to be 4.750 billion pounds, 2.2 per cent lower than in 2014 and 4.8 per cent lower than in 2013. In the first two months of the year, pork exports (on a carcass weight basis) were 15.9 per cent lower.

The weekly export shipment data, however, is showing an improvement in exports for March and so far in April. Based on the weekly report, we project pork exports in March at around 139,000 MT, about four per cent lower than a year ago. We came up with this number by first distributing the weekly export numbers on a daily basis and then totaling an entire month. Then we compared the implied monthly numbers based on the weekly report and the actual numbers reported by USDA.

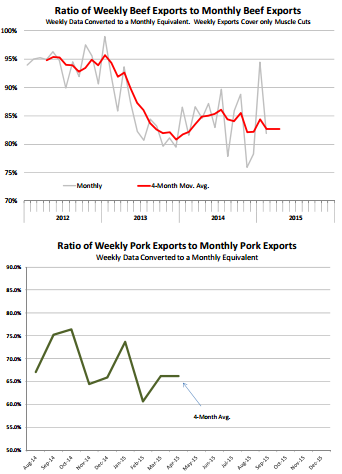

The chart below shows the ratio of these two data sets since August of last year. The reason we started in August is because last July USDA made significant improvements to the report that resulted in a much higher participation rate.

In the last four months, the ratio of exports as reported in the weekly vs. exports reported in the monthly statistics has averaged at around 66 per cent .

The weekly statistics only cover muscle cuts so they will always track below the total monthly number. Still, if the relationship is relatively consistent over time, it could allow us to use the early weekly numbers to project a monthly export value. Keep in mind, however, that this is just an indication and the projection has a high revision threshold.

With only about nine days of exports in April, we project April pork shipments at around 136,500 MT, 4 per cent higher than a year ago. Pork exports are increasing but a strong US dollar and low prices in competing markets continue to present significant headwinds for the US pork industry.

Also, the spread of HPAI in some US states presents the risk of increasing supplies of chicken in the domestic market at a time when pork volume also is one of the largest we have seen for a spring and summer market. Bottom line: Pork exports appear to be improving but more is needed to support pork prices this summer.

Beef: We think the latest weekly beef export data is quite positive for the cattle market. Shipments of muscle cuts in the last four weeks have averaged 12,224 MT, compared to 12,238 MT during the same four week period a year ago. Despite the very strong dollar, US exports to Japan during this four week period were 20 per cent higher than a year ago and exports to S. Korea were up 18 per cent .

Mexico demand has suffered and this is the biggest drag for US beef shipments, down 38 per cent compared to last year. As with pork, we have shown the ratio of weekly vs. monthly exports, which in the last four months has averaged about 83 per cent .

If the ratio holds, we could see March beef exports at around 65,000 MT, 4 per cent higher than last year. An early projection for beef currently pegs shipments at over 65,000 MT, +one per cent vs. Apr 2014.