CME: Pork Prices Are Down this Year

US - Pork and chicken prices are down this year and a quick look at the supply/demand balance table quickly tells you why, write Steve Meyer and Len Steiner.USDA updated yesterday its forecasts for beef, pork and chicken production and use and the revisions underscored some of the bearish factors driving meat prices at this time.

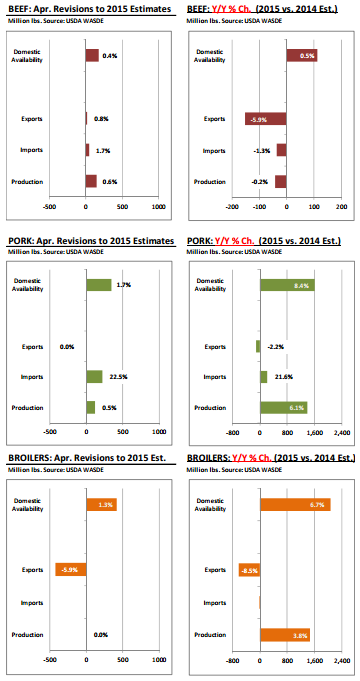

Below is a brief recap for the main species but we urge you to focus on the domestic availability number for all three species. The numbers are up, even for beef, as weakness in export markets and domestic output growth have bolstered supplies.

Pork: USDA revised higher its forecast for pork production in 2015. Pork production in 2015 is now forecast at 24.253 billion pounds, 120 million pounds higher than the March estimate and a tremendous 1.395 billion pounds (+6.1 per cent ) compared to a year ago.

There is speculation that USDA likely has not fully factored in the potential for larger supplies during summer and fall. Large current slaughter levels imply larger prig crops in previous quarters, which in turn imply a possibly larger than expected breeding herd. PEDv has not been a significant issue this winter and heightened biosecurity levels also may have reduced the incidence of other diseases.

Interestingly USDA Q2 pork production currently is pegged at 3.9 per cent above year ago. Current hog slaughter is running substantially above that. Hog weights will likely be 1 to 1.5 per cent lower in Q2 but it is possible we may see further revisions in Q2 slaughter estimates in the coming report.

Production in Q3 is estimated to be up 9.1 per cent , reflecting the surge in the pig crop we saw in the latest Hogs and Pigs report. But the increase in output is only part of the issue in the pork market. In the past, exports have always managed to soak up the increase in output.

USDA did not make any revisions to its earlier export forecast and continues to expect 2015 pork exports to be down 2.2 per cent from the previous year.

Pork exports in Jan and February have declined by almost 16 per cent and we expect Q1 exports to be down 10 per cent.

Exports will likely increase in the coming months given increased product availability. The strong US dollar and the decline in Russian pork purchases remain the key challenges for US pork exports in 2015. Per capita consumption in 2015 is currently expected to be 50 pounds per person, 7.7 per cent higher than a year ago and 6.8 per cent higher than in 2013.

Beef: Beef domestic availability in 2015 was revised by 180 million pounds compared to the previous month and USDA now expects availability in the domestic market to be 112 million pounds (+0.5 per cent ) higher than a year ago. Because of the increase in population, per capita consumption still is slightly lower but only marginally so.

The change in availability is a result of higher forecasts for beef production, further reductions in exports and an increase in beef imports. Beef imports in 2015 are expected to be 2.910 billion pounds, 50 million pounds larger than the earlier forecast but still 1.3 per cent lower than last year. Drought in Australia continues to push more beef to the US. The strong US dollar also helps with imports from a number of other markets, including Mexico. Heavier carcass weights are contributing to the increase in beef production.