CME: Exports Down on the Year

US - Weekly exports in recent weeks have not been as strong as a year ago and there are lingering concerns about the outlook for export demand into the summer and fall, write Steve Meyer and Len Steiner.While some would argue that pork needs robust pork demand more than beef, we think the latter also needs all the help it can get at this point. Some export beef items that last year were trading at all time record levels now are struggling (e.g. plates, briskets).

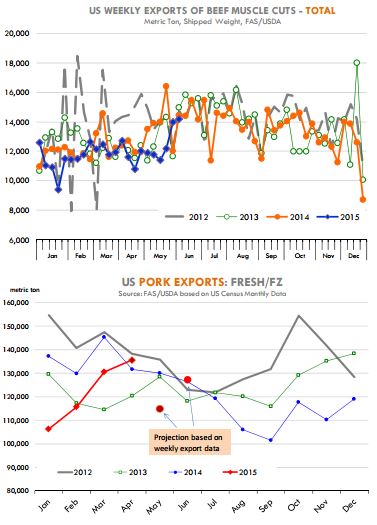

Beef exports for the week ending June 11 were better but the four week average (which gets rid of some of the noise) still points to a weaker beef trade than last year. In the last four weeks shipments of beef muscle cuts have averaged about 12,932 MT, 10 per cent lower than the same period a year ago.

This is somewhat to be expected considering the sharp decline in fed cattle slaughter. Still, the lower prices for some export items and double digit declines in exports to growing markets point to softer beef export demand.

Shipments to Hong Kong have shown some improvement in the last two weeks but the four week average still remains about 25 per cent lower than last year.

Brazilian beef is now allowed to go to China and it remains to be seen how that will impact the pace of US beef exports to the region. Shipments to Japan also have slowed down although seasonally this is the time of year when exports start to pick up.

In the last four weeks, US weekly beef exports to Japan have averaged 3800 MT/wk, 13 per cent lower than the same period a year ago. Exports to North American partners remain weak. Shipments to Canada for the last four weeks have averaged 13 per cent under a year ago while exports to Mexico in the last four weeks are down 16 per cent.

Pork exports did show some improvement in the last two weeks compared to May levels but given the increase in production, and lower prices, we expected better performance that we have seen so far.

The chart to the right is something we have increased before but it bears explaining again. It shows monthly exports of fresh/frozen pork (not all pork) as reported by USDA/FAS. Each week, we take the weekly export numbers as reported by USDA and calculate an implied monthly number.

The monthly volume calculated from the weekly numbers is not the same as the official statistics. For one, the weekly report only covers muscle cuts and there are some items that are not included.

USDA has increased significantly the number of market participants that report weekly data but it does not capture all. Still, the volume of data is large enough and consistent enough that we can use it to project what monthly pork export data may show for May and June.

May shipments are projected to be notably lower while June is expected to be near year ago levels. The rebound in June (we still have two weeks to go) is welcome but it is not large enough considering the volume of pork in the market and pricing compared to last year.

At this point we still cannot do a straight comparison to year ago since there was a major revision done in July. Pork exports to Mexico in the last four weeks have averaged 6,359 MT this compares to an average of 6,947 MT in April when ham values dropped sharply.

Pork supplies remain burdensome at this point and exports are needed more than ever to help clean up some of the additional supply. In the short term, however, the challenge for the pork market appears to be retail business.

Pork loins and pork butts account for a third of the carcass and were trading very firm into Memorial day. Since then, however, they have declined by 9 per cent and 27 per cent, respectively.

Ham prices appear to be holding steady but the seasonal is for prices to move up into July and August. So far that is not taking place and that does not bode well for ham values later this year when slaughter will jump to 2.4MM head a week.