CME: Food Service Sales Present Good Outlook for Meat Markets

US - Foodservice sales business appears to be in great shape and this is nothing but good news for the livestock sector, write Steve Meyer and Len Steiner.The latest data from the National Restaurant Association “Restaurant Performance Index” showed robust growth for all categories.

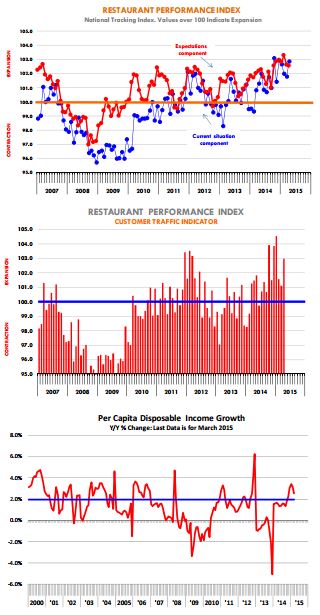

The index for April 2015 stood at 102.7 points, 0.5 points higher than the previous month and a full point higher than in April 2014.

This restaurant performance index has been steadily gaining ground since 2014 and the last time we had similar performance was in 2004 and early 2005. Both the current and expectations components of the index have been moving higher.

The index tracking current situation was quoted at 102.9 compared to 101.8 in March. We think this largely reflects the notable improvement in business conditions after a particularly difficult winter in the Northeast.

The recovery likely helped bolster beef demand in April, coincident with the sharp rally in cattle and fed beef prices.

The customer traffic indicator took a hit in the first quarter of the year, understandable given the disruptions caused by near record snowfall in heavily populated areas.

The April customer traffic index jumped to 103, almost two full points higher than the previous month.

The improvement in the customer traffic index is a particularly positive indicator for demand going into the summer. Beef/cattle prices should benefit the most from the improvement in foodservice demand and we already have seen this in the demand calculations, with Q1 retail beef demand index jumping 13.6 per cent compared to the previous year (Kansas State calculations).

Per capita expenditure analysis also presents a similar demand picture (see May 11 DLR).

A number of factors have supported the improvement in foodservice business but we would highlight two:

1) Per capita disposable income growth has been quite robust and there is a strong relationship between income growth and foodservice sales (see two charts to the right).

2) Unemployment numbers continue to decline and the economy has added 3.3 million new jobs since April 2014. More people with jobs and higher incomes normally is a good recipe for strong foodservice demand and the latest restaurant index is evidence of that.

We don’t have a breakout of the performance by segment, but data for March showed very strong gains for the ‘fast casual’ concept, with 90 per cent of operators indicating higher same store sales.

Family dining also has made a significant turn around. Fast food business appears to be doing well but 26 per cent of operators indicated lower same store sales compared to just 10 per cent in the fast casual segment.

Bottom line: A very positive foodservice report that bodes well for meat demand in general, and beef demand in particular, over the summer months.

The table on page 2 recaps the production numbers for the week. Total red meat and poultry production is currently up 4.5 per cent from a year ago, largely due to a sharp increase in pork and chicken production.

Chicken supplies are particularly large due to a 4.6 per cent increase in slaughter and another 4 per cent increase in weights.

Total broiler production on a ready-to-cook basis is up 9 per cent from a year ago. Nor surprisingly, chicken prices are down, with breast meat prices down 19 per cent from a year ago and leg quarters down 44 per cent.