CME: Hog Futures Rising

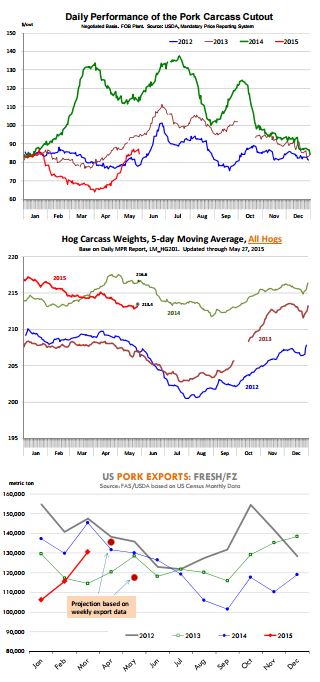

US - Hog futures were higher on Thursday, in part due to the sharp rally in the cattle complex but also reflecting some renewed strength in cash hog markets, write Steve Meyer and Len Steiner.Pork cutout values were lower for the day but market participants appear to focus more on cash hog trends.

USDA did not quote the IA/MN cash price but the national negotiated carcass price (LM_HG203) was quoted at $79.54/cwt, $0.76 higher than the previous day.

Packers paying up for hogs despite a lower cutout likely was viewed as positive for the market in the near term.

As for pork prices, it is not unusual for them to trade sideways after Memorial Day and this year appears to be no different.

Loin prices take a step back as retailers review their needs after the holiday weekend while ham sales generally are steady.

Belly demand normally does not start to ramp up until mid June when retail demand for July and August comes into play.

The pork cutout posted a significant rally in late April and May and so far market participants have little reason to believe that the normal seasonal increase will not be sustained into June and July.

Prices are well below year ago levels but they are in line with the seasonal we observed in 2012 and 2013.

As always, the degree of the seasonal ramp up in price will be dictated by supply availability in June and July as well as export demand.

On the first count, it appears that pork supplies will be plentiful and this may cap pork price inflation.

Hog slaughter for Q2 is projected to be 27.621 million head, this is 3.2 per cent higher than in 2013 and 3.6 per cent higher than in 2012. It is 8 per cent higher than last year.

Hog carcass weights are currently running well above levels we saw in 2012 and 2013. Normally weights start to decline at this point but that has yet to happen and bears watching going forward.

Carcass weights will decline, the question is by how much. This is as critical a factor in terms of determining pork supplies as hog slaughter for the next few weeks.

Hog carcass weights based on MPR data currently are 213.4 pounds per carcass (includes producer and packer hogs), 3.4 per cent higher than in 2012 and 2013.

The combination of heavier weights and higher slaughter implies pork production is running about 7 per cent above what we saw in 2012 and 2013.

If this kind of supply increase is sustained into July and August will the cutout stay above the $90 mark (which hog futures currently are pricing)? Can it go to $100 to sustain a hog rally?

This brings us to the second point. Export market demand needs to be robust in order to help absorb the increase in supply.

We should get the export data for April next week and this will help validate some of the projections we have made using the weekly pork export report. In the last two weeks, weekly pork export sales have been disappointing.

As a result, the projected monthly export number for May now is 117,469 MT (fresh/frozen pork), 10 per cent lower than a year ago and 8.5 per cent lower than in 2013.

Pork freezer inventories at the end of April were 699.6 million pounds, 19.8 per cent higher than the previous year. Higher freezer inventories and lower exports normally is not a good mix.

Memorial Day and Father’s Day demand has helped bolster pork values so far and strong beef prices also are supportive. As we move into the summer, however, absorbing the additional supply may become more challenging.