CME: Hog Report Shows Fall in Breeding Herd since Previous Quarter

US - USDA recently published the results of its quarterly survey of hog and pig operations and the results indicated that short term supplies are expected to be relatively close to what the market was expecting, write Steve Meyer and Len Steiner.In our view, the two big surprises in the report relate to expected supplies in 2016. We expect the report will be viewed by futures markets as neutral for 2015 futures contracts and moderately bullish for 2016 contracts, especially spring and summer of next year.

Below is a brief recap and implications of the latest survey:

USDA pegged the total inventory of hogs and pigs as of June 1 at 66.9 million head, 8.7 per cent higher than a year ago.

The inventory of market hogs (i.e. hogs that will come to market between June 1 and December 1 was 60.975 million head, 9.4 per cent higher than last year.

Prior to the report, market analysts were expecting the market hog inventory to be up 8.6 per cent. However, the analyst estimate number already seemed dubious considering that hog slaughter in the first three weeks of June was up 11.3 per cent and last week it was up another 12.3 per cent compared to a year ago.

The biggest difference between analyst estimates and USDA was precisely in the inventory of hogs over 180 pounds, which USDA reported at 13.4 per cent higher than a year ago while analysts were projecting to be up 10 per cent.

The inventory of hogs weighing between 120 and 179 pounds was 12.810 million head, 11.5 per cent higher than a year ago compared to analyst estimates looking for a 9.4 per cent increase.

The inventory of hogs weighing between 50 pounds and 119 pounds was 17.181 million head, 8.7 per cent higher than a year ago and slightly higher than analyst estimates looking for an 8.3 per cent increase.

These are hogs that should come to market between late August and mid October. This inventory implies September weekly slaughter at around 2.24 million head and then weekly slaughter of around 2.35 million head in October.

Pork supplies are expected to be large through the end of the year. In 2012, weekly slaughter in September hit 2.4 million head and this had a significant (albeit short term) negative impact on prices.

We may have a few 2.4 million head slaughter weeks again this fall but with much higher carcass weights.

A major wild card remains the pace of US pork exports. Shipments in June are expected to be up 5 per cent compared to a year ago but exports, particularly exports to Mexico, will need to post even stronger growth in order to help clear the market.

There were two major surprises in the report - the size of the breeding herd and farrowing intentions this fall. Coming into the report, analysts were expecting the breeding herd to be up about 2 per cent compared to the previous year.

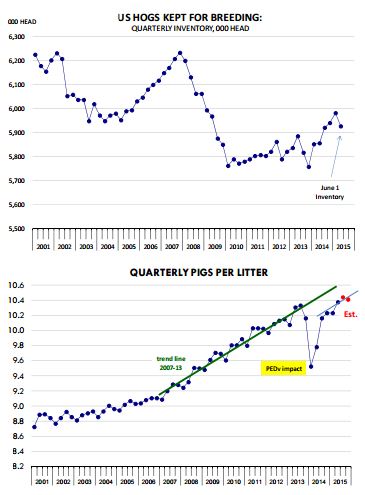

The USDA inventory number was 5.926 million head, 1.2 per cent larger than a year ago but 0.9 per cent lower than the previous quarter. If this number is correct, it would imply a significant reduction in the number of gilts retained during the March-May quarter.

There are some lingering questions as to whether this breeding inventory number is correct. After all, producers have enjoyed strong profits in the last three years and it is doubtful they have so quickly responded to market signals and reduced gilt retention.

The breeding herd number is critical as it drives forecasts for farrowings in the next three quarters and ultimately the forecast for hog slaughter and pork production in 2016.

The second surprise in the report were farrowing intentions for the Sep-Nov quarter, which were down 4.3 per cent compared to the previous year.

While farrowings were expected to be lower than a year ago, the decline is much larger than one would expect considering the size of the breeding herd.

This could be one of those numbers that end up being revised higher. The number of pigs saved per litter has recovered but it has yet to completely close the gap caused by the PEDv losses last year.

We expect pigs per litter to increase 2 per cent y/y in the next two quarters. If USDA is correct, pig crop in Sep-Nov would be down 2.7 per cent from a year , implying lower y/y slaughter in early next spring.

The full USDA Hogs and Pigs Report can be viewed here.