CME: Hog Futures Experiencing Sharp Swings

US - Hog futures have experienced some sharp swings in the last few days, write Steve Meyer and Len Steiner.Market participants remain deeply uncertain about the price implications of ever increasing weekly slaughter levels over the fall and winter months.

Seasonally the pork cutout rallies in the summer but so far there has been no sizzle in the pork market, in large part because the supply of pork coming at us has been overwhelming—forcing packers to keep prices low in order to clear the market.

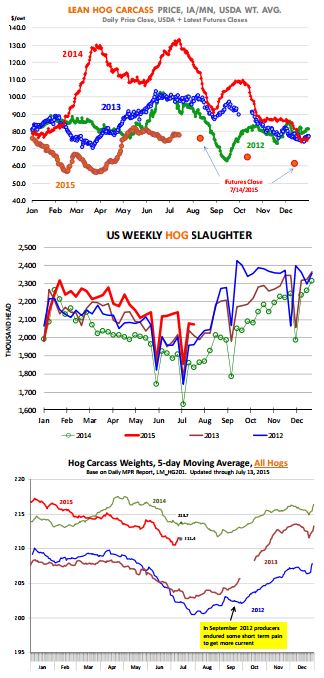

Since June, weekly hog slaughter has averaged 2.075 million head, 11.9 per cent higher than the previous year and also 8.5 per cent higher than the same period in 2013. But large as these numbers are, they are not unexpected.

The latest USDA ‘Hogs and Pigs’ report pegged the supply of hogs over 180 pounds (i.e. hogs coming to market in July and part of July) at 13.4 per cent over the previous year and 8 per cent higher than in 2013.

In addition to more hogs coming to market than normal for this time of year, the carcass weight of those hogs is significantly higher than what we saw in 2012 or 2013 (albeit a bit lower than last year).

The seasonal rise in pork cutout values over June, July and August for the most part is a function of tighter supplies. Weekly slaughter declines and hot weather takes a toll on hogs, pushing weights down.

So far, both of those factors have been far outside their norm and the result has been a pork cutout that is lower today than what it was in late May.

Exports are always the wild card but so far this summer they have not managed to change the dynamic in the market.

True, pork exports in May were higher than a year ago but there is little question that export demand needs to be a lot stronger in order to made a dent given the big increase in production this summer.

In past years, industry has benefited from a weaker dollar (relative to competitors in EU, Canada and Brazil) as well as from higher pork prices in other countries. The US held a distinct competitive advantage and when we had meat to sell the world came knocking.

This year the dollar has been strong and US hogs not that much cheaper compared to Danish, German or Canadian hogs. So where do we go from here?

Hog slaughter will be higher in the fall but it still may be a bit too early to panic that supply will completely overwhelm the market.

In part this will depend on how producers respond, and hog carcass weights will be an important indicator. So far weights have been quite heavy and last week they actually moved up— which some may have seen as a very bearish factor leading to the sharp selloff.

In 2012, producers were faced with a similar situation. Hog supplies were projected to be quite large in the fall and hog weights in late August started to turn up, implying a trajectory that would take weights to around 210-211 pounds (maybe even higher) by Q4.

This caused futures to sell off sharply, reminiscent of current trading patterns. But producers aggressively marketed hogs in late August and early September (see slaughter chart).

They had to take the short term pain of sharply lower prices (see top hog chart) but it also helped change the trajectory on weights and stabilized hog values for Q4.

Depending on how producers act this year, we could see a re-run of 2012 or further value erosion for Q4 hogs.