CME: Hog Weights Key to Supply Pressure Expectations

US - Lean hog futures managed to turn in a positive session yesterday as market participants continue to focus on spot hog and pork prices and try to price fall contracts accordingly, write Steve Meyer and Len Steiner.The pork cutout so far has managed to stay around $90/cwt despite hog slaughter climbing over 2.2 million head last week (+9.8 per cent vs last year but just 1.3 per cent larger than in 2013).

It is not terribly unusual for the pork cutout to hold together in the weeks leading to Labour Day. Retailers are finishing up with their holiday weekend orders and successful promotions (bellies have been the latest case) often lead to late minute fill in orders.

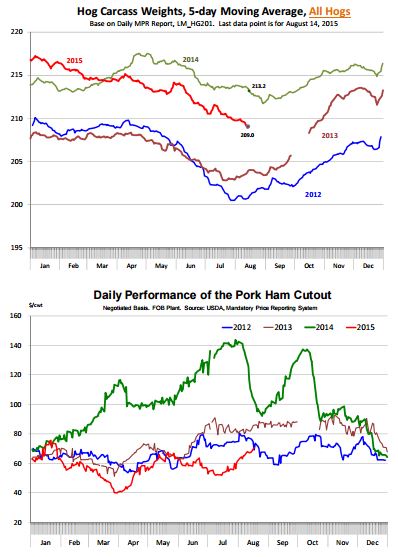

The pork cutout and hog prices also have benefited from the steady decline in hog carcass weights - again not that unusual for this time of year but the decline in weights has offset some of the increases from higher slaughter numbers.

Total hog weights, as reported in the USDA MPR daily reports, currently are running around 209 pounds per carcass. This is the average for week ending August 14.

Last year weights were around 213.2 pounds, so the decline in weights has subtracted about 2 per cent from the increase in slaughter.

Weights will remain a key factor for the market in the next four weeks - a barometer as to what the supply pressures will be going into the fall.

The expectation is for hog slaughter to ramp up quickly in late August and September. We think market participants have viewed positively the fact that that weights have continued to decline through the first two weeks of August.

In 2012, hog weights bottomed out in late July and then started to climb rapidly in August and early September. The situation in 2013 was similar although the gains in weights were not as pronounced.

So far it appears producers have been successful in staying current with their marketings but how long will that continue?

Packer margins have been good and, more importantly, pork has been selling, with belly market underpinning the entire cutout. What happens, however, when those belly retail ads run their course and the Labour Day effect wanes?

These are two key uncertainties for the hog/pork market and it is why futures traders remain unwilling/uncertain about building too much of a premium into the nearby October contract.

In the past, hams have been the saving grace for the pork market. As belly prices seasonally decline and loins/ribs struggle after the end of the grilling season, ham demand generally improves as we go into the fall.

There has been plenty of speculation that sky high turkey breast prices would provide some support for ham values going into this holiday season, but there is a limit to that turkey effect.

After all, we are talking about two proteins that have a very different volume footprint. Ham prices were weak for much of the summer but they have been showing some sign of life, recently.

Where hams in the past have had some trouble is that period in late August and early September. It is too early for the holiday demand to really kick in and a quick ramp up in slaughter sometimes leaves the ham market vulnerable to a downward correction.

This was the case in 2012 but in 2011 and 2013 ham values actually held steady through September and October.

Export sales are a key driver in the ham market as well and it is worth paying attention to Mexico shipments, by far the largest buyer of US hams.

To recap: Participants in the hog market will continue to pay close attention to the supply picture, watching the combination of both hog slaughter and hog carcass weights for any signs that production is ramping up too quickly.

Seasonally hams should be the item that helps underpin the cutout while bellies start to fade. Strong ham demand will be necessary to keep the hog market in the high 60s and the ham inventory number on Friday will likely be closely watched.