Greek Economic Situation Affecting EU Pig Market

GREECE - Greece is not generally regarded as a major player in the EU pork market but its recent economic problems are still having an impact.Greece’s domestic pig meat production is only in the region of 100,000 tonnes annually and per capita consumption is among the lowest in the EU at around 30kg per head.

However, it produces only around a third of the pig meat that it consumes, meaning that it is actually the third largest net importer in the EU, after Italy and the UK.

The Netherlands is the leading supplier, accounting for almost a half of shipments, with Germany and France also significant. Around 40 per cent of imports are of carcases, although the share is gradually falling.

Until recently, Greek imports have been relatively stable, falling only marginally last year and in the first five months of 2015. However, reports suggest that the recent crisis, with its controls on access to cash, have affected the ability of Greek importers to pay for product, meaning that trade has largely dried up.

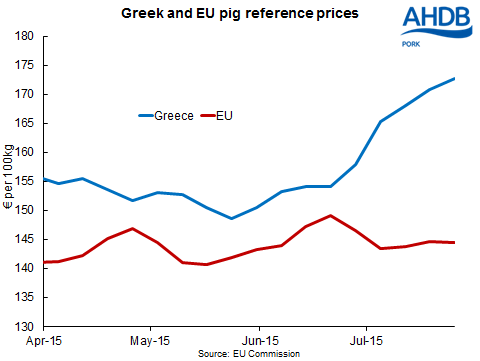

This development is too recent to show up yet in official trade figures but the impact is apparent in pig prices. Since the end of May, the Greek reference price has risen by over €22 per 100kg, as the lack of imported pork leads to increased demand for domestic pigs.

This has increased the gap to the EU average from €7 to €28 and the Greek price is now the highest in mainland Europe.

Over the same period, the fall in the Dutch price has been among the sharpest in the EU, although the extent to which this is due to the Greek situation is less certain.