CME: Hog Numbers Increase Expected

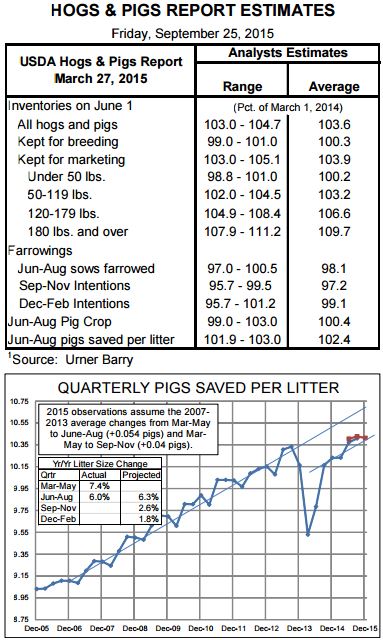

US - Market analysts expect USDA’s quarterly Hogs and Pigs report for September to show moderating increases in market hog numbers, a small increase in the breeding herd and lower farrowings when compared to one year ago, write Steve Meyer and Len Steiner.That would be our take in on the results of Urner Barry’s pre-report survey of analysts.

As usual, the high and low for each category was thrown out of the average calculation. Some key figures to watch in the report relative to these “expectations” which we think are generally reflected in futures markets at this time:

- The market herd inventory at 103.9 per cent of one year ago would put total market hog numbers at a RECORD-HIGH 68.354 million head with those supplies quite front loaded. As a reference, slaughter since September 1 (for 16 weekdays, 3 Saturdays and one holiday both this year and last) is running 9.6 per cent higher than one year ago - almost precisely the increase that analysts, on average, predict. The next two weight categories would comprise most of Q4 slaughter and would put that number about 5 per cent higher than one year ago should these estimates prove to be true. That figure is pretty close to what the June report indicated for Q4 slaughter.

- The 0.3 per cent expected increase in the breeding herd appears quite modest relative to “industry talk” and anecdotal evidence that a number of companies were expanding production capacity post-PEDv. It implies growth of only 12,000 for the breeding herd since June 1. That figure is, at least on its face, pretty reasonable given higher sow slaughter (up 7 per cent vs. one year ago since June 1) and a 0.8 per cent higher percentage of gilts in the slaughter mix based on the weekly data from the University of Missouri. The question is whether the higher sow slaughter is still a “correction” effort to get the age structure of sow herds back in line after they got screwed up due to immunity?driven sow retention during the PEDv onslaught of 2013?14. But if the higher sow slaughter was an effort to get rid of “too-old” sows, then gilts as a percentage of slaughter should be lower, right? The higher rates for both point to modest sow herd growth - good news for the long run.

- Analysts believe we are indeed back on the 2 per cent growth trend for litter size. The chart at right shows our forecasted litter sizes from the June report (ie. the red observations). Note that the last observation of the blue series would be the litter size (10.41 pigs) implied by analysts’ 102.4 per cent average forecast for the report. It fits very well with historical seasonal pattern and does confirm a return to steady growth in the number of pigs saved per litter. Note that this report will give us a glimpse of actual hog numbers coming through January. What transpires after that point will still be heavily influenced by what happens to PEDv this coming winter. No one knows for sure but the veterinarians we visit with almost universally expect slightly larger incidence and death losses this winter versus last but nothing nearly as severe as in 2013-2014 when US pigs had absolutely no immunities.