CME: Total Beef, Pork and Poultry Production Estimates Down

US - Total beef, pork, chicken and turkey production for week ending November 7 was estimated at 1.806 billion pounds, about 1.2 per cent lower than the previous week but 0.5 per cent higher than a year ago, write Steve Meyer and Len Steiner.You can see how the production number break down by species in the weekly summary table on page 2. However, that supply total may actually be even higher if one considers that some of the assumptions used to derive the production number will be revised higher in the coming weeks.

The slaughter numbers may be adjusted modestly but the major adjustment is likely to come from revisions to carcass weights. For instance, total hog slaughter for the week was 2.360 million head and the average dressed weight of hogs was pegged at 211.6 pounds.

This weight number is not actual, however, but based on what weights have been in the last few weeks. The numbers from the Mandatory Price Reporting system indicate that weights at this point are running almost 2 pounds higher than what USDA is using in its estimate (213.4 pounds in the MPR data vs. 211.6 pounds implied from USDA production report).

If we were to adjust for the weight difference (keep in mind that our numbers are not official here rather using a different data source), pork production for the week is about 4.3 million pounds higher.

Total cattle carcass weights are currently estimated at 853 pounds per carcass and for now that is the only data that exists out there. Steer weights normally do not peak until late November so it is possible that that current weight number is also understating cattle weights.

Total beef production for the week was 478.9 million head, 2.05 per cent higher than a year ago. All of the increase in production has come from the weight gains as slaughter continues to run under year ago levels while weights have jumped 3 per cent.

Steer and heifer slaughter was particularly light on Friday at ~75,000 head, but it was off- set by a larger Saturday slaughter (18k). For the week, we estimate steer and heifer slaughter at 448,000 head, about the same as a year ago.

Cow and bull slaughter, on the other hand, were estimated down 4.8 per cent compared to last year.

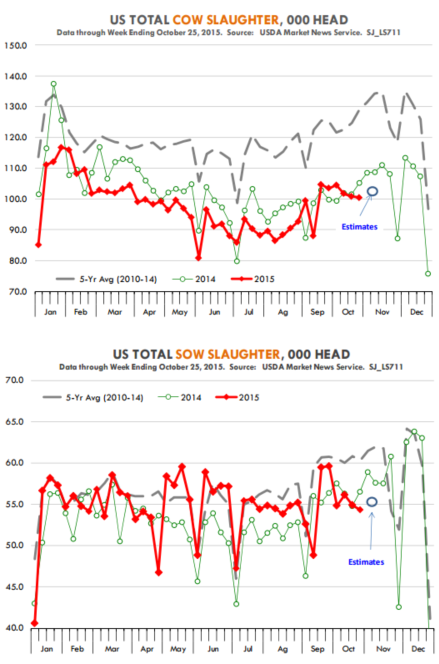

The top chart is important when considering expansion in the US cattle industry . While non-fed slaughter is running near or slightly under year ago levels, it is dramatically smaller than the five year average. Cow slaughter in the fall would run at 120,000 head vs. 105,000 head at this time.

Relatively high calf prices and ample feed supplies have encouraged cow-calf producers to retain more cows in the herd. Heifer slaughter also continues to run well below year ago levels. The heifer slaughter is reported with a two week lag but for the last reported week (Oct 25) heifer slaughter was down 16 per cent from a year ago while steer slaughter was up 3.8 per cent.

Sow slaughter was running well above year ago levels for much of the summer and early fall but it has turned lower in the last couple of weeks.

For week ending October 25, sow slaughter was 54,346 head, 3.8 per cent lower than a year ago and 9.9 per cent lower than the five year average.

Low feed costs have encouraged hog expansion and relatively low sow slaughter numbers indicate that producers are in no hurry to liquidate their breeding herd. Different from heifers, there is no USDA data that tracks gilt slaughter.

University of Missouri does a weekly survey of select producers and their data shows that gilt slaughter in the four weeks ending October 24 was down 1.2 per cent from the previous year.

In its October report, USDA revised higher its pork supply projections for 2016, we think in part because they expect the larger breeding herd numbers to bolster farrowings. It will be interesting to see if there will be further upward revisions to those supply projections in the WASDE report that will be released tomorrow.