2016 Brings Lots of Hog Market Questions

US - Happy New Year! Such are my normal greetings and they are indeed sincere. I do hope this year is a happy one for you and yours. Amid these New Year greetings, though, must be some trepidation about the US hog and pork sector, writes Steve Meyer in the National Hog Farmer.December’s Hogs and Pigs report says supplies should be manageable the first half of the year but should grow in the second half even when compared to the ample supplies we have seen in late-2015.

Summer futures prices are profitable and fall contracts would yield relatively small losses for low-cost producers, but will cash prices match those levels when we arrive at those distant months?

2016 Watch List

Here is my “Things to Watch in 2016” list.

- Did USDA catch all of the breeding herd growth – and how much more will it grow? The report, as discussed last week, found the first 6 million head-plus US breeding herd since December 2008. The 6.002 million head kept for breeding was 1.1 per cent larger than last year, just slightly more than analysts had expected. Successful Farming’s 2015 installment of its “Pork Powerhouses” listing of the largest US hog producers found that the 25 largest producers had increased their number from 3.303 million sows to 3.431 million sows, a gain of 3.9 per cent.

At least one of those top 25 producers was listed as having no growth when it is widely known that they had added several thousand sows. Had that increase been included, the growth rate would have been well over 4 per cent for these largest operations. While the breeding herd is not a very good predictor of hog numbers (see next point), it is still the engine that must be in place for the train to move down the tracks — especially if the pace of movement is growing.

- Does the breeding herd really matter much and, if not, how much will productivity grow? As alluded to before, US pig output has been very poorly correlated with the size of the breeding herd for years. See Figure 1. The reason, of course, is a steady increase in productivity that has been broken only by the porcine epidemic diarrhea virus epidemic of 2013-14. Disease problems are not completely behind us, but data from the University of Minnesota’s Swine Health Monitoring Project indicate that PEDV, though it showed increasing frequency in November, has quieted some recently.

.jpg)

Porcine reproductive and respiratory syndrome virus case numbers are the highest in four years, an expected occurrence given the mutating ability of the PRRS virus and the problems caused last spring by the 174 strain. Death losses, while serious, are not out of the norm and litter sizes are growing once again at 2 per cent (or more) per year. Swine breeding companies’ knowledge of the pig genome promise to maintain or even enhance that pace in the coming years, but I do not believe those improvements will come to bear this year. But 2 per cent is 2 per cent, and that number is additive to breeding herd growth.

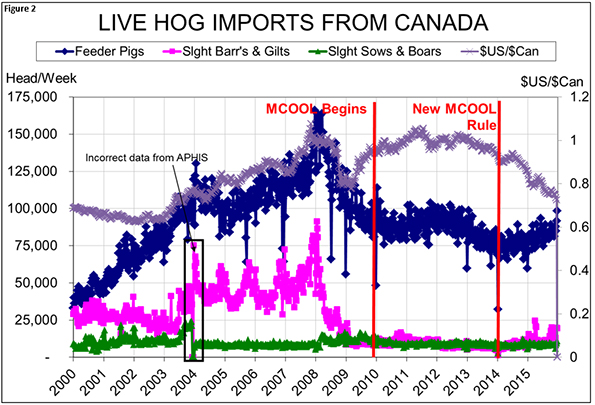

- Without mandatory country-of-origin labeling, how many hogs will come southward for feeding and slaughter? This is a great unknown at present but I’m sure the answer is “more,” and the primary driver is not MCOOL’s demise. There are two others that may be more important in the short run and all of them build on one another. First, there is the ongoing shortage of slaughter capacity in Ontario. Several thousand hogs per week have been moving to Quebec since the Quality Meats plant shuttered its doors in April 2014. Without the segregations challenge of MCOOL, many of those pigs will move south now instead of east, and that flow will be made even more profitable due to the exchange rate.

Note in Figure 2 that the number of weaned/feeder pigs flowing southward had been steadily increasing all year. The surge of market hog imports last spring was caused by a strike in Quebec and market hog imports have roughly doubled versus one year ago since September. There are few “extra” pigs in the west, but a lower Canadian dollar could provide a spark for expansion in places that will allow it – Alberta and Saskatchewan.

- Can exports grow in a strong dollar world? How about an even stronger dollar world? As can be seen in Figure 3, US pork exports have improved steadily since tanking in the summer of 2014. The surge last spring was simply the cleanup effort following the port strike that caused problems last winter. I still think we are going to be up a bit (2 to 4 per cent maybe) versus 2014 when the final 2015 data are released in February. But can we grow from there with the dollar so strong — and perhaps gaining strength as interest rates creep up and oil continues to fall? The USDA still thinks we can and so do I, but the growth rate will not be large.

.jpg)

- Will Chinese pork demand recover and drive imports higher? Where will any growth in US exports go? Maybe Mexico, our largest and most dependable export market. But we’ve seen double-digit growth the past two years and that is 10 per cent plus of a pretty big number these days. Just how long can that go on? Japan is very questionable until the Trans-Pacific Partnership starts to kick in significantly. Korea grew dramatically in 2015 so can that continue?

Nothing is happening with Russia and very little will happen with Canada given the exchange rate. China? Guesses are a dime a dozen. Pork demand still looks soft there. Russia — of all countries — is looking to export product to China. The European Union has made relationship inroads that won’t go away quickly and Brazilian product is cheap due to a weak real. Smithfield did just announce that its first processing plant is now open in China so some growth of carcass exports is expected. But how fast will that grow?

That’s a lot of questions. Nothing new there, I guess, but these questions appear particularly daunting. Meanwhile you have a business to run. But amidst it all, you can choose to be happy. It doesn’t guarantee that every occurrence will be good, but your attitude — and mine — can make a difference.