CME: Slaughter Hog Prices Should Move Seasonally Higher

US - Pork and hog sector analysts compare barrow and gilt slaughter numbers to data that were in the Quarterly Hogs and Pigs reports provided by USDA-NASS, write Steve Meyer and Len Steiner.This comparison is used as a gauge to see how the quarterly market hogs numbers match up to weekly slaughter levels. Yesterday, the weekly Federally Inspected (FI) slaughter data, released by USDA-AMS, were reported for the week ending January 23, 2016 on barrow and gilt slaughter.

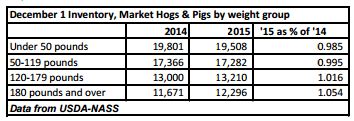

To see how slaughter is lining-up with the December Hogs and Pigs report, we will focus on the market hogs breakouts. As of the survey data (December 1, 2015) NASS estimates are in the following table.

The report indicated the expectation was that slaughter hog numbers were “front end loaded”, that is, the largest slaughter level increases would be near-term.

As the industry moves through the heavier hogs and into the group that was “50 pounds and under” as of the December Hogs and Pigs report, there could be a slight year-to-year decline in slaughter levels.

This would occur in May and June, and will be caused by a smaller pool of available animals in that time frame as indicated by the 1.5 per cent decrease of hogs in the light weight category in December 2015 compared to 2014.

Essentially, all the hogs over 180-pounds would have gone to slaughter in December. So, since the first of the year, we are now comparing slaughter levels to the market hog category from 120- 179 pounds; that category was up 1.6 per cent year-over-year.

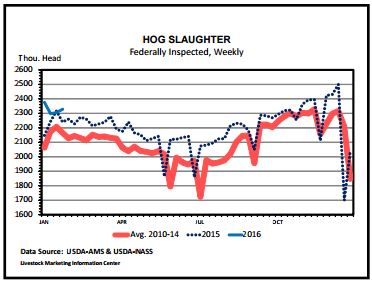

Over the first three full weeks of 2016, FI barrow and gilt slaughter has averaged 4.4 per cent above the comparable weeks last year. Importantly, the trend over the first three full weeks in January has been back towards 2015 slaughter levels, with the year-to-year difference narrowing as the month progressed.

For the first week of the year barrow and gilt slaughter was up 11.0 per cent (week ending January 9th), the second week was up a much more modest 2.4 per cent and the third week was essentially unchanged year-on-year (down 0.02 per cent).

For the last two weeks, FI slaughter has matched-up rather well with the indications of the Quarterly Hogs and Pigs report. From a supply perspective the large year-over-year increases in US pork production for the next few months seems to be behind us.

Still, close attention to slaughter levels will be important especially until the next Quarterly Hogs and Pigs report from NASS (released in March).

The recent uptick in hog prices has been facilitated by dampening of the year-over-year increases in slaughter levels. If the recent slaughter pattern is maintained, slaughter hog prices should generally move seasonally higher over the next few months.

Another important seasonal trend to follow is dressed hog weight. So far this year weights have continued to post year-onyear declines. That trend started in late March 2015.

In recent weeks, dressed weights have been running 2 pounds below a year ago.

LMIC forecasts the year-over-year declines may not persist in 2016. That is something to watch, too, as it will impact the amount of pork being produced per animal.

In recent days there have been media reports that update the status of the new hog packing plant being built in Iowa and that plant could be operation as early as mid-year 2017.

There is also a new plant in Michigan under construction, which we currently believe opening is planned for late 2017. This week, it was Minnesota’s turn. Plans are to turn the former PM Beef plant in Southern Minnesota into one for hogs.