CME: Pork Processing Sector to Transition Over Next Two Years

US - The US pork processing sector will be in transition the next two years. Two new state of the art US packing plants are under construction, one long-closed hog plant is expected to be modernized and reopen yet this year, a former cattle plant is planned for modernization and conversion to a hog plant, and in the last few weeks another has been added to the drawing board, write Steve Meyer and Len Steiner.In this Daily Livestock Report, some background is provided on the developments as well as some points regarding recent estimated returns for harvesting and processing hogs.

Out of the five incoming plants, two plants are well under construction in Coldwater, Michigan, and Sioux City, Iowa. Apparently, initial operations could begin next summer (2017) or early this fall at both plants; each are expected to have single-shift slaughter capacity of 10,000 head per day when fully implemented. According to media reports, a third plant out of the list may be the first plant to provide additional slaughter capacity, although it will be a smaller plant (3,000 head per day capacity). That plant will be located in Pleasant Hope, Missouri and owned by Moon Ridge Foods. It was a long closed plant that has had some fits-and-starts in attempting to reopen a few years ago.

Moving on to a fourth plant on the list, earlier this year it was announced that the former PM Beef plant in Windom, Minnesota had investors to convert it from beef into a modern and technologically advanced hog plant (about 5,000 head per day slaughter capacity).

The Windom plant is could begin operations as early as late 2016, or it could open in 2017 based on some media stories. The most recent announcement (making for the fifth plant) came from Prestage Farms, a poultry company that also has extensive hog production facilities. That plant will be in Mason City, Iowa and the company has recently been acquiring local permits and financial support.

Their announced plan is for the ability to process 10,000 hogs per day and starting initial operations in mid-2018.

Adding new packing capacity is not a common occurrence in the red meat sectors, let alone five in process at the same time. As far back as we can tell, in the modern era of large commercial facilities harvesting animals, this is the most capacity being added in a few years than has ever occurred.

Some US plants are getting a bit aged, but the main incentive to build, convert, or restart/refurbish long-closed plants is economic returns to processing hogs.

Since market analysts do not have access to profit and loss statements for packing plants, even if they did they could not discuss such, estimated margins are typically tracked and evaluated. Those are usually designed to get a flavor of margins and provide some implications for how aggressive bids by packers will be for animals.

The live-to-cutout margin (spread) is the difference between the cost of an animal bought for processing and the value of the meat produced plus the byproduct value (variety meats, tallow, skin, etc.). Typically, the meat value is taken from the USDA-AMS cutout reports provided by their Market News division. Of course, many companies process hog cuts into further processed items like cured hams, bacon, marinated items, specialty exported cuts, and even cooked products.

The full costs of processing an animal are not included in these margin calculations. The list of non-included items is long, from labor to trucking to facilities costs.

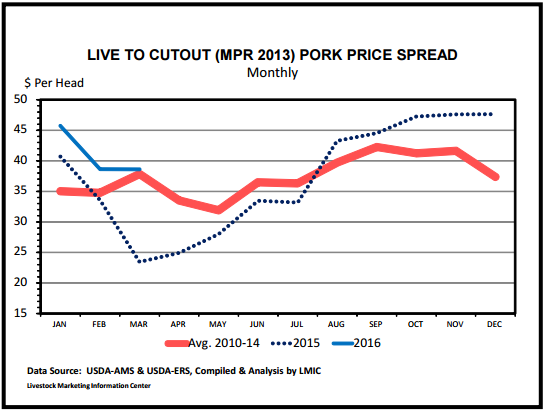

Since last summer, the estimated live-to-cutout margin on hogs per head has been above a year earlier (see accompanying graphic).

In March, that margin was dramatically above 2015’s (up over $15.00 per hog slaughtered or about 65% higher); however, it’s clear that hog packer margins were depressed a year ago. In terms of general background, the live-to-cutout spread is seasonal and largest in the fourth quarter of the year when seasonally the number of marketready hogs is largest (see associated graphic). So, generally strong hog returns have increased interest in adding processing capacity. Additionally, the number of hogs being produced in the US is growing and many firms recognize that fourth quarter hog slaughter capacity constraint will emerge without more plants. The sheer number and the size of plants coming on line raise issues for the industry. Further, many plants could eventually be double shifted.

Competition will increase for the available supply of animals with each new plant that becomes operational. Packer margins may be squeezed and some older plants will likely succumb due to the new level of competition. That is very similar to what happened in the cattle industry a few years ago, leading to an overall reduction in capacity. Long-term modern efficient plants will help the US remain a low cost producer and very competitive internationally.