CME: 2015 a Difficult Year for Pork Exports

US - Monthly trade numbers, on a carcass weight basis, will be released on Thursday by USDA-ERS. This data will be for the month of March. Looking back on 2015, it was a difficult year for exports across all protein categories.Many countries banned US broiler meat due to HPAI that affected the laying and turkey industries.

The beef complex faced headwinds from record high product prices coupled with an increased value of the US dollar and declining world economies.

Pork exports faced the same high value of the dollar and economic slowdown worldwide. Exports are largely forecast to improve this year for all proteins, compared to last year, but it is important to keep in mind the extent which exports affect volume of product available to the domestic consumer.

Or, how much of our annual production goes to customers outside of the U.S. This is key to remember, as trade dynamics help us understand general market changes that would have to occur to clear product in the domestic market. Below we will review export dynamics in beef, pork, and poultry.

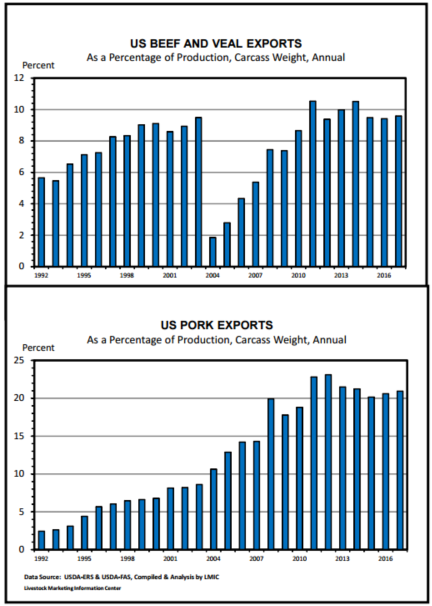

Starting with the beef complex, annual meat export volume accounted for 9.8 per cent of total annual production for the five year period from 2010- 2014.

For 2015, total exports made up 9.5 per cent of annual production, and 2016 and 2017 exports as a percent of production are forecast (by the Livestock Marketing Information Center) at 9.4 per cent and 9.6 per cent, respectively. While this ratio is staying relatively stable, we must remember that beef production is forecast to increase about 4 per cent year-over-year in both 2016 and 2017 to 24.8 and 25.9 billion pounds, respectively. That means we are expecting exports will increase about 70 million pounds from 2015 to 2016 and increase another 150 million pounds from 2016 to 2017.

If exports fall short of expectations the additional product will have to be absorbed by the domestic market, likely at a lower price point. For the first two months of 2016, exports as a percent of production are running even with year ago levels, which is good news as our beef production numbers are up yearover-year.

On a historical note, the severe decline in beef exports from 2003 to 2004 was due to the discovery of BSE in the U.S. cattle herd at the end of 2003. The pork industry is more reliant on exports compared to the beef sector. For the 2010-2014 five year average, annual pork exports made up 21.5 per cent of annual production.

In 2015, this number moved to 20.2 per cent and 2016 and 2017 are forecast at 20.6 per cent and 20.9 per cent respectively. While the ratio of exports as a percent of production decreased in 2015 compared to the five year average, pork exports actually increased 1.7 per cent year-over-year compared to 2014’s. This was not enough of an increase to absorb the over 7 per cent production increase from 2014 to 2015.

Combined January and February 2016 exports were 18.8 per cent of the two month production total, compared to 17.9 per cent for the same time frame in 2015. In the broiler industry, on a ready to cook (RTC) basis, the five year annual average of exports as a percent of production was 19.0 per cent.

In 2015, that number dropped significantly to 15.8 per cent as a result of trade bans on U.S. poultry due to HPAI in layer and turkey flocks and year-over-year increases in broiler production. Looking at just export volume in 2015 compared to 2014, it was down 13 per cent (down 980 million pounds).

That 980 million pounds had to be consumed domestically, pushing broiler prices downward. Broiler exports for the first two months of the year are sitting at 15.8 per cent of production so far, compared to 16.2 per cent for year ago levels.

International markets are important to all of our protein industries, as we usually export specific products that have a higher demand internationally, increasing the value of that product compared to domestic demand. For example, broiler dark meat historically has commanded a higher price from our trading partners than it has in the U.S. As a market exports a larger share of production, more risk comes along with the added value.