CME: Strong Gains in Lean Hog Futures

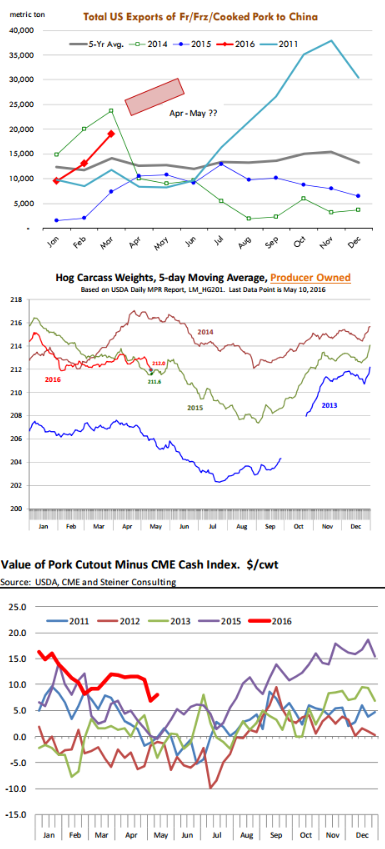

US - Lean hog futures posted strong gains yesterday on expectations that strong export demand and current hog supplies will help support cash hog values into the summer months. The export story continues to percolate in the markets and, those that hold a bullish view, often point to it as one of the key drivers for the market this summer.Memories are still fresh of the big surge in exports to China in 2011 which helped underpin hog values that year. The official USDA export numbers are only through March, showing total shipments to China for that month at 19,003 MT, 160 per cent higher than a year ago. For the first quarter exports to China were up 409 per cent (keep in mind last year exports were minimal in Jan and Feb).

But these export numbers are for March. How about April and May? The USDA weekly export numbers have become increasingly more reliable although there is still a lot of variability week to week.

Based on the recent relationship of the weekly and monthly export data, we would project April exports to China at around 26,000 MT and May exports could be even higher. Data for week ending May 5, showed exports to China at 5,275 MT.

Exports to Hong Kong also have taken off and combined shipments to these two markets are now dramatically higher than a year ago. Will this be enough to support the market through the summer. It is possible although we still need other markets, particularly Mexico and Japan, to sustain their buying pace.

Keep in mind that last year US pork exports were as high as 162,000 MT in April but then dropped to 137,000 by July. The reason why market participants view current China purchases as bullish is that they do not see a slowdown in exports in the short term.

Pork prices in China are extremely high, with the recent loose credit policies further fueling inflation. And if US pork producers are able to ship 30,000 MT to China on top of bigger exports to Hong Kong, it shows that the ractopamine issue may not be as big a hurdle as previously thought.

At this point the expectation is for hog numbers to be quite large into the fall, hence the spread between Jun and Dec futures. Still, as the summer market heats up, it has helped pull up fall and winter contracts, in the process offering hog producers more attractive opportunities to hedge themselves.

But a quick look at June hog futures chart tells you that market participants were bullish about summer hog price prospects before only to become disappointed, leading to the huge $7 break in late March and early April. The pork cutout so far has been increasing at a slower pace than usual.

Pork belly prices, which for a while helped underpin the value of the cutout, have pulled back. It is not usual for bellies to be weaker in May but will current futures imply a notable improvement in bellies by June. Retail promotions often are the key for bacon in the summer and recent break in prices may set the stage once again this year. Ham prices rallied in late April and May but have eased lower in the last couple of weeks. Last year ham prices were quite soft through July, contributing to the weakness of the overall cutout.

If exports take off this summer, that could quickly fix the problems in the ham market. But again, it’s a big if, dependent on robust export business. Further improvements in the cutout, a smaller slaughter and lighter weights are needed to justify the lofty hog price projections for the summer and fall market.