CME: Retail Pork Prices Moving in Seasonal Fashion

US - USDA-ERS released June average retail meat prices on Friday, write Steve Meyer and Len Steiner.To quickly review, retail prices are calculated from a very limited number of retail cuts, for each protein, using several assumptions by USDA‐ERS (those cut prices are collected by the Bureau of Labor Statistics to calculate the U.S. consumer price index).

Due to the nature of these calculations and the retail environment, people tend to call these average retail prices “sticky” meaning, as the fundamental live animal and wholesale markets change, the retail price changes are slower to appear. Additionally, to take beef for example, no consumer buys “beef”, they buy steak, or hamburger, or roasts, etc. To average all of these prices together to get one value for beef can be misleading, however these retail prices are still useful as a barometer to the industry.

Starting out with retail beef prices, the June average All Fresh Beef price was $5.83 per pound. This was $0.27 per pound below a year ago (down 4%). Within the monthly retail meat prices, roasts and ground beef have experienced the most decline year‐over‐year, all down over 6%.

Steak cuts were only down 1%‐3% year‐over‐year. This is supportive of beef cutout data and weekly wholesale price levels.

Retail beef prices are moving in a seasonally normal paƩern and we expect them to slowly increase into fourth quarter, but stay below year ago levels.

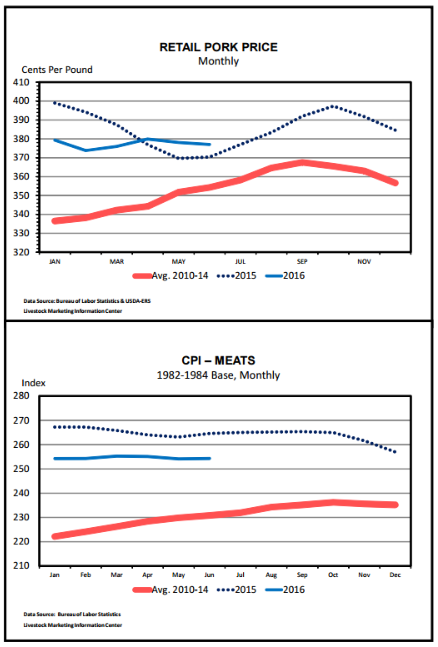

On the pork side, retail prices were actually up year‐over‐year for June. Looking back on last year though, retail pork prices experienced a seasonally abnormal decrease from January through June. So far this year, retail pork prices have moved in a more seasonally normal fashion. Compared to June 2015, pork was up $0.07 per pound (up 2%) to $3.77 per pound in grocery stores this year. Bacon and ham were the only cuts with average monthly retail prices above year ago, but other pork cuts were only down 1%‐3% year‐over‐year.

Retail broiler composite prices were $0.07 per pound below their year ago level (down 4%) at $1.92 per pound. Retail whole fresh chicken prices saw a steep drop in June compared to May, down $0.10 per pound, and ended up at $1.41 per pound, almost $0.11 below year ago levels. Average retail turkey prices tracked right on year ago levels since February, but June’s price fell slightly below that of 2015’s, down 2% year‐over‐year to $1.51 per pound.

All major proteins, except pork, averaged below their respective 2015 values in June. Pork, although above year ago, has not experienced a significant increase in retail prices but instead was comparing to a seasonally abnormal price movement in 2015. These generally lower protein prices, including lower dairy and egg prices, continue to show up in the Consumer Price Index data.

The CPI, released this past Friday by the Bureau of Labor Statistics, is a collection of items from multiple sectors of the economy to form a singular basket of goods so prices can be compared over time and the effect on U.S. consumers can be monitored. The CPI for June reflected generally lower meat prices compared to year ago levels. This has been a consistent trend since the start of the year. Energy CPI continued to increase, up 11% since January, largely on higher fuel costs. The “all items less food and energy” category continues to track about 2% above year ago, with the main contributors to the year‐over– year increase being housing and medical costs.