2016 EU Pork Exports Expected to Reach Record Level

EU - In 2016, EU pigmeat exports are expected to reach a record level at 2.7 million tonnes (+24 per cent on annual basis) thanks to the boost in exports to China, according to the European Commission Autumn 2016 Short-Term Outlook.The current negotiations for access to other markets closed due to SPS reasons could even further improve the export situation. Strong import demand from China due to the restructuring of its domestic pigmeat sector explains the 44 per cent increase in EU total pigmeat exports over the January-July 2016 period.

EU pigmeat exports to China reached more than 100,000 tonnes in April, May and June and represented now more than 40 per cent of total EU pigmeat exports or almost 600,000 tonnes in the first half of 2016. If Hong Kong is included in the exports, another 30,000 tonnes should be added.

In the first half of 2016 China imported already as much pig meat from the world as in the whole year 2015 (i.e. 780,000 tonnes). All EU countries exporting to China saw their exports doubling or tripling since the beginning of 2015. Germany, Spain and Denmark took the biggest share of the cake with respectively 31 per cent, 19 per cent and 17 per cent of EU meat exports to China.

Poland cannot take advantage of this opportunity as direct exports to China are banned due to several cases of African Swine Fever (ASF).

However, the euro/yuan exchange rate, the EU pigmeat production capacity and the consequences of

the economic slowdown on Chinese consumer demand and its meat sector could influence downwards EU exports in the coming months. According to the Chinese Agricultural Outlook, a significant yearly import demand for pigmeat is projected to continue over the medium-term but at a lower level (close to 900,000 tonnes by 2025).

Having this in mind, the current level of EU exports to China should be considered as a short term opportunity rather than a medium term fact. Other important exporters to China are the US and Canada, representing 14 per cent and 11 per cent of total Chinese pigmeat imports in the period January–July 2016.

Other notable increases in the first half of 2016 were noted in EU shipments to Japan (+16 per cent), Taiwan (+15 per cent), Ukraine (9 per cent) and the US (+40 per cent). The dispute about the tariffs on certain pigmeat exports to the Philippines has been settled and reflected in an increase of 33 per cent in the first half of 2016 (+17,000 tonnes). The recovery of the US market share on the international scene after the 2014 PEDv12 crisis seems to come along slowly as US pig exports reached the same level as last year in the first half of 2016. This probably explains why the EU exports to Japan were better than expected. In addition, exports to South Korea were dropping slightly, while those to Australia were stabilising.

In this outlook, the Russian sanitary import ban introduced in March 2014 is expected to be maintained. The official WTO ruling on the sanitary ban has been made public on 19 August 2016.

The Russian government has launched a notice of appeal on the 23 September. The WTO decision on the appeal is to be expected within three months. In the meantime, the assumption that the import ban will remain in place for 2016 and 2017 is retained, blocking almost all exports to Russia.

EU pigmeat prices on the rise

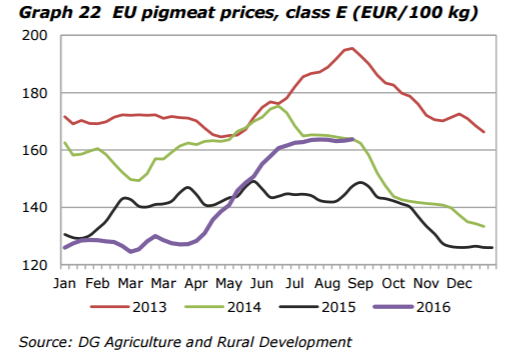

Contrary to 2015, EU pigmeat prices in 2016 seem to follow again their seasonal price increase during summer (Graph 21). After a flat start at the beginning of 2016, prices have been going up steadily since the end of April 2016. From the beginning of July the EU pigmeat prices went above the 160 €/100kg and stabilised around 165 €/100kg. This price increase is mainly due to the surge in exports to China and the tighter balance between EU supply and demand.

After some recovery of its average weekly level in the beginning of January 2016, the piglet price stabilised around 40 EUR between February and the end of May, followed by a slight rise beginning of June and stabilising again during summer. The EU average price in August was around 43 €/head, which is 30 per cent higher than the same period last year. In Spain, on the contrary, piglet prices started already decreasing since half of July, earlier than the seasonal trend, although still largely above prices of last year.

Despite a brief surge, feed prices, especially soya, came down again, reducing the feed cost and improving the profitability of pigmeat production.

Moreover, the quality of the cereal harvest might be such that a larger share of wheat will go to feed production.

EU consumption of pigmeat reached 32.4 kg per capita in 2015 (retail weight), almost 1 kg up compared to 2014. Due to the very favourable prospects of EU exports to China, there could be a temporary shortage on the EU market as operators favour exports. Therefore, the level of per capita consumption is expected to decrease in 2016 by 1.6 per cent (32 kg per capita) and stabilise in 2017, more or less in line with the trend over the last ten years.

.PNG)